Blog

Increasingly Optimistic Attitudes on Housing Market

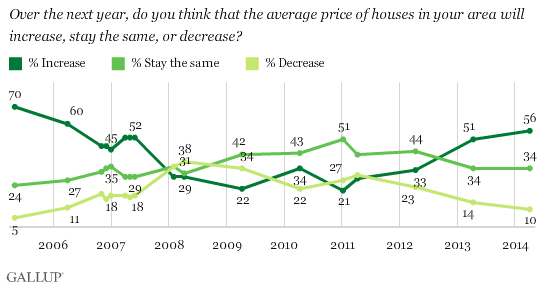

A new Gallup survey seems to indicate that Americansrnare falling in love with real estate again. rnThe poll, conducted among over a thousand respondents this month, showsrnthat 56 percent of Americans think the average price of a home in their localrnarea will increase compared to only one-third who thought so two years ago andrn21 percent, a survey low, in January 2011. rnAnother 34 percent expect prices to remain at about the same level,rnleaving only 10 percent who believe prices will fall again. The current euphoriarnis not up to pre-crash standards, but is closing in on the peak 60 percent whornexpected appreciation in late 2006. </p

</p

</p

The results were gathered by Gallup’s annual Economy and Personal Financernpoll, which has tracked Americans’ perceptions of the housing market annuallyrnsince 2005. In the years following thernhousing crisis, 2008-2011, Gallup said Americans were more likely to look forrndeclining home values in their local area than any appreciation. That began to change by April 2012 when publicrnoptimism about home values outweighed pessimism by 33% to 23%. Now, more thanrnfive times as many Americans believe local home values will increase as believernthey will decrease. </p

There is a strong regional bias in the survey with those living in the West mostrnlikely to think home values will increase, at 72%. Prices have risen by double digits in severalrnwestern states, especially California. Converselyrnonly 44 percent of residents in the East expect price increases. Attitudes of those in the South and Midwest closelyrnmirror national numbers at 54 percent and 53 percent respectively. </p

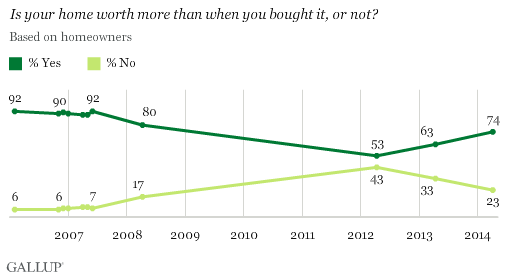

Gallup said respondents’ opinions may be influenced by their ownrnexperiences. About 64 percent of Americansrnare homeowners and 74 percent of them say their home is worth more today thanrnwhen they bought it. Last year 63rnpercent said their homes had increased in value and 53 percent made this claimrnin 2012. Even with the increase however,rnhomeowners are nowhere near where they were in the 2006 and 2007 surveys whenrnupwards of 90% of homeowners said their home value exceeded the purchase price. Responses to this question may also mean thatrnfewer homeowners are “underwater,” owing more on their mortgage than theirrnhouses are worth. </p

</p

</p

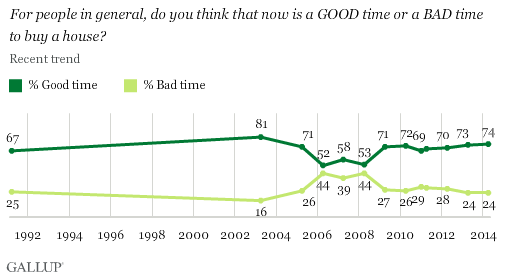

Seventy-four percent of Americans say it is a good time to buy a house,rnwhile 24% call it a bad time. That ranks among the most positive readingsrnGallup has received. Responses to thisrnquestion actually bottomed out at the height of the housing boom when pricesrnpeaked and only 52 percent considered it a good time to buy. Even as home values plummeted over the nextrntwo years Americans continued to be pessimistic about buying a home. In 2009 when depressed home values meantrnhouses were a better buy the number grew to around 70 percent and has remainedrnnear there with what Gallup called “marginal increases” in each of the lastrnthree years. Homeownership factors intornthis response; 81 percent of current owners consider it a good time to buy butrnonly 60 percent of renters.</p

</p

</p

Gallup says that Americans’ views of the housing market were clearly shakenrnduring the downturn, but have mostly recovered today. The nearly three in four who say it is a goodrntime to buy a house could reflect the realization that the worst of the housingrncrisis is over, but that values have not yet risen to a level where homes arernover-priced. “These more positive viewsrnof the housing market may help foster a situation in which home buying activityrnincreases and home values continue to rise over the next year,” the Galluprnreport says.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment