Blog

Home Prices Rise 9.7%, Largest Annual Gain Since 2006: CoreLogic

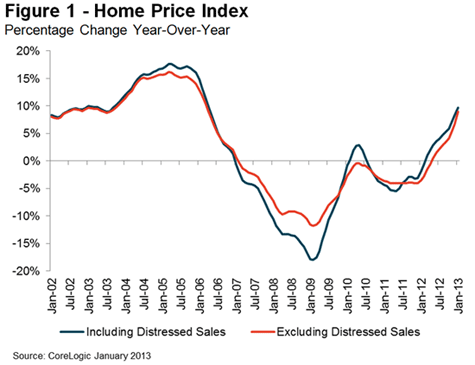

Home prices as measured by the CoreLogic Home Price Index (HPI)rnhad the largest annual increase in January that it had experienced since Aprilrn2006. The January number was up 9.7rnpercent from January 2012 and represented the 11th consecutive month the HPI,rnwhich includes distressed sales, increased from its level one year earlier. Thernindex was up 0.7 percent from December. rnAll but two states, Delaware and Illinois are experiencingrnyear-over-year price gains. </p

</p

</p

The HPI which excludes distressed sales was up 9.0 percentrncompared to one year earlier and 1.8 percent from December. There were no states in which prices ofrnhomes, excluding distressed sales, i.e. lender-owned real estate (REO) or shortrnsales, declined on an annual basis. </p

CoreLogic’s Pending HPI indicates that February 2013 homernprices, including distressed sales, will rise by 9.7 percent on arnyear-over-year basis from February 2012 and fall by 0.3 percent on arnmonth-over-month basis from January 2013, reflecting a seasonal winterrnslowdown. Excluding distressed sales, the annual increase in February isrnexpected to rise 11.3 percent from February 2012 and 1.8 percent compared tornJanuary 2013. The Pending HPI is a proprietary metric that maps trends in homernprices based on Multiple Listing Service (MLS) data measuring price changes forrnthe most recent month.</p

“The HPI showed strong growth during the typically slow winterrnseason,” said Mark Fleming, chief economist for CoreLogic. “With these gains,rnthe housing market is poised to enter the spring selling season on soundrnfooting. The improvements are materializing across the country, with all butrnDelaware and Illinois showing increasing HPI and 15 states within 10 percent ofrntheir peak values.”</p

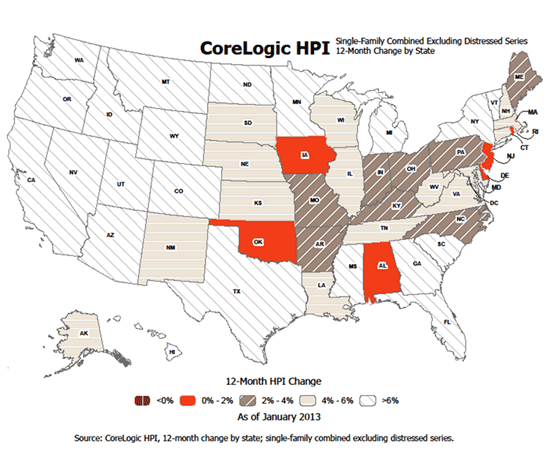

“Homernprices continued to gather steam across a broad swath of the country inrnJanuary, continuing the positive trend we saw during most of 2012,” said AnandrnNallathambi, president and CEO of CoreLogic. “Many states across the westernrnU.S. and along the East Coast saw average price gains of more than 6 percent,rnwhich is likely to boost home sale activity into the first half of 2013.”</p

Of the top 100 Core Based Statistical Areas measured byrnpopulation, 92 showed year-over-year increases on the HPI in January, up fromrn87 in December. </p

The states with the highest home price appreciation including distressed sales were Arizona (+20.1rnpercent), Nevada (+17.4 percent), Idaho (+14.9 percent), California (+14.1rnpercent) and Hawaii (+14.0 percent). rnIllinois and Delaware posted price depreciation of 0.4 and 0.1 percentrnrespectively. </p

Excludingrndistressed sales, the five states with the highest home price appreciation were: Nevada (+17.5rnpercent), Arizona (+16.5 percent), California (+14.5 percent), Hawaii (+13.9rnpercent) and Idaho (+13.2 percent).</p

Thernpeak to current change in the national HPI (fromrnApril 2006 to January 2013) was -26.4 percent including distressed transactionsrnand -19.9 percent excluding those sales with Nevada, Florida, Arizona,rnMichigan, and Rhode Island all posting declines exceeding 35 percent.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment