Blog

Homeownership Slump Drives Rental Construction to 25 Year High

Much has been made lately over thernpropensity of so-called millennials, the demographic cohort which is nowrnbetween 18 and 34 years of age, to forgo homeownership. In its September Public Outlook Freddie Mac points out that this is not without anrnupside.</p

The monthly report, written by FreddiernMac’s Chief Economist Frank E. Nothaft and Deputy Chief Leonard Kiefer,rnconcedes that the recovery from the Great Recession has been “extraordinarilyrnslow” but it has picked up over the last couple of years and that increasingrnrecovery has been led by the multifamily sector, especially the development ofrnrental apartments.</p

In July, housing starts rose to arnseasonally adjusted annual rate of 1.09 million units and on an unadjustedrnbasis was the highest monthly start rate in more than six years, 101,000 units. Construction of buildings with at least fivernunits hit the highest monthly construction pace since early 2006, but today, unlikernthen, condominium complexes are not the driving force.</p

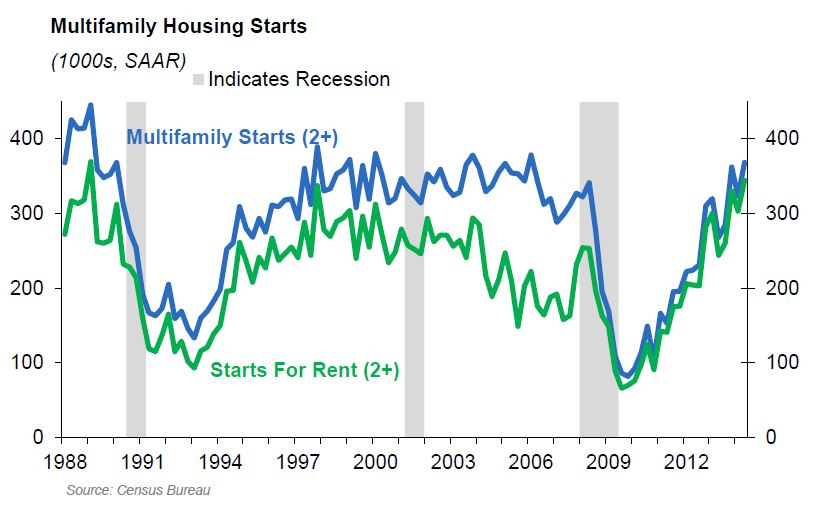

A demand for rental units, especially byrnyounger households, has created a boom in the construction of rental apartments</band in 2014 that construction has been running at the highest level in arnquarter century. Outlook quotes the National Multifamily Housing Council’s reportrnthat the apartment market had tightened even further over the prior threernmonths as of mid-July.</p

</p

</p

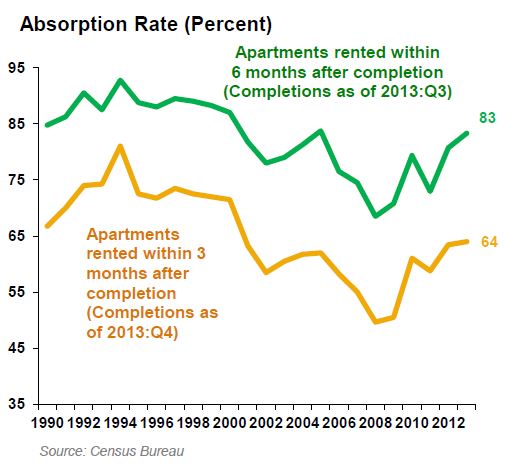

The tightened market means that thernabsorption rate of rental units has also picked up and the most recent figuresrnfor newly built, unfurnished, unsubsidized apartments puts rentals at thernfastest pace in a decade. The CensusrnBureau puts the most recent 3- and 6-month absorption rates at 64 percent andrn83 percent respectively showing, the economists say, that the demand is therernto absorb the new supply.</p

</p

</p

The increased demand is, of course, a reciprocalrnof the decline in overall homeownership in the U.S. which fell to 64.7 percentrnin the second quarter, the lowest rate since 1995. Indeed, over the past four quarters allrngrowth in household formation has belonged to renters. </p

The decline in homeownership has beenrnprimarily concentrated among younger households. Among households under age 35 it has fallenrnfrom 43.6 percent in the second quarter of 2004 to 35.9 percent ten yearsrnlater. </p

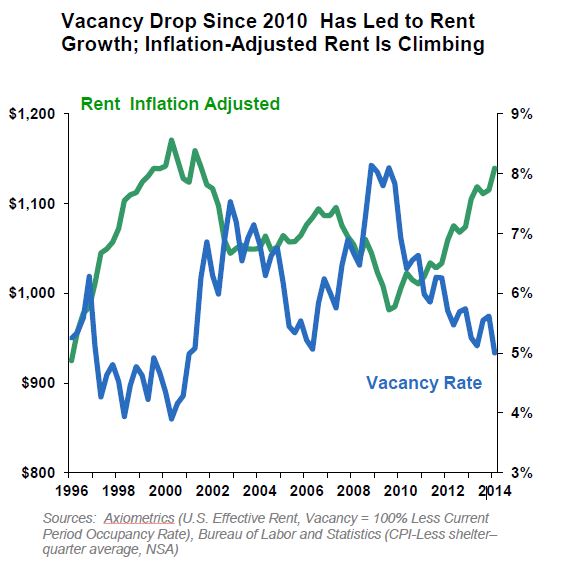

Vacancy rates have also tumbled to theirrnlowest levels since 2000 which has place upward pressure on rents. On average, Freddie Mac says, inflationrnadjusted rents have returned to their peak levels of 14 years ago and the lowrnvacancy rates appear to be positioning rent increases to outpace the growth inrnoperating costs over the coming year. </p

</p

</p

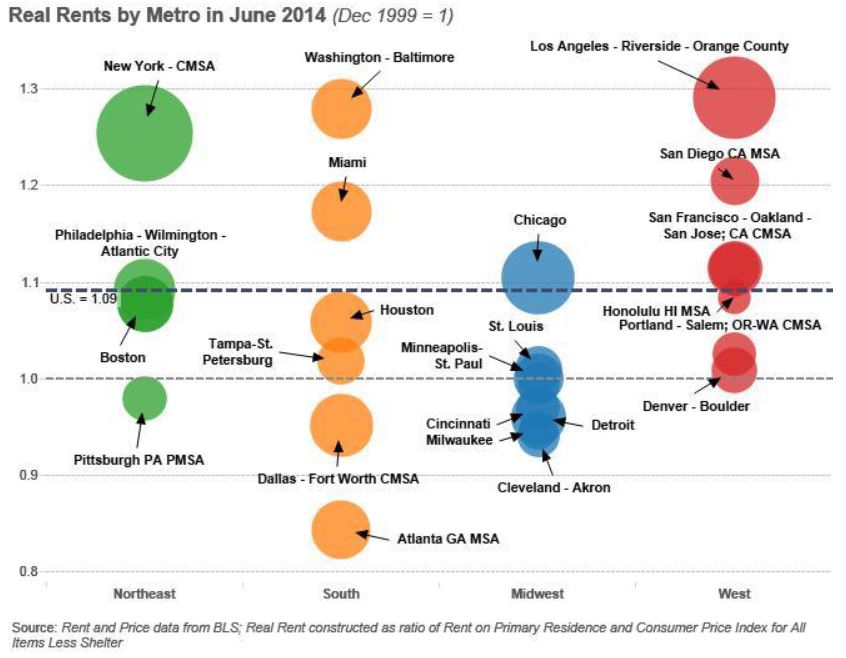

Comparing estimates of rents on arnprimary residence to consumer prices for non-shelter items gives a realrn(inflation adjusted) rent growth of 9 percent over the period from Decemberrn1999 to June 2014. This figure has variedrnacross metropolitan areas with rent growth generally highest in large metros</band those in the West or Northeast. Inrnthe south only Miami and the Washington-Baltimore area have had real rentsrnexceeding the national average. In thernMidwest Chicago is the only city to beat that average. </p

</p

</p

Nothaft and Kiefer see the multifamilyrnsector continuing to be the bright spot in housing. Despite the relatively weak August jobsrnreport they expect to see the labor market peak up steam in the coming monthrnand with that improvement household formation should increase. This will translate into increased demand forrnapartments and other rental units. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment