Blog

Home Prices Rise Again According to Latest CoreLogic Report

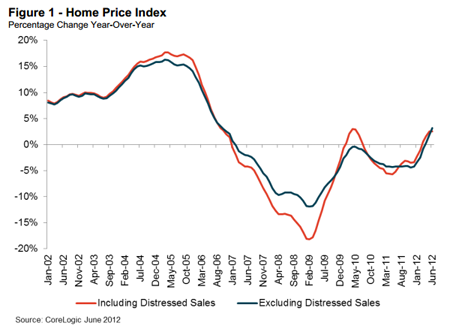

CoreLogic reported this morning thatrnJune home prices nationwide were up 2.5 percent compared to those one yearrnearlier. The company’s Home Price Index (HPI) which includes sales ofrndistressed properties also rose by 1.3 percent in June compared to the Mayrnfigure. This marks the fourthrnconsecutive month that prices have gone up on both a monthly and annual basis. Distressed properties are defined as shortrnsales and sales of bank-owned properties (REO.)</p

The HPI that excludes these distressed propertyrnsales increased 3.2 percent year-over-year in June and 2.0 percent month overrnmonth; the fifth consecutive month where a month over month increase was noted.rn</p

</p

</p

CoreLogic projects that its July HPI includingrndistressed sales will increase by at least 0.4 percent from June and 2.0rnpercent on an annual basis and excluding distressed sales it will be up by 1.4rnpercent and 4.3 percent for the two time periods. CoreLogic’s forward leaning index is based onrnMultiple Listing Service (MLS) data that measures price changes in the most recentrnmonth. </p

“Home prices are respondingrnpositively to reductions in both visible and shadow inventory over the pastrnyear,” said Mark Fleming, chief economist for CoreLogic. “This trendrnis a bright spot because the decline in shadow inventory translates to fewerrndistressed sales, which helps sustain price appreciation.” </p

“At the halfway point, 2012 isrnincreasingly looking like the year that the residential housing market may havernturned the corner,” said Anand Nallathambi, president and CEO ofrnCoreLogic. “While first-half gains have given way to second-half declinesrnover the past three years, we see encouraging signs that modest price gains arernsupportable across the country in the second-half of 2012.” </p

The Index for overall sales by staternincreased the most in Arizona (+13.8 percent,) Idaho (+10.4 percent,), and SouthrnDakota (+10.1 percent.) Excludingrndistressed sales, the states with the highest appreciation were: South Dakotarn(+10.2 percent), Utah (+9.1 percent), and Montana (+8.7 percent).</p

The worst performing states overallrnwere Alabama (-4.8 percent), Connecticut (-4.0 percent), and Illinois (-3.4rnpercent) and excluding distressed sales, Delaware (-3.6 percent), Alabama (-3.1rnpercent), and Connecticut (-2.1 percent),</p

Of the top 100 Core BasedrnStatistical Areas (CBSAs) measured by population, 27 are showing year-over-yearrndeclines in June, five fewer than in May. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment