Blog

Home Sellers Push Buyer Incentives as Tax Credit Expiration Erodes Loan Demand

The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the week ending May 7, 2010.

Michael Fratantoni, MBA's VicePresident of Research and Economics says:

“The recent plunge in rates on US Treasury securities, due to aflightto quality as investors worldwide sought shelter from the Greekdebtcrisis, benefited US mortgage borrowers last week. Rates on 30-yearmortgages dropped to their lowest level since mid-March. As a result,refinance applications for conventional loans jumped, hitting theirhighest level in six weeks….In contrast, purchaseapplications fell almost 10 percent in the first week following theexpiration of the homebuyer tax credit, as the tax credit likelypulledsome sales into April that would otherwise have occurred in May orlater.”

The Mortgage Banker's application survey covers over 50% of all US residential mortgage loan applications taken by mortgage bankers, commercial banks, and thrifts. The data gives economists a look into consumer demand for mortgage loans. In a low mortgage rate environment, a trend of increasing refinance applications implies consumers are seeking out a lower monthly payments which can result in increased disposable income and therefore more money to spend in the economy or pay down other debts like credit cards and car loans. A rising trend of purchase applications indicates an increasein home buying interest, a positive for the housing industry and theeconomy as a whole.

From the Release…

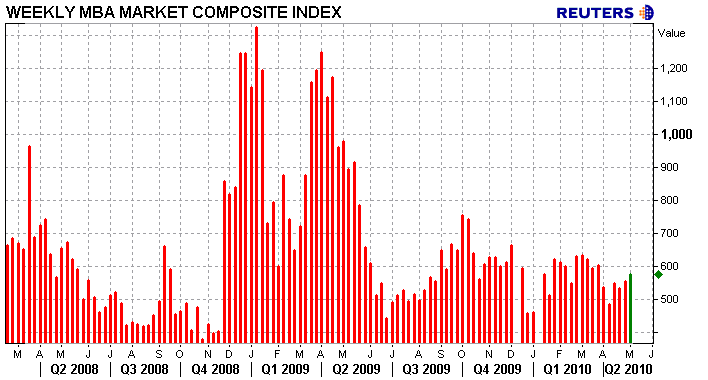

The Market Composite Index, a measure of mortgage loan application volume, increased 3.9 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 3.4 percent compared with the previous week. The four week moving average for the seasonally adjusted Market Index isrn up 4.4 percent.

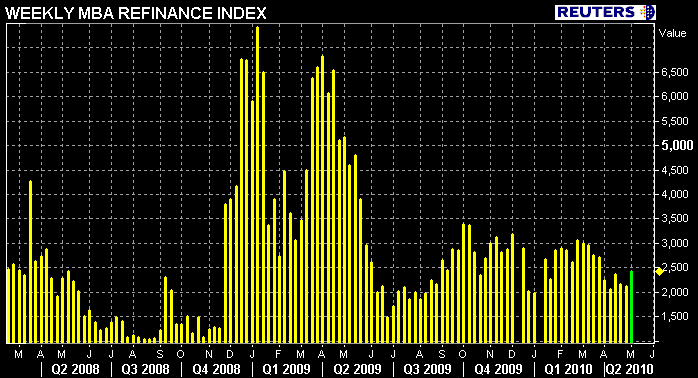

The Refinance Index increased 14.8 percent from the previous week. The four week moving average is up 4.4 percent for the Refinance Index. The refinance share of mortgage activity increased to 57.7 percent oftotal applications from 51.9 percent the previous week.

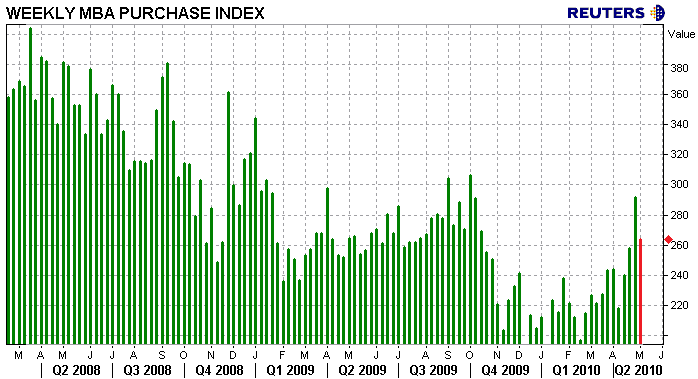

The seasonally adjusted Purchase Index decreased 9.5 percent from oneweek earlier. The unadjusted Purchase Index decreased 8.9 percentcompared with the previous week and was 0.6 percent lower than the sameweek one year ago. The four week moving average is up 4.5 percent forthe seasonally adjusted Purchase Index.

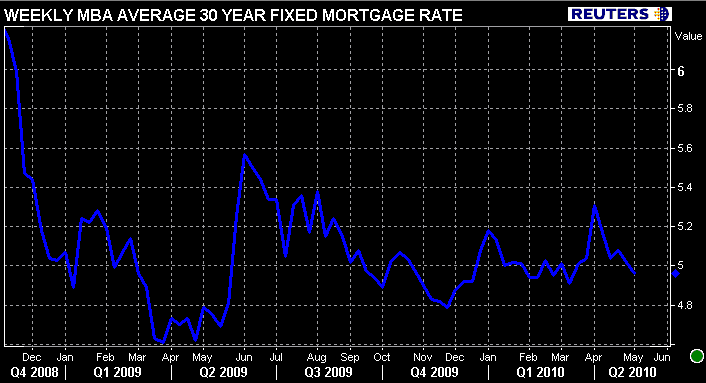

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.96 percent from 5.02 percent, with points decreasing to 0.91 from 0.92 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The effective rate also decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 4.32 percent from 4.34 percent, with points increasing to 0.81 from 0.80 (including the origination fee) for 80 percent LTV loans. The effective rate also decreased from last week.

The average contract interest rate for one-year ARMs decreased to 6.86 percent from 7.03 percent, with points increasing to 0.35 from 0.28 (including the origination fee) for 80 percent LTV loans. The adjustable-rate mortgage (ARM) share of activity remained unchangedrn at 6.3 percent of total applications from the previous week.

The homebuyer tax credit has expired and the housing industry isscrambling to refocus its marketing efforts on the core fundamentals ofsustainable homeownership.

From a CNBC story titled: “Homebuyer Tax CreditEnds, But Other Incentives Emerge“

“The expiring credit—which gives first-time homebuyers and somecurrent homeowners a tax credit of up to $8,000 if they sign a contractby midnight tonight and close the sale by June 30—has been widely viewedrn as helping boost home sales in recent months. For that reason, somereal estate firms are pushing home sellers to offer incentives of theirown, usually by agreeing to refund some of the purchase price to thebuyer. Some developers are offering similar refunds to buyers of newrn homes or condos.”

AND…

“One of the larger companies pushing the new incentives is Coldwell Banker, a subsidiary of the global real estate giant Realogy. It is asking sellers to participate in a program that will give buyers 3 percent off the agreed-to sale price, up to a maximum of $8,000. The program will run from May 1 through July 31.”

While I do not see any RESPA or Reg Z violations yet, these “incentives” are misleading.

If the refund strategy is attempted before closing, it would be viewed by an underwriter as a reason to reduce the sales price by the size of the “refund”….which negates the refund, lowers the value ofrn the home and increases the loan to value ratio (which couldrn affect loan pricing). If the refund is done post-closing and the HUD is amended, the loan would be a prime “buyback” candidate as appraisals are under a great deal of scrutiny by regulators, specifically over-inflated valuations. If the refund is done post-closing and the HUD is not amended…that is when we can start talking about illegalities.

The Coldwell Banker program that “gives buyers 3 percent off the agreed-to sale price, up to a maximum of $8,000” is smoke and mirrors (not in a fraudulent way). This is nothing more than good 'ol seller concessions. Fannie Mae calls them “Interested Party Contributions”.

NOTE: The article is written as “3 percent off the agreed-to sale price”. That should have read “3 percent OF the agreed-to sales price”…if it was not a typo, this tactic is not seller concessions, it is a refund. See comments about refunds

From the Fannie Mae Seller Guide:

Interested party contributions (IPCs) are costs that are normally thern responsibility of the property purchaser that are paid directly orindirectly by someone else who has a financial interest in, or caninfluence the terms and the sale or transfer of, the subject property. Fannie Mae does not permit IPCs to be used to make the borrower’sdownpayment, meet financial reserve requirements, or meet minimum borrowercontribution requirements.

IPCs are either financing concessions or sales concessions. FannieMae considers the following to be IPCs:

- funds that are paiddirectly from the interested party to the borrower;

- funds thatflow from an interested party through a third-party organization,including nonprofit entities, to the borrower;

- funds that flow torn the transaction on the borrower’s behalf from an interested party,including a third-party organization or nonprofit agency; and

- fundsrn that are donated to a third party, which then provides the money to payrn some or all of the closing costs for a specific transaction.

Plain and Simple: seller concessions are very common in this housing environment, every buyer should request this “incentive”. While the borrower is required to have “skin in the game” (3.5% for FHA), these IPC are intended to help cover a portion of the borrowers closing costs or buydown their interest rate. Nothing illegal about that…unless the concessions are coming from a builder and are offset by higher costs elsewhere in the transaction.

The removal of government funded homebuyer incentives is forcing loanoriginators, realtors, and builders to produce new promotion strategiesand modernize long-standing advertising approaches. Given theever-evolving regulatory regime and super sensitive risk retentionenvironment, the rush to innovate new trade tactics will likely lead tomore and more violations and loan repurchase requests. Be very careful and always ensure you are within compliance.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment