Blog

Housing Scorecard Shows Borrowers Continue to Access MHA Programs

ThernU.S. Department of Housing and Urban Development (HUD) and the U.S. Departmentrnof the Treasury today released the January edition of the ObamarnAdministration’s Housing Scorecard. ThernScorecard is a summary of housing data from various sources such as thernS&P/Case-Shiller house price indices, the National Association of Realtors®rnexisting home sales report, Census data, and RealtyTrac foreclosurerninformation. Most of the information hasrnalready been covered by MND. </p

ThernScorecard is accompanied with the month report on the various programs operatedrnby the Making Home Affordable programrnincluding the Home Affordable Modification Program (HAMP), the Second LienrnModification Program (2MP), and Principal Reduction Alternatives (PRA). The current report contains program activityrnthrough the end of November 2012.</p

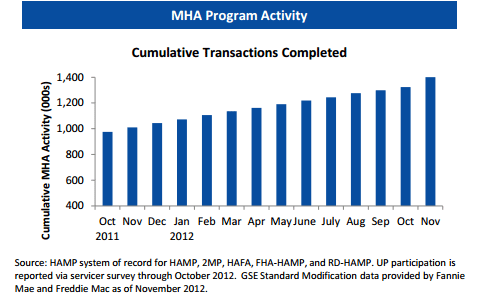

Activity under the various programsrnoperated under MHA has now reached 1.43 million borrowers. The majority of these, 1.12 million have beenrnserviced through HAMP but standard modifications have been done through thernGSEs for 84,961 borrowers; FHA and RD HAMP permanent modifications have beenrncompleted for 10,463 borrowers. Therernhave been 101,722 2MP modifications, 29,050 UP Forbearance Plans and 85,881rnHome Affordable Foreclosure Alternatives completed. </p

</p

</p

Despiternthe overall improvement in the housing market borrowers are continuing tornutilize the various MHA programs. SincernOctober data was released there have been 21,816 new entrants into the HAMPrnprogram and 15,399 borrowers have converted their modifications from trialrnstatus to permanent modifications. In addition to the 1.21 million permanentrnmodifications since the program began almost 68,000 borrowers remain in trialrnstatus.</p

HAMPrnhas now begun reporting on Tier 2 modifications. Tier 1 modifications follow a series ofrnwaterfall steps including interest rate adjustment, term extension, andrnprincipal forbearance. Tier 2 providesrnanother opportunity for borrowers who do not qualify for Tier 1 or who fall outrnof a Tier 1 trial. There have been 4,174rnTier 2 modification trials started over the life of the program and 331rnpermanent modifications. Of thosernstarting a Tier 2 modification 39 percent were previously in a Tier 1 trial orrnpermanent modification and 22 percent were evaluated for but did not qualifyrnfor a Tier 1 trial. </p

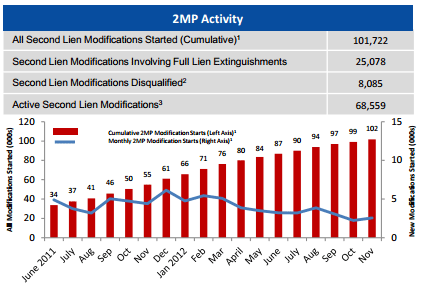

Thern2MP program is available to borrowers when second mortgages interfere withrntheir ability to obtain a modification of the senior lien. Servicers attempt to work with the secondrnlienholder to modify or erase the 2nd lien so modifications of thernfirst lien can proceed.</p

Torndata the program has identified 123,638 second liens that appear eligible forrn2MP and 82 percent or 101,722 of these liens have been modified. About a quarter of these modificationsrninvolve full extinguishments of the second lien and 68,559 liens were modified.</p

Thernmost controversial of the MHA programs has been the PRA or Principal ReductionrnAlternative program. Principalrnreductions are offered as a part of the loan modification arsenal but not forrnGSE loans. This has been the subject ofrnconsiderable conflict between the GSE’s conservator the Federal Housing FinancernAgency (FHFA) and Congress. To datarnservicers have started 110,482 PRA modifications under HAMP and 85,361 permanentrnmodifications. There have been 3,652rnpermanent HAMP PRA modifications started since the last MHA report. Servicers have started another 146,141 trialrnmodifications using non-HAMP principal reduction guidelines and 113,439rnpermanent modifications. </p

“The Obama Administration’s effortsrnto speed housing recovery are showing continued progress as the Januaryrnscorecard indicators highlight clear forward momentum in the housing market,”rnsaid HUD Deputy Assistant Secretary for Economic Affairs Kurt Usowski. “Thernhousing market has clearly bottomed out nationally and is turning a corner withrnnew home construction increasing to a level not seen since June 2008 and homernprices showing strong annual gains. But with so many households stillrnstruggling, we have important work ahead.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment