Blog

Housing Scorecard: HAMP Remains an Active Program as Crisis Recedes

The Departments of Treasury and Housingrnand Urban Development released their October edition of the ObamarnAdministration’s Housing Scorecard on Friday afternoon. The report highlighted the Federal HousingrnFinance Agency’s housing price index which posted its largest annual gain inrnfive years and new home sales which are at the fastest pace since April 2010, nearrnthe end of the homebuyer’s tax credit program. Because of the increasing strength of the housingrnmarket the scorecard notes that 1.3 million additional homes are now abovernwater with their mortgages. </p

The Scorecard is a summary of housingrndata from various sources such as the S&P/Case-Shiller house price indices,rnthe National Association of Realtors® existing home sales report, Census data,rnand RealtyTrac foreclosure information. rnMost of the information has already been covered by MND. It also includes by reference the monthlyrnreport on the Home Affordable Modification Program (HAMP) and its subsidiaryrnprograms such as the Second Lien Modification Program (2MP) and the PrincipalrnReduction Alternative (PRA). The currentrnreport covers information through September. </p

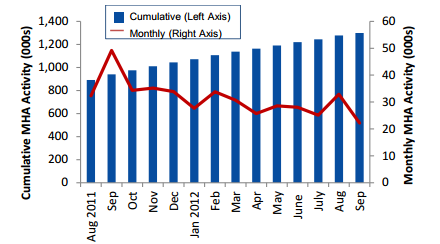

HAMP continues to be an active program even though the volume hasrndecreased from levels in 2010 and 2011. rnSince the last HAMP report an additional 15,186 homeowners have enteredrninto trial modifications and 13,849 trial modifications became permanent. HAMP has now initiated 1,927,625 trials since thernprogram was initiated in April 2009 and 1,090,596 of those trials became permanent. These homeowners have reduced their first lien mortgage payments by arnmedian of approximately $541 each month – more than one-third of their median before-modification payment – saving a total estimated $15.6 billionrnto date in monthly mortgage payments.</p

</p

</p

Permanent modifications continue to perform well over time. More than 94 percent of homeowners remain inrnpermanent modifications after six months in the program while 9.4 percent arern60 or more days delinquent. HAMPsrnmodifications continue to exhibit lower delinquency and default rates than proprietaryrnmodifications according to the Office of Comptroller of the Currency.</p

The 2MP program has now initiated almost 97,000 second lienrnmodifications, 23,656 of which have resulted in full extinguishments of thernsecond lien and 62,443 modifications. </p

The Unemployment Program (UP) offers temporary forbearance of at leastrn12 months to homeowners who are unemployed. rnThrough September 23,307 homeowners have been granted forbearance withrnsome monthly payment required and 3,724 forbearance without a required payment.rn </p

PRA is available only to mortgages not owned or guaranteed by FanniernMae or Freddie Mac. There have been 90,851rnpermanent modifications using principal reduction under the HAMP program,rn68,805 of which have been done through the PRA program. Active permanent modifications done throughrnPRA have resulted in a median principal reduction of 31.7 percent compared to arnmedian reduction of 18.0 percent for HAMP modifications with principalrnreductions done outside of PRA. Therernhave been 3,865 PRA trial modifications started since the last report and 3,070rnpermanent modifications.</p

Just over 100,000 transactions have been initiated under the HomernAffordable Foreclosure Alternatives Program (HAFA) which facilitates shortrnsales and deeds-in-lieu of foreclosure. CompetedrnHAFA transactions include 73,536 short sales and 1,887 deeds-in-lieu. The bulk of completed transactions – 50,561 -rnwere on privately owned mortgages, 19,807 were portfolio mortgages, and 5,055rnwere mortgages owned or guaranteed by one of the government sponsoredrnenterprises (GSEs).</p

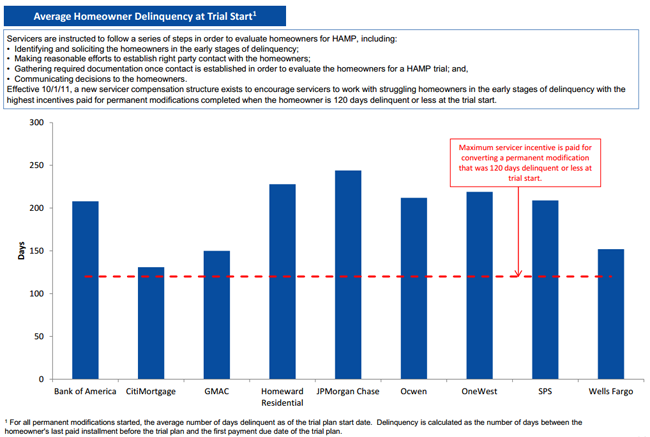

Most servicers now appear to be performing at or above HAMP standards.rnOne such standard is that servicers must complete permanent modifications beforerna borrower’s delinquency exceeds 120 days receive to receive full financialrnincentives. All of the large servicesrnnow meet or exceed that standard.</p

</p

</p

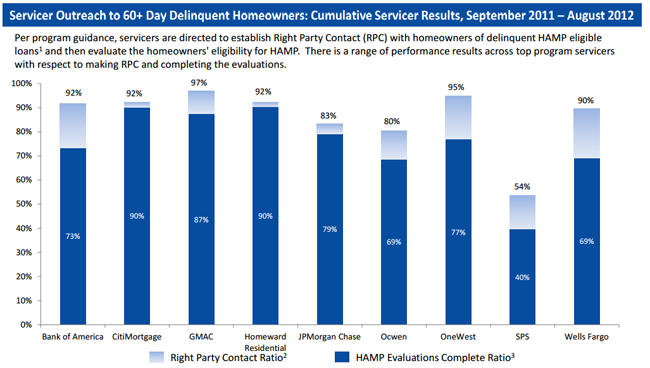

Performance is a little more ragged for a second standard under which servicers arerndirected to establish Right Party Contact (RPC) with homeowners of delinquentrnHAMP eligible loans and then evaluate the homeowners’ eligibility for HAMP.</p

</p

</p

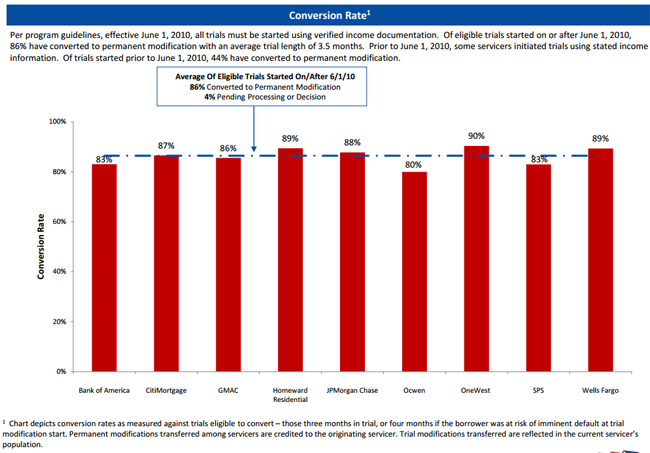

Finally, effectivernJune 1, 2010, all trials must be started using verified income documentation.rnOf eligible trials started on or after June 1, 2010, 86% have converted tornpermanent modification with an average trial length of 3.5 months. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment