Blog

Individual Loan Officer Applications Fall for the First Time Since 2011

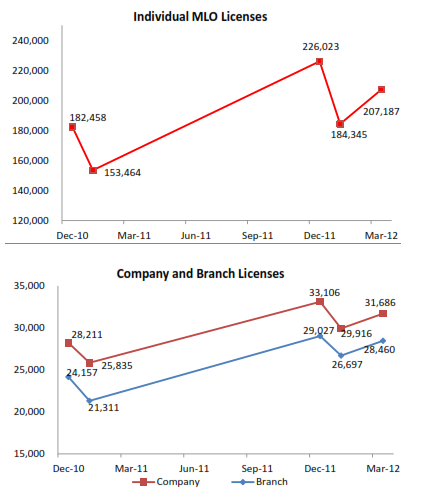

NMLS has reported that 120,142</bindividuals are now licensed by the states as mortgage loan originators (MLOs)</bas are 16,688 companies. NMLS's FourthrnQuarter report includes tallies on both state licensed or registered loanrnoriginators and those licensed by federal government agencies.</p

The 16,688 companies which have 18,819rnbranches hold a total of 33,872 licenses. rnThese licenses include separate licenses required for other trade namesrnor for different authorities (i.e. Lender and Broker) required in somernstates. Federal licenses are held by 124rnof the state licensed companies. Individual licensees hold 258,948 licenses andrn5,530 hold both state licenses and federal registration.</p

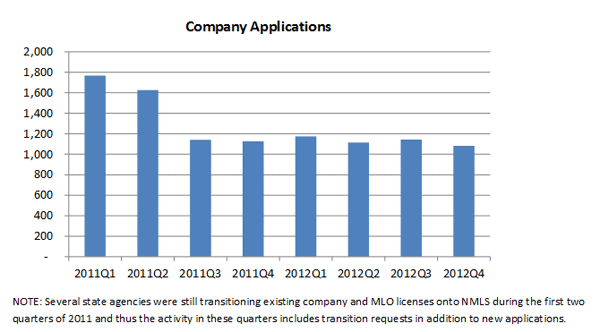

In the fourth quarter applications forrnlicensing/registration were submitted by 1,082 companies, 3,021 branches, andrn20,689 individuals. Applications werernapproved for 837 companies, 2,587 branches, and 16,653 individuals. Once state agencies finished transitioningrncompany and MLO licenses into the NMLS system in mid 2011 the quarterly levelrnof new company applications has remained relatively static at around 1,100 torn1,200. Individual MLO applications howeverrnhave increased fairly steadily from a low of about 14,000 in the third quarterrnof 2011 to the present level, although applications in Q4 were down slightlyrnfrom those in Q3. </p

</p

</p

</p

During the quarter there were 19rncompany, 12 branch, and 8 MLO licenses revoked. rnEleven of the company licenses and all of the branch licenses were inrnCalifornia as were four of the MLO licenses that were revoked. </p

At the end of the fourth quarter therernwere 11,052 institutions holding federal registration, an increase of 1.3rnpercent from the third quarter. MLOrnregistrations totaled 399,286, an increase of 1.2 percent. The largest increases in individual licenses werernin Montana, up 5.1 percent and the District of Columbia, +3.7 percent. The largest declines were in Arizona, downrn3.7 percent and New Hampshire which declined 2.9 percent. </p

The largest number of federalrnregistrations, 232,142, is through the Office of Comptroller of the Currencyrnwith the next highest number, 74,868, registered with the Federal DepositrnInsurance Corporation.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment