Blog

Housing Fundamentals Suggest Solid 2013 Recovery

Fannie Mae’s economists said on Thursday that, despite the feeble note on which 2012 ended, the economy has the building blocks, including housing, for strong growth. Housing is now on a sustained growth path as are manufacturing and energy production but, given circumstances in Washington, Doug Duncan, Orawin T. Velz, and Brian Hughes-Cromwick said they see no reason to revise their forecast from January. They said, however, that if their forecast is wrong it will be erring on the side of being too conservative.</p

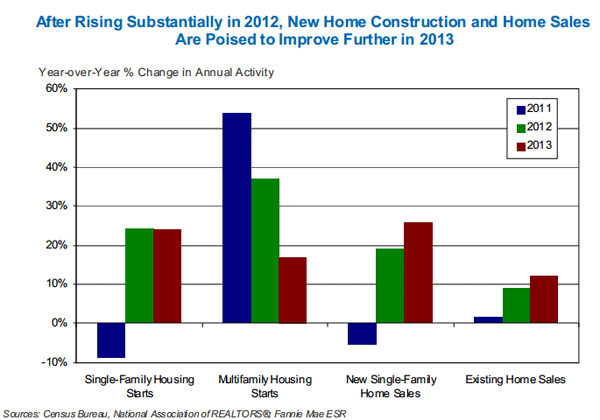

Housing underpinned the broader economy in 2012, particularly the pickup in home construction. However home sales weakened and leading indicators such as pending home sales and building permits also pulled back, suggesting some softening momentum in the near term. Aside from the month-to-month volatility, all housing indicators performed quite well in 2012 compared with 2011, and housing fundamentals suggest a continuing solid housing recovery this year.</p

There was a general consensus that home prices bottomed earlier in the year and continued to build momentum, exhibiting robust year-over-year gains unseen since the housing boom, even during the traditionally weaker winter months. The seasonally unadjusted CoreLogic house price index rose 0.4 percent in December from November, and 8.3 percent from last year-the biggest gain since May 2006.

Home prices end year – p 5 (link below)</p

The dwindling inventory of homes available for sale, now at the lowest level since December 1994, is the main driver of rising prices. Delays in the foreclosure process and strong investor demand have greatly reduced the inventory of distressed properties and the sales share of these properties dropped to 24 percent of existing homes sales at the end of 2012 from 32 percent a year earlier. A shift toward short sales also has helped boost home prices.</p

Positive home price expectations are a crucial factor for a continued broadening housing recovery. The Fannie Mae January National Housing Survey showed consumer expectations for home price increases hovering near the strongest levels recorded in the survey’s two-and-a-half-year history. Such expectations provide an incentive for potential homebuyers to get into the market especially as many also expect interest rate increases.</p

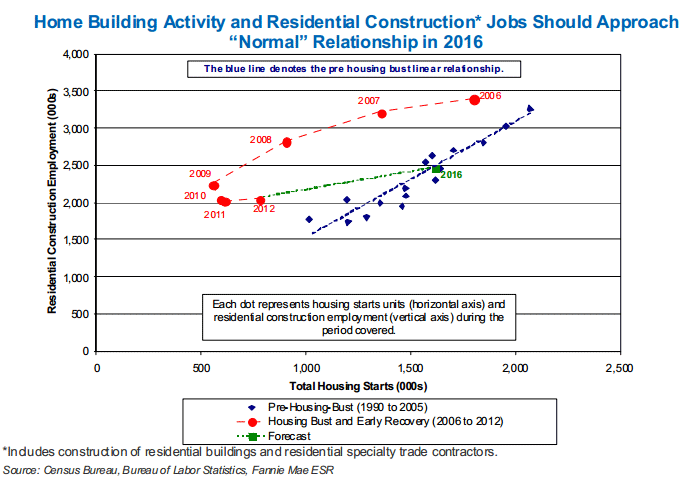

Continued lean inventory and the increase in the rate of household formation as the labor market improves bode well for homebuilding activity and residential construction employment. The economists say they expect housing to be a bigger contributor to growth going forward. So far in the housing recovery, multifamily building has been a brighter spot than the single-family segment.</p

</p

</p

</p

</p

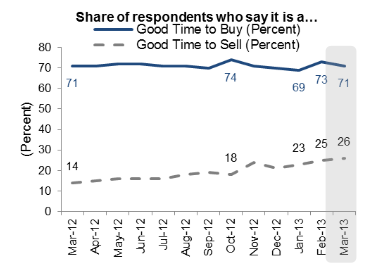

One question on the supply side of the market is how many homeowners would offer their homes for sale if their mortgages were not underwater. The share of survey respondents saying it is a good time to sell continues to rise so house price increases may be preparing more current homeowners to offer their homes for sale.</p

</p

</p

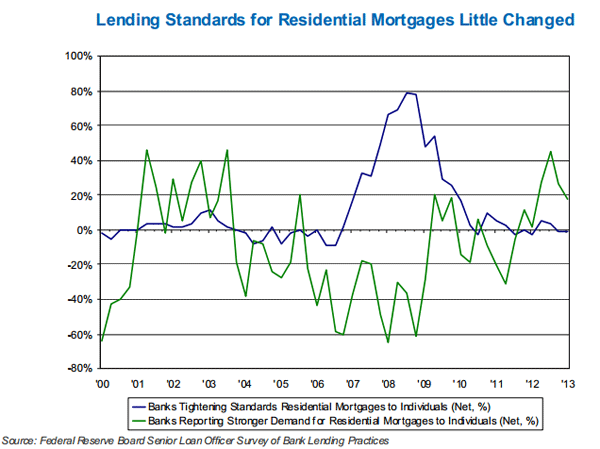

Before the housing recovery can reach a normal level of activity credit availability must improve. The latest Federal Reserve Senior Loan Officer Survey showed that while lending standards were less tight in 2009 and 2010, they were little changed since then. It is unlikely that they will ease substantially this year.</p

</p

</p

The economists project that purchase mortgage originations will rise to $628 billion from a forecast of $530 billion in 2012 but rising rates will sharply reduce refinancing. The drop in projected refinance originations is more pronounced now than in the January forecast as the projected mortgage rates paths are roughly 30 basis points higher. Refinance originations should decline to $880 billion from a projected $1.4 trillion in 2012, resulting in a refi share of 58 percent in 2013 based on the scheduled expiration of the Home Affordable Refinance Program (HARP) at the end of 2013. The single-family mortgage debt outstanding will decline an additional 1 percent in 2013, following an estimated 2.8 percent decline in 2012.</p

The three economists said that, while they expect the housing recovery to continue to firm going forward there are challenges. One is the scheduled 10-basis point increase in FHA insurance premiums which will tend to hurt first-time homebuyers but the impact will spill over to affect the trade-up cycle. The increase in the MIP also will create a hurdle for some FHA refinancers who obtained mortgages after June 2009. In the conventional conforming space, further rises in guarantee fees also would increase the cost of obtaining a mortgage.</p

Finally, the economists said they expect little impact from the final rule of Qualified Mortgages released in January because the various exclusions mean the rule will affect only a small portion of the overall mortgage market

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment