Blog

Housing Market Optimism Surges in Fannie Mae Survey

Americans responding to the Fannie Mae’srnSeptember edition of its National Housing Survey displayed greater optimismrnabout the housing market, homeownership, and the country’s economy inrngeneral. Fannie Mae said that there hasrnbeen a gradual improvement in attitudes about housing over the last few monthsrnbut consumer attitudes about the economy as a whole improved substantially inrnthe most recent survey, “breaking the progression of waning confidence seen duringrnmuch of this year.”</p

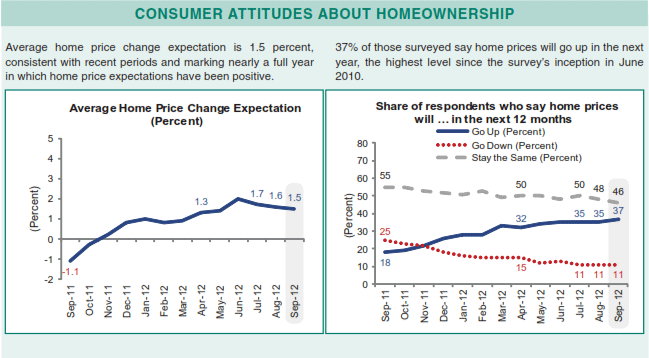

“Consumers are showing increasing faith in thernnascent housing recovery,” said Doug Duncan, senior vice president and chiefrneconomist of Fannie Mae. “Home price change expectations have remained positivernfor 11 straight months, and the share expecting home price declines hasrnstabilized at a survey low of only 11 percent. Furthermore, the Federal Reserve’srnlatest round of quantitative easing has caused a large drop in mortgage raternexpectations. Friday’s September jobs report, including the strong upwardrnrevisions for prior months, a sizable increase in earnings, and a sharp declinernin the unemployment rate, should provide further impetus for improving consumerrnconfidence in the housing market.”</p

Fannie Mae’s survey polls 1,000rnindividuals by phone each month. The surveyrnincludes homeowners with and without a mortgage on their homes and renters. Respondents are asked more than 100 questions whichrnare used to track attitudinal shifts. rnThe survey has been conducted since June 2010,</p

The percentage of respondents whornexpect home prices to rise over the next year is now at 37 percent, up from 18rnpercent one year ago and the highest level in the survey’s short history. Only 11 percent think prices will experiencernfurther declines. The average increasernexpected by respondents is 1.5 percent, down slightly from each of the previousrntwo months but the 11th straight month that price changernexpectations have been in positive territory.</p

</p

</p

Half of respondents expect mortgagernrates to remain unchanged over the next 12 months – an increase of 3 percentagernpoints from August while the percentage expecting rates to rise declined fromrn40 to 33 percent.</p

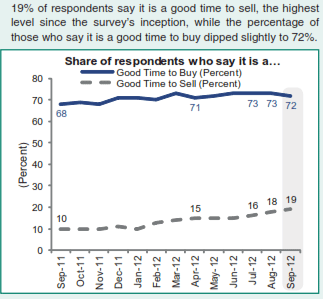

Seventy-two percent of respondentsrnview this as a good time to buy a home, a number that has risen only fourrnpoints over the last year. However, thernpercentage who view the present as a good time to sell has risen 9 points to 19rnpercent in the same time frame. Tyingrnthe June 2012 level for the all-time high, 69 percent of participants said theyrnwould buy if they were going to move.</p

</p

</p

Rental prices are expected tornincrease by 47 percent of those responding with an average increase of 3.1rnpercent. Price increase expectationsrnhave moderated a bit since early summer when respondents were looking forrnincreases averaging 3.9 percent. </p

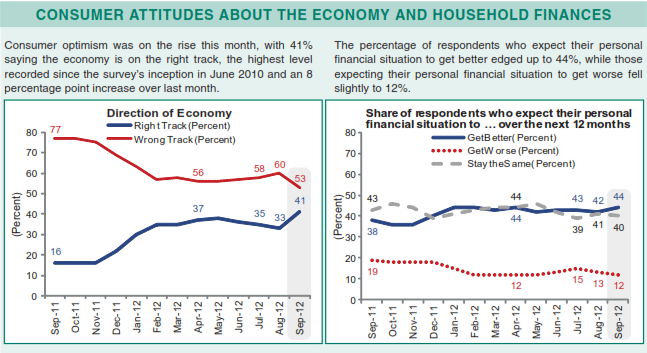

Consumer confidence was way up; 41rnpercent now believe the economy is on the right track, up from 33 percent lastrnmonth. The percent who believe therndirection is wrong dropped from 60 percent to 53 percent. These are, respectively, the highest andrnlowest readings in the survey’s history.</p

When it came to personal financing,rn44 percent responded that they expected their own situation to improve over thernnext year, up from 42 percent the previous month. At the same time, the percentage thatrnreported they actually had a higher household income than one year earlierrndeclined from 20 percent to 17 percent and the percent saying their householdrnexpenses are higher than a year ago rose 2 percent to 34 percent month-over-month.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment