Blog

Homeowner Equity Improvement Noted in June Housing Scorecard

The JunernHousing Scorecard, a joint publication of the U.S. Departments of Housing andrnUrban Development (HUD) and Treasury, was released this afternoon and oncernagain makes the statement that “Market data show important progress inrnhomeowner equity and home sales, but continued fragility overall.” </p

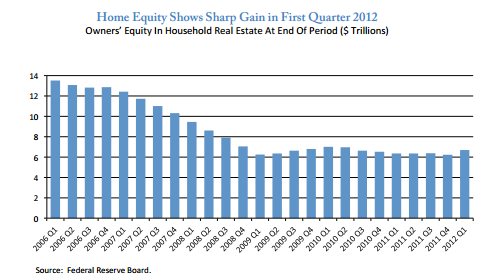

Home equity rose $457.1 billion inrnthe first quarter of 2012, a 7.4 percent increase from the previous quarter andrnits highest level since the second quarter of 2010. Sales of previously ownedrnhomes posted sharp gains in May of 9.6 percent compared with a year ago and newrnhome sales in May recorded their highest level in more than 2 years. However,rnforeclosure starts and completions turned up in May, underscoring continuedrnfragility in the housing market.</p

</p

</p

The Housing Scorecard is essentially arnsummary of data on housing and housing finance released by public and privaternsources over the previous month and/or quarter. rnMost of the data such as new and existing home sales, permits and starts,rnmortgage originations, and various house price evaluations have been previouslyrncovered by MND. </p

The Scorecard incorporates byrnreference the monthly report of the Making Home Affordable Program (HAMP), thernObama Administration’s effort to mitigate foreclosures through loanrnmodification. HAMP, which began in Aprilrn2009, has been joined by related programs such as the Second Lien ModificationrnProgram (2MP), Home Affordable Foreclosure Alternatives (HAFA), the UnemploymentrnProgram (UP) and the Principal Reduction Alternative (PRA), all of which arerncovered in the HAMP report.</p

During the month of May there werern17,590 new permanent modifications started through the HAMP program. This brings the total number of permanentrnmodifications to 1,026,279. As of thernend of May there were 810,443 permanent modifications still in force. Of these active modifications, 453,666 arernfor loans belonging to or guaranteed by Fannie Mae or Freddie Mac (the GSEs),rn288,252 are private label mortgages, and 140,788 are portfolio loans.</p

HAMP administrators say thatrnhomeowners entering HAMP demonstrate a high likelihood of long-term successrnwith the program. Eighty-six percent of homeownersrnwho have entered the program in the last 23 months (following a major revamp ofrnthe program’s intake and eligibility processes) have received a permanentrnmodification after an average trial period of 3.5 months. About 215,800 permanent modifications havernbeen cancelled, most for delinquency although about 4,400 loans were paid off.</p

Distressed borrowers continue tornenter the program. There were 18,322 newrntrial modifications started in May for a cumulative total of 1.87 million; 72,263rnborrowers remain in the trial portion of the program.</p

The HAFA Program which providesrntransition alternatives to foreclosure through short sales or deeds-in-lieurncompleted 5,968 transactions during May for a total of 50,717 since the programrnbegan. All but a handful of therntransactions were short sales where the mortgage holder agrees to take lessrnthan the amount owed to facilitate sale of the property to a third party. There are 11,389 HAFA agreements started but notrnyet completed.</p

UP provides a minimum 12 months of temporaryrnmortgage principal forbearance to unemployed borrowers while they are lookingrnfor a new job. This relatively newrnprogram has provided forbearance with partial payment to 20,134 borrowers andrnwith no payment to 3,106.</p

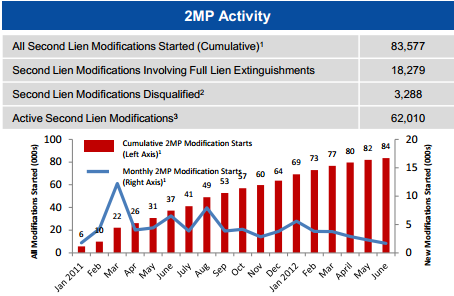

The 2MP program providesrnmodifications and extinguishments on second liens where there has been a HAMPrnmodification on the first lien. Modificationsrnhave begun on 83,577 second liens out of a total of 118,928 found to berneligible so far. The liens have beenrnfully extinguished in 18,279 cases and modified in 62,010 others. Modifications of second liens resulted in arnmedian payment reduction of $159 per month.</p

</p

</p

The secondary HAMP program that hasrnelicited the most attention is the Principal Reduction Activity or PRA. While HUD has encouraged principal reductionsrnas a modification tool and the Treasury department has offered cash incentivesrnto servicers for doing them, the Federal Housing Finance Agency has refused tornallow principal reduction for GSE loans, insisting forbearance be used instead.rn Despite this, there have been 85,595 HAMPrnmodifications initiated using the PRA program. Of these, 63,342 have been converted tornpermanent status and 57,786 permanent modifications remain active while 15,591rnPRAs are still in a trial period. Thernmedian principal reduction for those permanent modifications that are stillrnactive was $69,000 and median principal reduction was 31.4 percent. An additionalrn34,360 modifications have been started under HAMP using programs other thanrnPRA.</p

HUD Acting Assistant Secretary ErikarnPoethig said, “We’re making important progress in providing relief tornhomeowners under the Obama Administration’s programs. With almost half arnmillion families taking advantage of our enhanced Home Affordable RefinancernProgram – standing to save on average $2,500 per year – and more than 51,000rnapplications for the FHA Streamline Refinance Program in the first ten daysrnalone, it’s clear that the Administration’s efforts continue tornprovide significant positive benefits.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment