Blog

HOPE NOW Reports 63K Modifications, 38K Short Sales in May

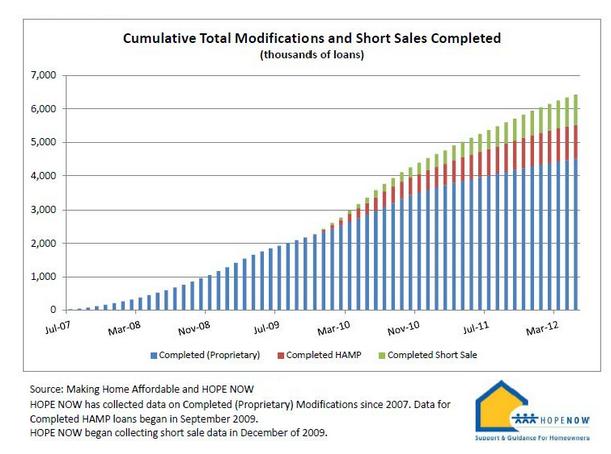

On Friday the Home AffordablernModification Program (HAMP) reported that 17,590 loans were converted tornpermanent modifications during May. Todayrnthe May report from HOPE NOW, the voluntary private sector alliance of mortgagernservicers said that servicers, investors, mortgage insurers, and non-profitrncounselors effected 45,000 proprietary modifications in addition to those underrnHAMP for a total of 63,000 modifications during the period.</p

HOPE NOW also completed approximatelyrn38,000 short sales during the month, bringing the total number of such sales torn906,000 since the organization began tracking them in December 2009. Non-foreclosure solutions including modificationsrndone under all programs and short sales now total 6.43 million since thernalliance began in 2007. </p

</p

</p

Faith Schwartz,rnExecutive Director of HOPE NOW said “We have been tracking short sales forrnalmost two years and we now have meaningful data that shows the impact of shortrnsales on the housing market. Since 2007, the industry has completed 6.43 millionrnpermanent solutions, which includes short sales and loan modifications. </p

This figure compares torn4.5 million foreclosure sales in the same period of time – and shows that realrnprogress has been made by the industry, non-profits and government on behalf ofrnat-risk homeowners since the housing crisis began.</p

Both foreclosure starts and foreclosurernsales were up in May. Starts increased 15rnpercent to 204,000 from 177,000 in April and 65,000 foreclosures were completed,rn5,000 or 9 percent more than the month before.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment