Blog

Improving Markets List Expands to Include at Least One Major City in Every State

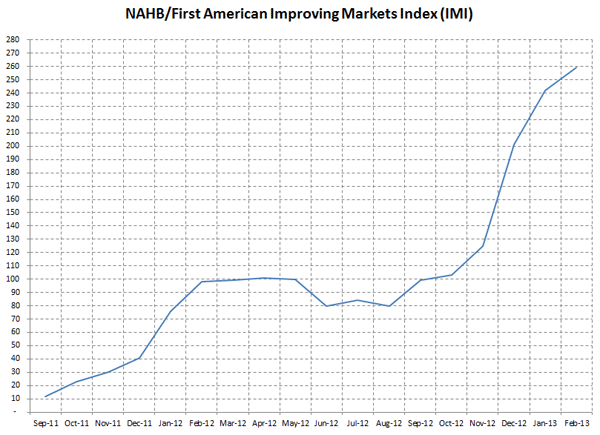

All fifty states and the District ofrnColumbia are now represented on the Improving Markets Index (IMI) that wasrnreleased today by National Association of Home Builders (NAHB) and FirstrnAmerican Title Insurance. The FebruaryrnIMI expanded to a total of 259 metropolitan areas with the addition of 20 citiesrnto the list</p

The new cities represented 15 statesrnwith five of those states, Georgia, Indiana, Kansas, North Carolina, and Texasrnadding two metropolitan areas each. Amongrnthe new additions were Racine, New York, El Paso, Albuquerque, and Topeka. Threernareas, Champaign, Illinois; Lebanon, Pennsylvania; and Amarillo, Texas droppedrnfrom the list in February. </p

Improving markets are defined as those thatrnhave posted six straight months of improvement from their respective troughs onrneach of three economic measures; home prices provided by Freddie Mac,rnemployment data from the Bureau of Labor Statistics, and construction activity asrnmeasured by data on building permits from the Census Bureau. </p

NAHB and First American began compilingrntheir list of improving markets in September 2011. The number of markets, which was fairlyrnstatic for the first half of 2012 has since risen rapidly, increasing from 80rncities to 259 in six months.</p

</p

</p

“The fact that all 50 states nowrnhave at least one metro on the improving list shows that the housing recoveryrnhas substantial momentum and continues to expand from one market to thernnext,” said 2013 NAHB Chairman Rick Judson, a home builder from Charlotte,rnN.C. “Of course, there is still much room for improvement in metros thatrnhave not yet been listed as well as those that have, and we know that a keyrnfactor slowing this progress is today’s overly stringent mortgage standardsrnthat are keeping qualified buyers on the sidelines.”<br /<br /"Just over 70 percent of the 361 metros covered by the IMI are listed asrnimproving this month," said NAHB Chief Economist David Crowe. “That’srna far cry from when we initiated this index with just 12 improving metros inrnSeptember of 2011 for the purpose of highlighting places that didn’t fit thernmold of the national headlines. Today, the story is about how widespread thernrecovery has become as conditions steadily improve in markets nationwide.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment