Blog

Housing Market Improvements Changing The Approach for Investors

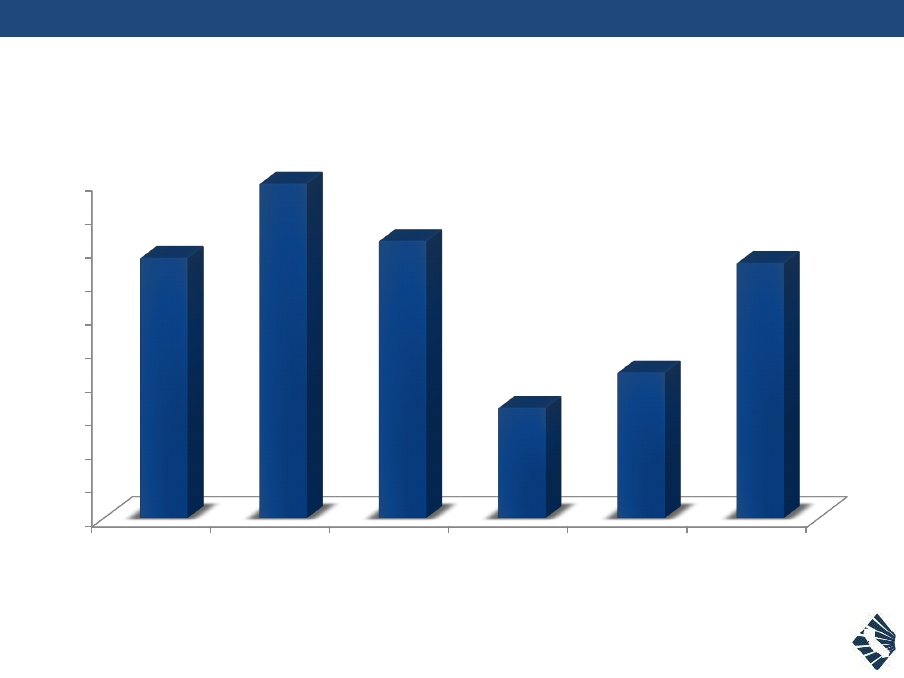

Realtors responding to a recent surveyrnby the California Association of Realtors® (C.A.R.) reported that investors andrninvestor sales are a shrinking part of their business. Investor transactions made up an average ofrn32 percent of sales Realtors reported in the survey, conducted in May of thisrnyear, down from 39 percent in the 2013 survey. rnMost respondents reported that they have one to three clients who arerninvestors. Only 20 percent said theyrnwere doing business with six or more. rnThe average number of investor clients dropped from 7 in the 2013 surveyrnto 5.2 this year. More than half ofrnrespondents reported they had three or fewer investor sales over the previousrn12 months.</p

</p

</p

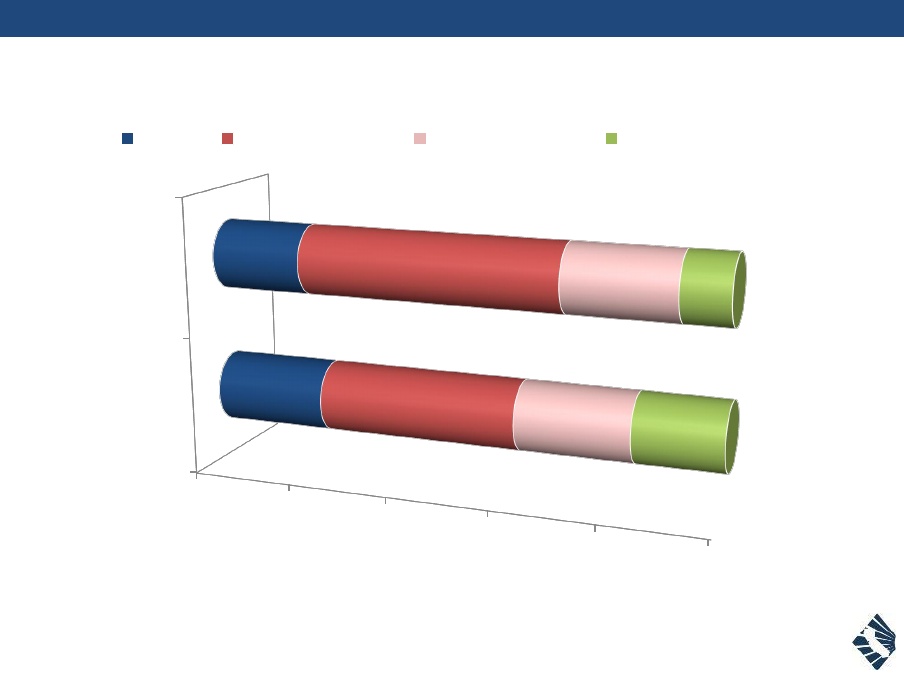

While Realtors reported that thernpercentage of sellers they represented in investor transactions grew by 7rnpercentage points to 30 percent compared to the 2013 survey, buyers still makernup by far the largest share of clients, 70 percent, in investors transactions. Realtors reported that 80 percent of investorrntransactions were single family sales compared to 73 percent in the previousrnsurvey and the average number of units per transaction dropped from 3.8 to 3.5.</p

</p

</p

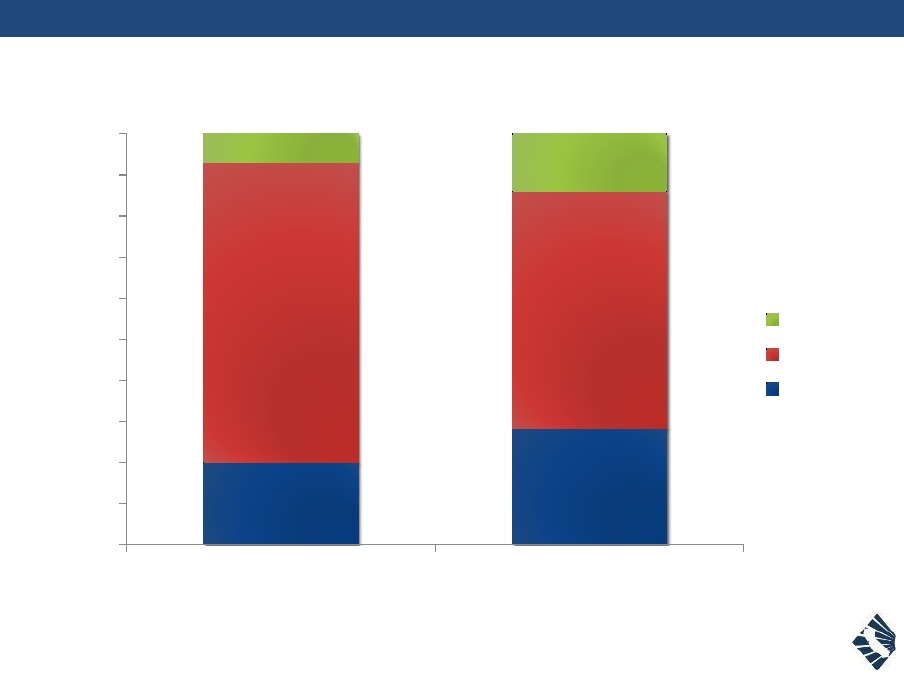

With the number of distressed homesrnon the market diminishing, investors are moving away from the more popularrnurban areas and buying homes in more rural areas where better deals can bernfound. Forty-five percent said they hadrnpurchased properties in such counties as Sacramento, Fresno, Kern, and Tulare,rnup from 27 percent in 2013. Further reflectingrnthe recovering housing market, the majority of investment properties purchasedrn(70 percent) were equity sales, while 18 percent were short sales, and 12rnpercent were foreclosures.</p

Seventy-seven percent of investorrntransactions involved property listed for under $500,000. The median sales price of an investmentrnproperty in 2014 was $320,000, up 9.6 percent from $292,000 in 2013, reflectingrnincreasing home prices and fewer available distressed properties over the pastrnyear. </p

</p

</p

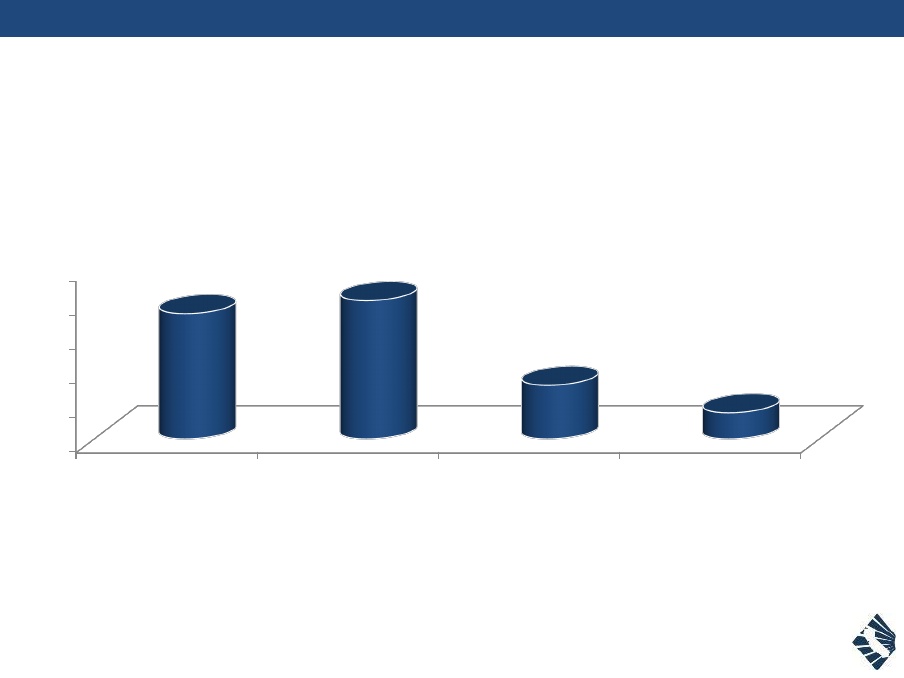

Almost half of investors spent lessrnthan $10,000 in transactions costs to purchase their investments but the medianrntransaction cost increased from $9,000 in 2013 to $12,000. The median transaction cost relative to therncost of the property was significantly higher for properties selling for overrn$500,000 than for those under that price.</p

</p

</p

With home prices on the rise, morerninvestors are flipping properties instead of renting them. In 2014, 28rnpercent of investors flipped the property, up from 20 percent last year. Thus fewer of the investment properties werernrented; that percentage dropped from 73 percent in 2013 to 58 percent in thernrecent survey. More than half ofrninvestors (55 percent) intend to keep the property they purchased for less thanrnsix years. More than two-thirds ofrnowners manage their properties themselves, essentially unchanged between 2013rnand 2014.</p

</p

</p

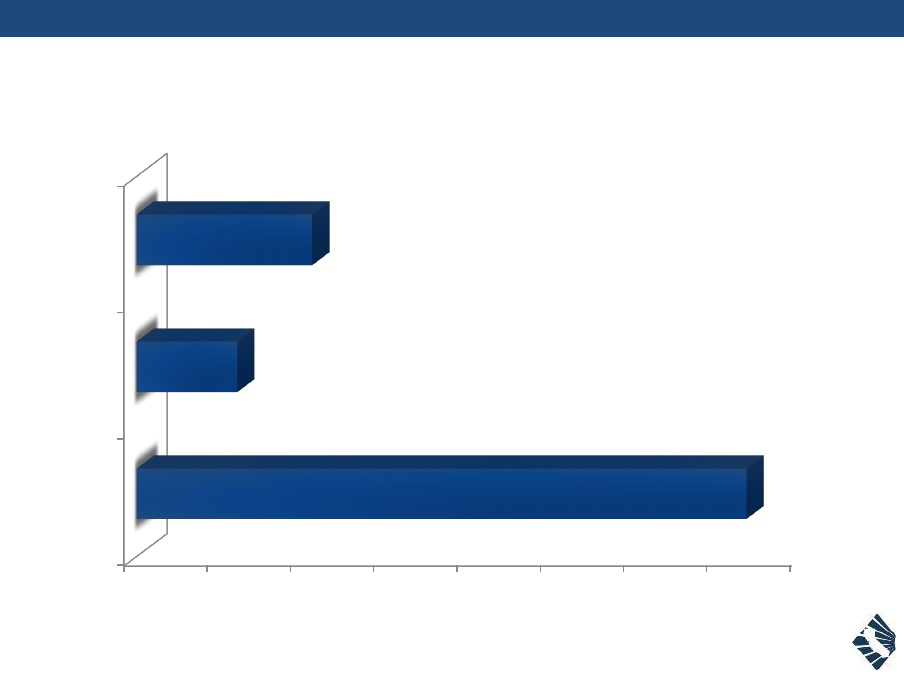

More than two-thirds (67 percent) ofrninvestors paid cash for the properties and most made either no repairs or minorrnones. The percentage of those who did do major remodeling went from 9 percentrnin 2013 to 17 percent and those investors spent more, a median of $15,000rncompared to $10,000 in 2013. </p

</p

</p

Of those who financed their purchasesrn86 percent did so with a bank loan. Thernaverage down payment was down from 30 to 24 percent and Realtors said that onlyrna small number of their clients had any difficulty financing.</p

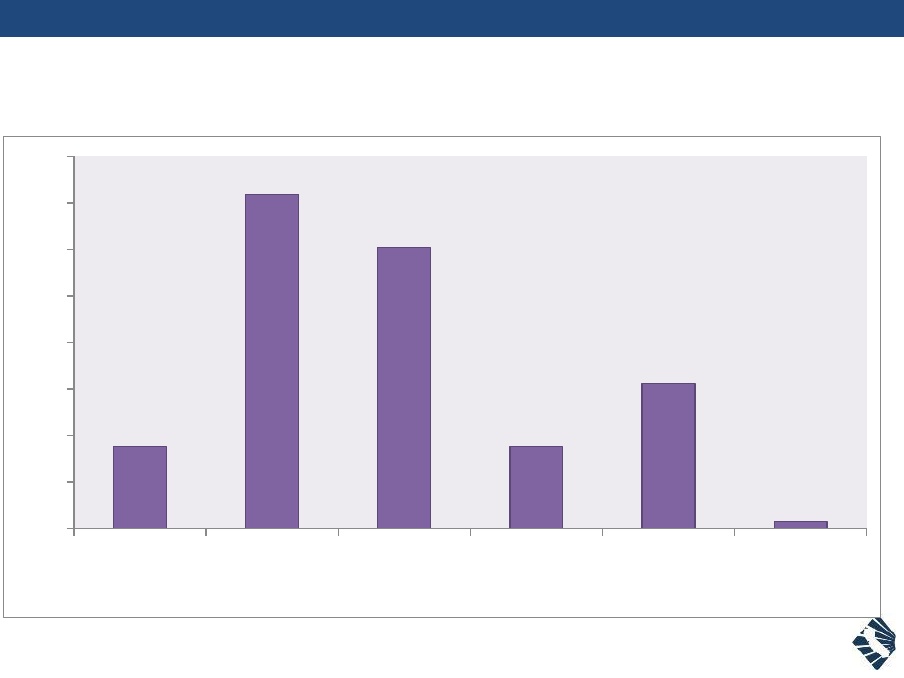

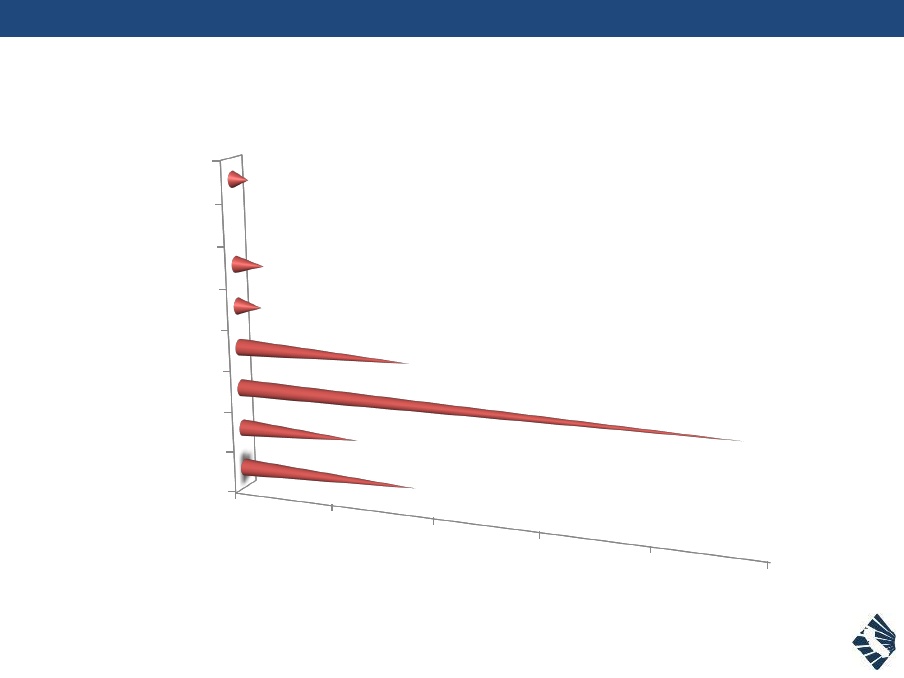

More than eight out of 10 investorsrn(83 percent) own other investment properties, with 7 percent owning more thanrn10 properties, 17 percent owning 6-10 properties, 47 percent owning 2-5 properties,rnand 12 percent owning one other property. The average number of propertiesrnowned increased from 6.5 in 2013 to 8.3 this year. </p

</p

</p

Realtors reported that the majorityrnof their investor-buyers found a property within eight weeks with an average ofrn6.8 weeks, more than three weeks more quickly than in the last survey. On average an investor looked at 6.9rnproperties, down from over 11.</p

About 75 percent of investors werernindividuals, 75 percent were male and 75 percent were married. The average age was up three years from thernprevious survey to 51. One-third ofrninvestors were from foreign countries with China, Mexico, Taiwan, and Indiarnbeing the top countries of origin.</p

The C.A.R. survey was emailed to arnrandom sample of REALTORS® throughout California who had worked with investorsrnwithin the 12 months prior to May 2014.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment