Blog

HOPE NOW: Short Sales Top 1 Million

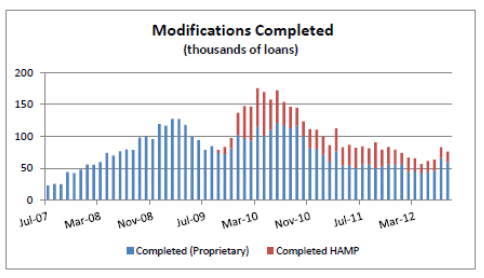

HOPE NOW, the voluntary, privaternsector alliance of mortgage servicers, investors, mortgage insurers andrnnon-profit counselors, reported that its participants completed an estimatedrn75,968 permanent loan modifications during August. An additional 16,509 modifications were completedrnthrough the Home Affordable Modification Program (HAMP). So far this year 400,285 homeowners havernreceived proprietary modifications and HOPE NOW has processed an additionalrn143,320 through HAMP.</p

</p

</p

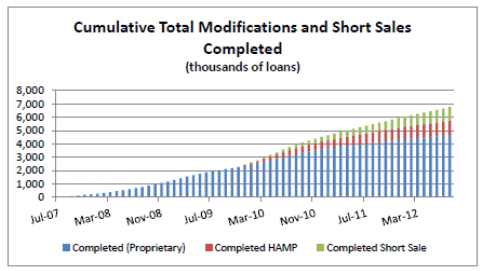

Short sales, which were virtuallyrnnon-existent in the early days of HOPE NOW, have grown steadily over the last 2-1/2rnyears and the program is now utilizing these sales at nearly three times thernrate it is putting loans through HAMP modifications. There were 39,559 short sales completed inrnAugust, a total of over 1 million since December, 2009.</p

</p

</p

Since 2007 HOPE NOW has enabledrn4,678,514 homeowners to obtain proprietary loan modifications and 1,076,747 tornobtain relief through HAMP for a total of 5.75 million modifications. </p

HOPE NOW said modificationsrncompleted via proprietary programs continue to show characteristics ofrnsustainability and affordability for homeowners. For the month of August:</p<ul class="unIndentedList"

There were 71,149 foreclosure salesrnreported in August, an increase of 12 percent from 65,527 in July and therernwere 187,941 foreclosure starts. Thisrnwas an increase of 14 percent from 164,593 starts reported in July.</p

Serious delinquencies declined fromrn2.47 million in June to 2.42 million in July, a 2 percent decrease.</p

Faith Schwartz, Executive Director, said,rn”The cumulative efforts of many different parties have made a significantrndifference in preventing foreclosures where possible. Without therncollaboration of industry, non-profits and our government, we would not havern5.75 million loan modifications for homeowners or over 115,000 total permanentrnsolutions for the month of August. The increase of short sales has beenrnsignificant and, for the first month since reporting on short sales, wernestimate a high of 39,559. Short sales provide another tool to avoid the highrncost of foreclosure for families, communities and investors.</p

“We are seeing improvement acrossrnthe board in ‘serious delinquencies’, currently at 2.42 million homeowners. rnWhile this is almost 40% lower than the all-time high of 4 million homeownersrnseriously past due on their mortgage, we cannot forget there are many more whornremain at risk of foreclosure.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment