Blog

Housing Slowdown – Healthy Signal or Coal Mine Canary?

Redfin, a multi-state real estate firm based in Seattle, saysrnit is seeing “signs of an enduring slowdown” in the housing market. This isn’t necessarily bad the company says,rnciting anecdotal information about bidding wars and mammoth profits rung up byrnshort term owners. Slowing could mean arnnormalization of the housing market. </p

Or it could be another indication that the economy isrnslowing as well.</p

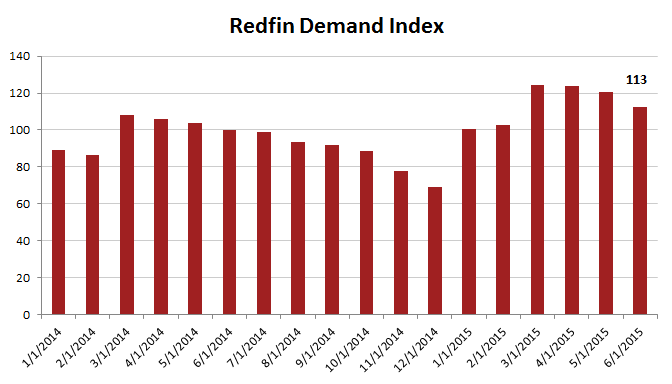

Redfin’s Housing Demand Index tracks home tours and purchasernoffers in 15 metropolitan areas served by the company. It showed a 6.7 percent drop in June, a farrnsteeper decline (albeit from a far higher level) than at the same time lastrnyear. The company says it expect pricesrnto grow at a modest 2.2 percent in August (we assume that is an annualrnprojection.)</p

</p

</p

Redfin noted that June’srnPending Home Sales Index from the NationalrnAssociation of Realtors also took a dive, falling 1.8 percent after five straightrnmonths of increases, meaning fewer home sales in the pipeline. While it’srnroutine for sales to slow this time of year, Redfin says, the steep declinerncaught economists off guard.</p

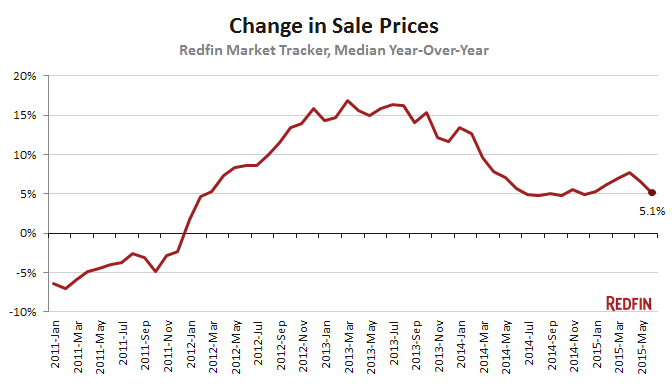

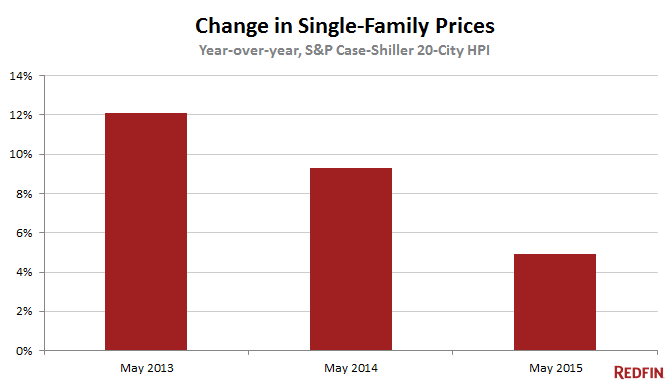

Price increases are also deceleratingrnas indicated by both Redfin’s Market Track and the S&P Case-Shiller HomernPrice Index. A slowing of appreciationrnis a good thing in this environment the company says, especially for buyers.</p

</p

</p

</p

</p

So what is behind the slowdown? Redfin cites a number of factors:</p<ul class="unIndentedList"<liMortgagerncredit is tighter than it used to be and a lot of houses already are priced outrnof reach for a lot of people. </li<liEvenrnthough companies are hiring, employers aren't stepping up to the platernsalary-wise. Abroad measure ofrncompensation from theLabor Departmentshowed almost no growth in payrnand benefits last quarter and economists at PNC Financial Services called it "arndefinite disappointment" that might give pause to the Fed as it ponders a raternhike.</li<liGlobalrnpressures are being brought to bear on housing, too. Economists at both WellsrnFargo and CoreLogic have noted the strong U.S. dollar might discourage foreignrnbuyers in some markets. </li<liHomeownershiprncontinues to decline. It is now at itsrnlowest rate since 1967. </li</ul

They cite demographics as well. The country is getting younger as the hugernmillennial generation crests, but since 2007, while the population of 18- torn34-year-olds grew by 3 million, the number of young adults living independentlyrnactually fell, from 42.7 million to 42.2 million this year. It is a confounding development, Redfin says,rnborn of student debt and the slow economic recovery. It will probably change as the generationrnages, but maybe it won’t. </p

Homeownership is among the mostrnreliable routes to building wealth so declining homeownership will mean it willrnbe investors not homeowners who reap the benefits. That, Redfin says, spells trouble for thernwealth gap. With more Americans rentingrnand paying higher rent than ever that problem increases. One in four households now spend half or morernof their income on rent.</p

But Redfin’s take on slowing home sales may be more than arnsignal that housing is “normalizing.” rnThere are other clouds on the horizon. rnExisting home sales in June were very strong but the report on new homesrnsales, which probably came out after the Redfin article was written, showed arn35,000 decline in the June annual rate compared to May. July job creation was softer than anticipatedrnand retail sales showed broad weakness, way below analysts’ expectations atrn-0.3 percent with auto, furniture, building materials, and restaurant sales allrndown. Consumer sentiment has showedrnsigns of softening and the Consumer Confidence index for July fell almost 9rnpoints reflecting, according to Bloomberg, pessimism about the jobs outlook.</p

The month is young but three of the four economic reportsrnout so far were not great. Factoryrnorders for June rose respectably but construction spending was flat at +0.1rnpercent and both July manufacturing indices, the PMI and the ISM were down – 0.2rnpercent and 0.8 percent respectively.</p

Housing has been expected to drive the economy over the nextrnfew quarters and recent indicators show that it may need the help. If housing is also slowing as Redfin says,rnthe future may be less rosy than we thought.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment