Blog

Homeowner Shift to Condos won't affect Prices -S&P

In the S&P/Case-Shiller home price indices report forrnApril David M. Blitzer, Managing Director andrnChairman of the Index Committee at S&P Dow Jones Indices notes that, “Salesrnof new and existing homes are rising in recent reports and construction of newrnhomes enjoyed strong gains in May. At the same time, the proportion of new constructionrnthat is apartments rather than single family homes remains high.” Over the last year, he says, 34 percent ofrnhousing starts were apartments compared to an average of 22 percent over thernyears since 1975. He points out that onernaspect of this could be an increase in condominium construction and that in allrnfive of the cities in which Case-Shiller tracks condos, their prices are risingrnfaster than single family homes. </p

In the June edition of RealtyTrac’s HousingNewsReport Blitzer expands on that statement, saying that “ThernU.S is witnessing a shift from single family homes to apartments andrncondominiums.” This is evidenced notrnonly in the multifamily share of housing starts, which rose from 19.8 percentrnduring the period of 2000 to 2004 to 35.2 percent in the 15 months that endedrnthis past March, but also in the decline in homeownership. These indicate both a move from owning tornrenting and a move from single to multi-family housing.</p

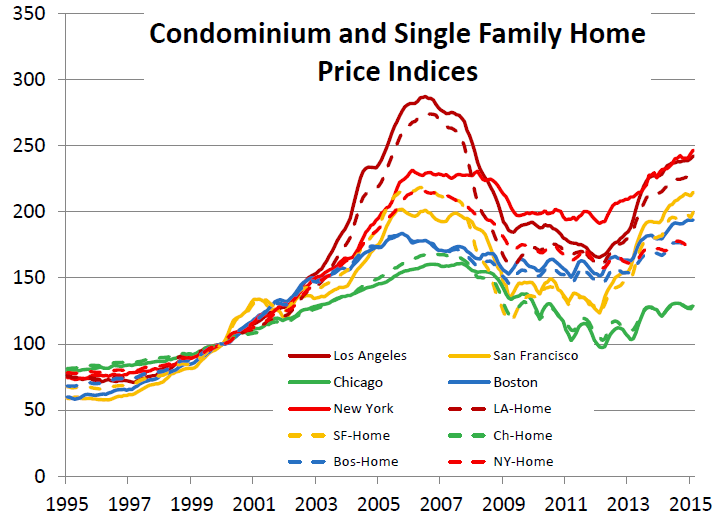

He points out that there are relatively few analyses thatrnfocus on the condominium sector during the housing boom and its aftermath so hernuses the Case-Shiller price information on Los Angeles, San Francisco, Chicago,rnBoston and New York and compares it to the corresponding single-family Case-Shillerrndata for those cities. The data coversrnthe entire metropolitan area in each case, not just the central cities. </p

Blitzer says that condo prices have recovered from the housingrnbust more quickly than single-family houses. rnNew condo price peaks have been set since the recession in SanrnFrancisco, Boston, and New York. Onlyrntwo cities among the 20 in which Case-Shiller tracks single-family home prices,rnDenver and Dallas, have set new highs, it seems to be condos in dense urbanrnareas that are staging strong recoveries. rn </p

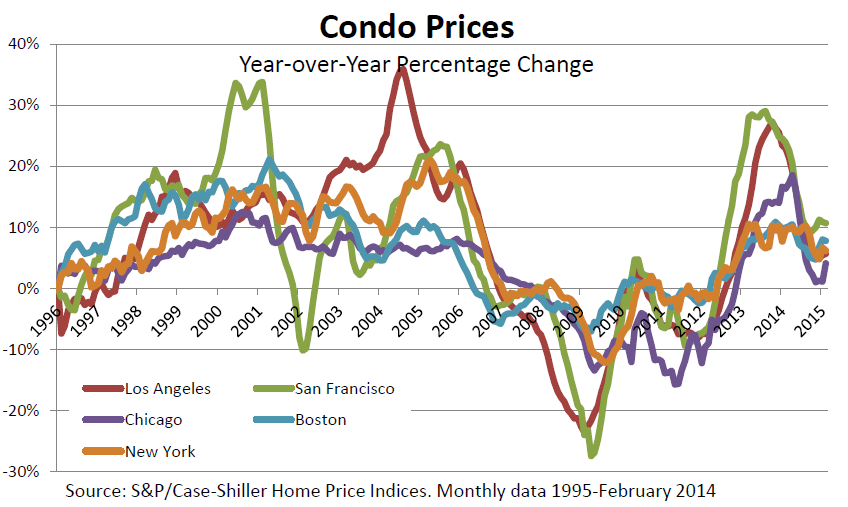

The figure below shows how condo prices changed on an annualrnbasis in each of the five cities between January 1996 and February 2015 andrnillustrate the individual ways each city reacted to economic events. The tech boom in the late 1990s and bust inrn2000 to 2001 are clear in the San Francisco data. Although the tech bustrnaffected Wall Street as much as it did Silicon Valley prices in New Yorkrncontinued to show solid gains through both boom and bust and then acceleratedrnafter the 2001 recession through 2006 with condo prices peaking in March 2005rnwith a 20 percent annual gain. </p

</p

</p

In Los Angles condo prices gained 35 percent in the 12 months</bending in August 2004. This reflected arnresponse to gains in the national economy between 2002 and 2004 by a city withrna diversified economy and a strong reliance on tourism as well as a spike in itsrnpopulation growth in the nine year that preceded the price surge. However Blitzer says there is no majorrndevelopment that can be easily identified in L.A. like the tech boom in SanrnFrancisco.</p

Chicago and Boston saw condo prices follow the other citiesrnbut without as sharp a pattern of peaks and troughs; a pattern more like thatrnof their single family home prices. In each of the five cities the peak inrncondo prices occurred roughly at the same time as the peak in it single family housernprices and the levels in condo prices and single family houses are similar -rnwith no pattern among the cities as to which type housing had the higherrnpeak. </p

When the housing crisis arrived both condo and single familyrnprices collapsed and the peak to trough declines were very similar for each inrnLos Angeles and Chicago. In the otherrnthree cities the condo swing was slightly smaller. Condo prices hit bottom inrnall five cities in either February or March of 2012, the same time framerngenerally given for the trough in single family home prices.</p

</p

</p

Blitzer says the data for the five cities shows generallyrnsimilar price patters with some indication that condo prices may be slightlyrnless volatile and gives no support to ideas that ownership in condos follows arndifferent pattern than in single family homes or is more transitive. He concludes that “While the shift inrnconsumer preferences for condos versus single family homes seen in the housingrnstarts data may be a change in people’s housing preferences or housingrnaffordability, it does not appear to be changing the patterns of pricernmovement. Moreover, the shift to condominiums isn’t likely to make home pricesrnmore or less volatile than in the past. It certainly won’t reduce the risk ofrnanother housing boom-bust cycle in the future.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment