Blog

Home Prices up in August, Sharper Increase Predicted for September

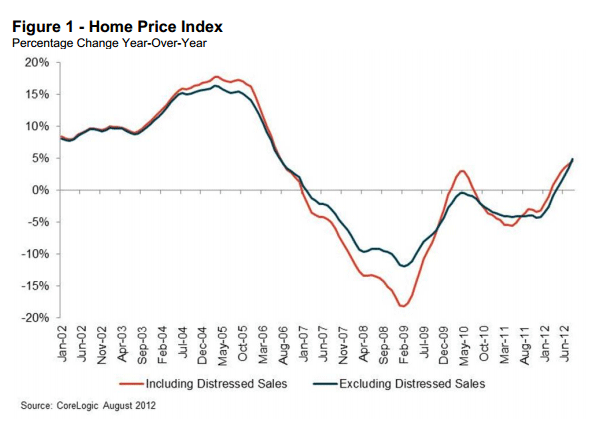

Home prices in August posted the largest annual increase inrnover six years according to data released this morning by CoreLogic. The company’s August Home Price Index (HPI)rnwas up 3.6 percent over the August 2011 index number and was 0.3 percent abovernthe index in July 2012. This is thernsixth consecutive month that home prices have increased nationally on both arnmonth-over-month and year-over-year basis. rnCoreLogic’s HPI, which includes distressed sales, increased in all butrnsix states </p

Excluding distressed sales – sales of bank owned real estatern(REO) and short sales – home prices increased 4.9 percent on an annual basis inrnAugust and 1 percent from the July index. </p

</p

</p

Core-Logic is predicting that, when reported next month,rnSeptember home sales including distressed sales will be up another 5 percent onrnan annual basis but will fall by 0.3 percent from August figures as the summerrnsales season comes to a close. When distressed sales are excluded CoreLogic isrnpredicting that it Pending HPI will be up 6.3 percent year-over-year and 0.6rnpercent month-over-month.</p

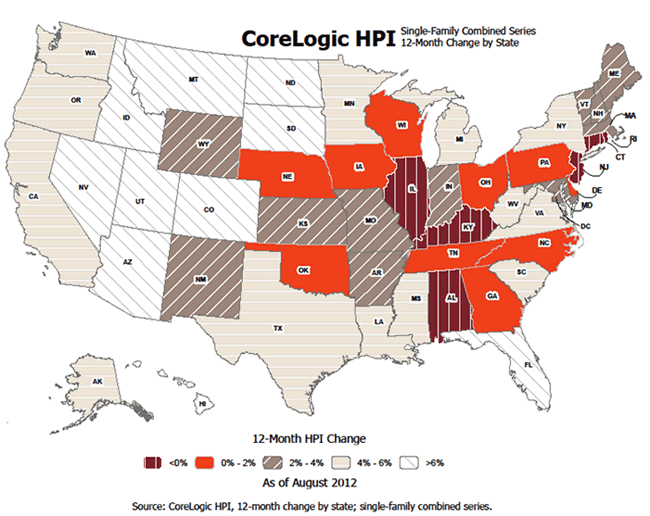

“Again this month prices rose on a year-over-year basis and ourrnexpectation is for that to continue in September based on our pending HPIrnforecast,” said Mark Fleming, chief economist for CoreLogic. “The housingrnmarkets gains are increasingly geographically diverse with only six states continuingrnto show declining prices.”</p

Some of the states that took the greatest hits to their homernvalues during the housing crisis are among those bouncing back thernfastest. Arizona had the largest annual percentagernincrease both including distressed sales (+18.2 percent) and excluding them (+13.0rnpercent). Idaho was second for all sales (10.4 percent) and fourth whenrndistressed sales were excluded (+8.6) while Utah was second in market salesrn(+10.0 percent) and fourth (+8.9 percent) when distressed sales were included.</p

</p

</p

The three states with therngreatest depreciation including distressed sales were Rhode Island (-2.6 percent),rnIllinois (-2.3 percent), and New Jersey (-1.4 percent.) Excluding distressed sales, prices in RhodernIsland were down 1.7 percent, in New Jersey 1.4 percent, and in Alabama -0.2rnpercent.</p

Including distressedrntransactions, the peak to current change in the national HPI was 26.7 percent. Without distressed sales the decline was 19.9rnpercent. When distressed sales arernincluded the decline was greatest in Nevada (-54.7 percent), Florida (-44.3rnpercent) and Arizona (-42.0 percent.)</p

“Sustained economic recovery inrnthe U.S. requires a healthy housing market. You cannot have a healthy housingrnmarket without price stabilization and ultimately home price appreciation,”rnsaid Anand Nallathambi, president and CEO of CoreLogic. “Improving pricingrntrends over the past few months and our forecast for continued gains in Septemberrnbode well for a progressive rebound in the residential housing market.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment