Blog

Homeownership Rate Hits 10 Year Low. Youngest Demographic is Biggest Drag

The Census Bureau today released Residential Vacancies and Homeownership data for the first quarter of 2010

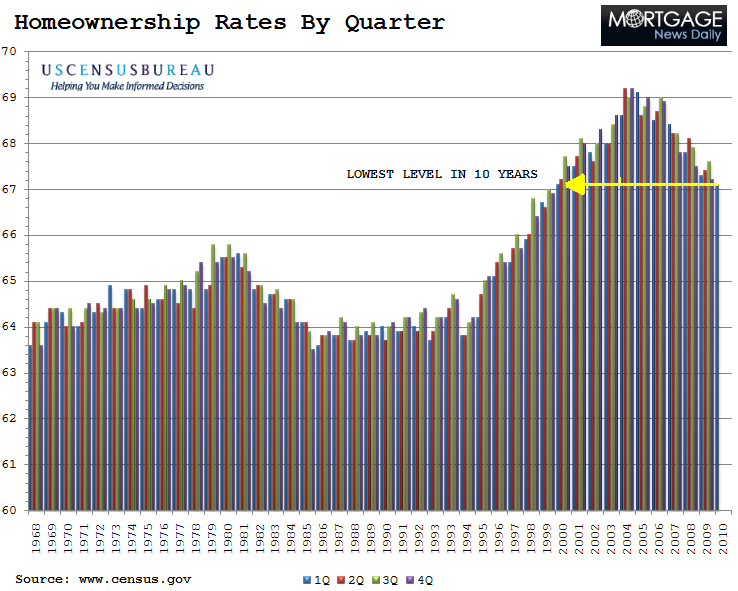

While vacancy rates are appearing to moderate, home ownership in the U.S. has declined to a level last seen at the beginning of the decade. The greatest decrease is among the youngest homeowners.

The Q1 2010 homeownership rate of 67.1rnpercent equals the rate recorded during the first quarter of 2000. The recent number is 0.1 percent lower than the raternin the fourth quarter of 2009 and 0.2 percent lower than in the first quarter ofrn2009. The rate hit its all time highrnmark of 69.2 percent in both the second and fourth quarters of 2004.

Seniors continue to have the highest rates ofrnownership. The current rate of 80.6rnpercent is among the highest rates recorded in the last five years bypersonsrnover the age of 65 while the rate of homeownership for persons under 35yearsrnof age was 38.9 percent, the lowest recorded for that age group in thefivernyears for which the census provided data, and down from 40.4 percent onernquarter earlier. Those 35 to 44 years ofrnage had a rate of 65.3 percent, down from 65.7 percent in the fourthquarter; whilernthe 45 to 54 age group increased its rate of ownership from 74.0 percentrn torn74.8 percent and the 55 to 64 cohort improved to 79.1 percent from 78.9rnpercent.

The quarter-over-quarter decline in homeownership, however,rnimpacted only two regions – the West and the Midwest, each of which declinedrn0.4 percent while the Northeast and South actually experienced an increase inrnthe rate of homeownership of 0.5 percent and 0.1 percent respectively.

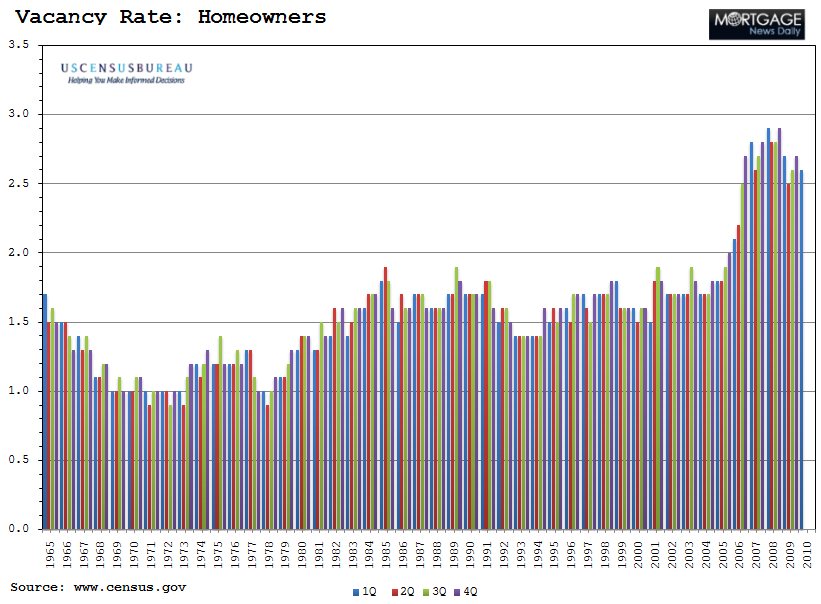

Vacancy rates for both rental housing and previouslyrnowner-occupied properties were down slightly in the first quarter of 2010 comparedrnto the third quarter of 2009 and were off more significantly from peak numbersrnrecorded in 2008 and 2009.

Rental housing had a vacancy rate of 10.6 percent inrnthe first quarter compared to 10.7 in the previous period and 10.1 percentrnduring the first quarter of 2009. rnVacancy rates for rentals hit a historic high of 11.1 percent during thernthird quarter of 2009.

The highest rental vacancies were recorded in principalrncities which had an average rate of 11.3 percent compared to 10.6percent arnyear earlier. 9.8 percent of suburbanrnrentals were vacant compared to 9.5 percent a year ago. By region, thehighestrnrental vacancy rate was in the South at 13.2 percent and lowest in thernNortheast at 7.5 percent. Rates in bothrnareas were higher than one year ago when the South had a rate of 12.9percentrnand the Northeast 6.9 percent.

Homeownerrnvacancies were at 2.6 percent, down slightly from 2.7 percent in Q4 2009. Vacancies in thisrncategory hit all-time highs of 2.9 percent in Q4 2008.

Homeownershiprnvacancies were also highest in principal cities at 3.0 percent. Thishowever, was down from 3.4 percent in thernfirst quarter of 2009. The suburban raternwas also down from 2.6 percent to 2.4 percent. rnThe South had the highest rate in the homeownership category at 2.8rnpercent, down from 3.0 percent year-over-year. rnThe rate in the Northeast was down from 1.9 percent to 1.8 percent overrnthe year.

Total U.S. housing inventory increased from 129,732,000 in thernfirst quarter of 2009 to a recent figure of 130,873,000. The occupiedrnportion of these homes also increased from 110,778,000 to 111,850,000. Owner occupied homes made up 57.4 percent ofrnall housing units and renter-occupied homes comprised another 28.1 percent.

11.1 percent all housing was made up of vacantrnyear-round units and 3.5 percent were vacant seasonal properties. This implies there are around 14.5 million vacant “year-round units” and about 4.6 million vacant seasonal properties.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment