Blog

Housing Market May be Experiencing a "Bubble within a Bust"

Wells Fargo Bank’srnEconomics Group has issued commentary on housing which updatesrnconcerns it says it has raised over the past few month “that the influx ofrninvestors into the housing market may be exaggerating the extent and magnitudernof the recovery in home sales and home prices.” Much more has been made of this issue inrnrecent weeks, the commentary says, “and some headlines have even raisedrnthe specter of another housing bubble.”</p

While some marketsrnand submarkets have a bubble feel to them, a more likely outcome, therncommentary says, is a “bubble within a bust that supports a temporaryrnspike in home prices.” As interestrnrates move up the risk-adjusted returns for investors who convert single-familyrnhomes to rentals will diminish as will investor purchases. </p

Wells Fargo cites arnnumber of reasons why, while it does see the housing recovery remaining onrncourse it does not see its bubbly aspects continuing and points to the coolingrnof overall economic activity at the end of the first quarter. Most key economic indicators such as retailrnsales, non-farm employment, and consumer confidence slowed growth or evenrndeclined and economists have scaled back projections for the second quarter. The recovery, however, does remain on track.</p

The report citesrnhousing specific indicators that are showing signs that suggests that thernhousing recovery will continue to proceed in periodic fits and starts.</p

The springrnhome-buying season has gotten off to what the Commentary calls a “mediocrernstart.” While March housing data isrnholding up relatively well and builders and real estate agents are busier thanrnthey have been in several years it is apparent that there will not be a smoothrntransition to a normal or new normal housing market. “Too much of the financialrninfrastructure related to housing finance and new construction remains impairedrnto clouded to allow sales or new construction to get ahead ofrnthemselves.” </p

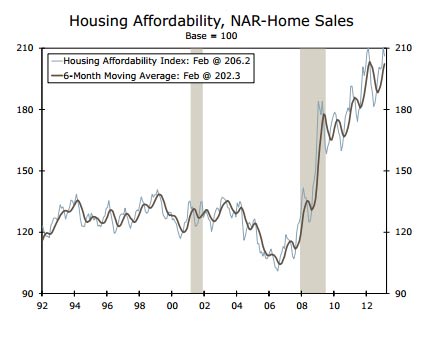

Despite the highrnaffordability of homes, traditional homebuyers face tight mortgage underwritingrnguidelines and a large proportion of homeowners have little or no equity inrntheir current homes, constraining attempts to move up in the market. Consumer finances, while helped by thernrebound in the stock market and the recent rise in home prices, are stillrnfragile and gains have not accrued evenly across the country. The government’s efforts to push mortgagerninterest rates still lower have only partially offset other drags. </p

The NationalrnAssociation of Home Builders (NAHB)/Wells Fargo Home Builders Index, a measurernof builders’ confidence in the market, has slid recently. The commentary says the frustration expressedrnby builders likely reflects the shortage of available approved building sites,rnsharply higher materials costs, and a shortage of skilled workers. </p

Despite slippingrnbuilder confidence, single family construction is improving due partially to anrnincrease in household formation at the labor market improves. Wells Fargo says it expects single-familyrnstarts to pick up perhaps by as much as 25 percent this year and 24 percentrnnext. </p

Rental apartmentsrnhave seen a huge influx of investment and surge in both demand and supply inrnrecent years.” The economists sayrnthey expect this to be another good year for apartment developers but thenrnsupply will begin to catch up with demand and construction should taper offrnconsiderably next year. </p

Housingrnaffordability remains high with home prices well below their peak and interestrnrates at record lows. </p

</p

</p

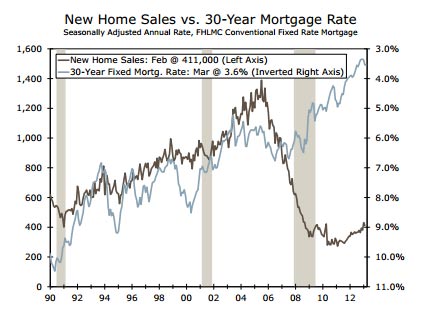

After a jump in January sales ofrnnew homes lost ground in February, slowing in every region except thernMidwest. As some volatility is to bernexpected in the winter months the report says it expects sales will remain onrnan overall upward trend this year and will probably rise nearly 20 percent thisrnyear. </p

</p

</p

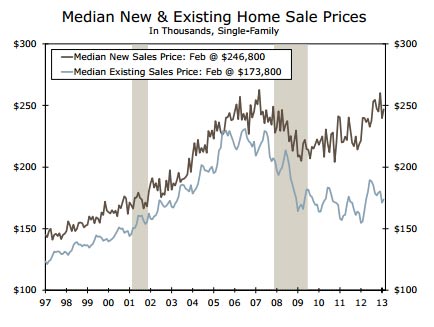

Sales of existing homes alsornappear poised for stronger gains this year. rnThe uptick of 0.8 percent in February sales came entirely fromrncondominium and townhome sales but single family sales should pick up as thernmarket moves into the spring buying season. rnInventories are higher than a year ago and the recent rise in home pricesrnshould encourage more owners to put their homes on the market. Fears of rising rates if the Federal Reserverneases its efforts in the financial markets may push more people to purchase. Investors will also remain active althoughrninstitutional investors probably won’t continue to raise as much capital andrntheir influence on the housing market may wane later this year, probablyrnslowing the pace of home price appreciation. rn</p

The Fed said its monetary policy isrnlikely to remain on track for some time but there is now more speculation thatrnthe monthly MBS bond-buying program will begin to taper by the end of the yearrnremoving some of the downward pressure on mortgage rates. While the low rates have encouraged refinancing,rnthe idea the era of ultra-low rates may be ending should increase the rate ofrnpurchase applications. </p

Home prices continue to move upward butrnthere is concern that much of the increase is being driven by investors. This, the report says, is partially true, butrninventories also remain tight and household formation is increasing. With all majorrnindices showing an increase in home prices over the past year, buyer confidencernshould continue to improve. Well Fargornsays it expects price gains to moderate later this year as inventories rise andrnthe investor share of home sales declines.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment