Blog

Housing Market Entering Dicey Transition Phase

RealtyTrac estimated that homernsales in July were at an annualized rate of 4.63 million units, a decrease of 3rnpercent from June and down 12 percent from July 2013. This would be the third consecutive month inrnwhich RealtyTrac has projected a decrease in sales volume and the report is sharprncontrast to the Existing Home Sales report issued last week by the NationalrnAssociation of Realtors® (NAR). Thatrnreport showed existing home sales rose 2.4 percent from June to July, thernfourth straight month-over-month increases, to an annualized total of 5.15rnmillion sales and a rate down only 4.3 percent from the previous July.rn</p

</p

</p

The RealtyTrac report points to a decreasing share ofrndistressed sales – bank owned real estate (REO) and short sales – in therntransaction mix. REO accounted for 8.0rnpercent of all single-family and condo sales during the month, down from 8.1rnpercent in June and 9.1 percent in July 2013. rnShort sales accounted for 4.5 percent of all single family andrncondo sales in July, up from 3.5 percent in the previous month but down fromrn5.2 percent a year ago. </p

Asrnthe share of distressed sales has shrunk so has the discount that traditionallyrnaccompanies them. The median price of shortrnor REO sales was $128,000 in July, up 3 percent from the previous month and uprn11 percent from a year ago, but still 37 percent below the median price ofrnnon-distressed sales: $204,000.</p

The waning influence of distressed sales is contributingrnto rising housing prices. Thernmedian price of U.S. residential properties sold in July – including bothrndistressed and non-distressed sales – was $191,000, up 3 percent from thernprevious month, and up 12 percent from a year ago to the highest level sincernSeptember 2008, a 70-month high. </p

“Asrndistressed sales continue to decline, the share of sales is tilting toward morernexpensive homes, boosting the nationwide median sales price,” said DarenrnBlomquist, vice president of RealtyTrac. “The nationwide home price increase,rnhowever, masks slowing home price appreciation in the majority of housingrnmarkets across the country. This slowing appreciation was expected and providesrnanother sign that the real estate recovery thus far is behaving rationally.rnStill, the housing market is entering a dicey transition phase where it isrnbecoming much more reliant on first-time homebuyers and move-up buyers tornsustain the recovery as investor involvement wanes.”</p

Eighteenrnof the 183 major markets reached new median home price peaks in the last twornmonths, including Denver, San Jose, Columbus, Ohio; and Charlotte. States with the biggest annual increase inrnmedian sales prices were Michigan (+24 percent) and Ohio and Virginia (tied atrn+20 percent). Metros with the biggestrnannual increase in median sales price included Detroit (+33 percent), Dayton (+31rnpercent), and Stockton (+24 percent),</p

Propertiesrnselling in the $200,000-and-below price range accounted for 49 percent of allrnsales in July, down from 52 percent of all sales a year ago, while propertiesrnselling above $200,000 accounted for 51 percent of all sales in July, up fromrn48 percent of all sales a year ago </p

</p

</p

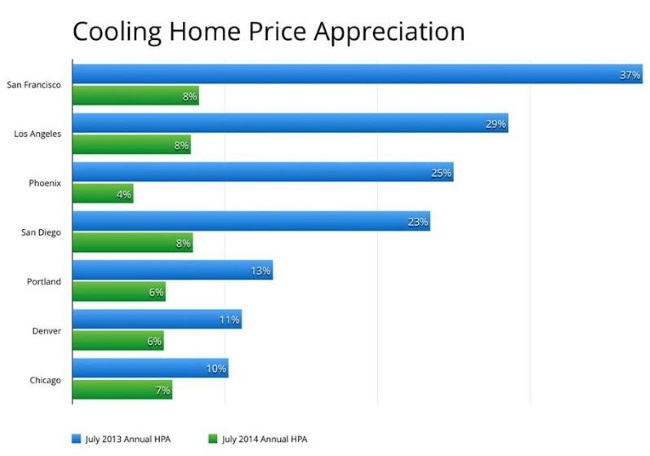

Stillrnthe RealtyTrac data concurs with most other analytic sources; the rate ofrnappreciation is slowing. Markets wherernannual home price appreciation in July 2014 dropped to single digits fromrndouble digits a year ago included San Francisco, San Diego, Los Angeles,rnChicago, Portland, Denver and Phoenix. Amongrnmetro areas 65 percent (119) saw lower home price appreciation than they didrnone year earlier.</p

</p

</p

Despiternnational trends, sales of REO and short sales continue as a major influence inrnsome markets. In Las Vegas those salesrnhad a 40.3 percent market share and they made up more than 30 percent of salesrnin Stockton and Modesto California and in Lakeland Florida. Distressed sales increased in some markets asrnwell, notably New Haven, Louisville, and Boston.</p

Salesrnat foreclosure auctions accounted for 1.2 percent of all single family andrncondo sales in July, up from 1.1 percent in June and up from 0.8 percent inrnJuly 2013. The highest share of thesernsales were in Miami, Lakeland, and Orlando, Florida but none rose above a 5rnpercent market share.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment