Blog

Home Prices Show First Positive Annual Increase Since 2010

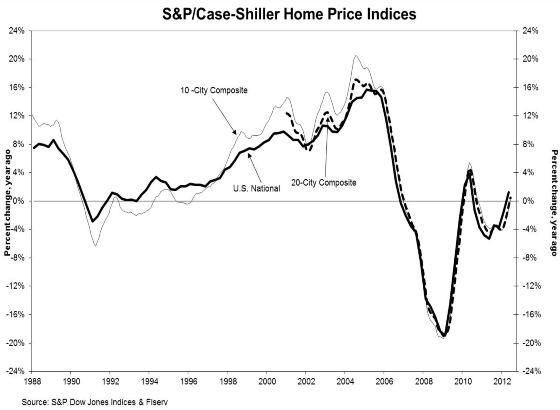

While the gains were modest, all threernmajor S&P Case-Shiller Home Price Indices ended the second quarter of 2012rnwith positive annual growth rates for the first time since the summer of 2010. The national composite index was up 1.2rnpercent in the second quarter compared to the second quarter of 2011 and wasrn6.9 percent higher than in the first quarter of this year.</p

</p

</p

The two indices that make up thernnational composite – the 10-City and 20-City were up 0.1 percent and 0.5rnpercent respectively on an annual basis and 2.2 percent and 2.3 percent fromrnMay to June. This was the secondrnconsecutive month that both the 10-City and 20-City indices and all 20 of therncities posted positive monthly gains. Eighteenrnof the 20 metropolitan statistical areas (MSAs) also showed larger month overrnmonth increases in June than they had in May; only in Charlotte and Dallas didrnthe rate of increase slow. Detroitrnrecorded the highest monthly increase at 6.0 percent.</p

Thirteen cities had positive annualrnrates. Six, Atlanta, Chicago, Las Vegas,rnLos Angeles, New York, and San Diego still had negative annual rates of changernwith Atlanta in double digits (-12.1 percent). rnThe annual rate in Boston was unchanged from one year earlier. Phoenix was the most improved, up 13.9 percentrnsince June 2011.</p

David Ml Blizer, Chairman of the IndexrnCommittee at S&P Dow Jones Indices said, “The regions showed positivernresults for June. All 20 of the citiesrnsaw average home prices rise in June over May and all were by at least 1.0rnpercent.” Detroit was up the most, +6.0rnpercent, and Charlotte the least, +1.0 percent. rnThe Composites showed the same increases as last month – the 10-City rosernby 2.2 percent in June and the 20-City by 2.3 percent. We are aware that we are in the middle of arnseasonal buying period, but the combined positive news coming from both monthlyrnand annual rates of change in home prices bode well for the housing market.”</p

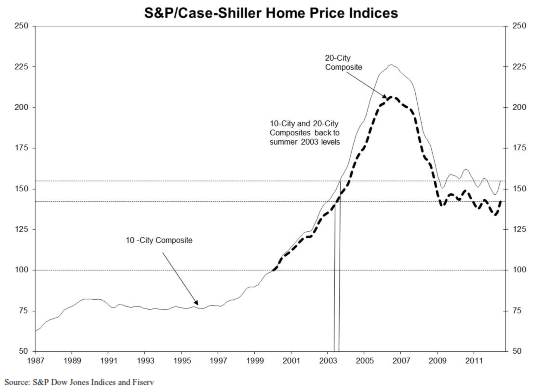

As of June average home prices for bothrnthe 10- and 20-City Composites are back to their summer 2003 levels. Measured from their June/July 2006 peaks,rnboth Composites are down approximately 31 percent and both have risen about 6rnpercent from their recent troughs in March 2012. Atlanta, Detroit, and Las Vegas continued tornhave average home prices below their January 2000 levels, the benchmark for thernCase-Shiller indices.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment