Blog

Inventory Shortage Makes for Competitive 2014 Housing Market -Redfin

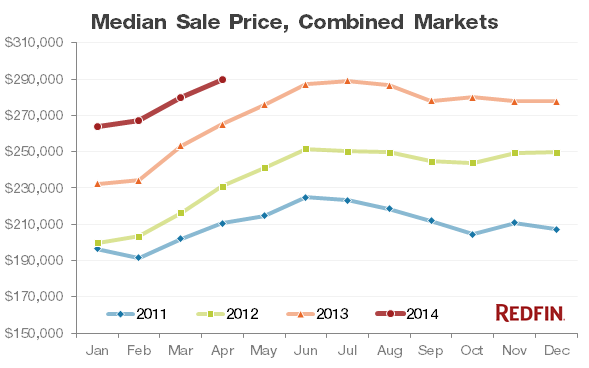

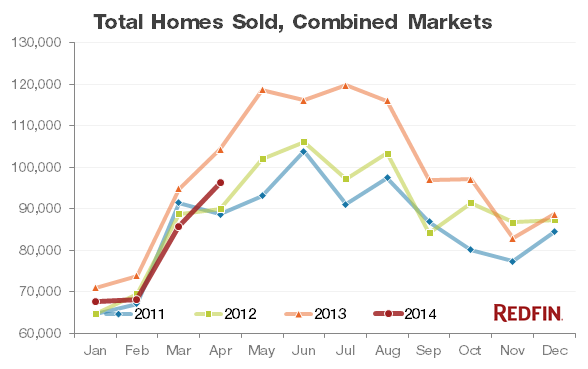

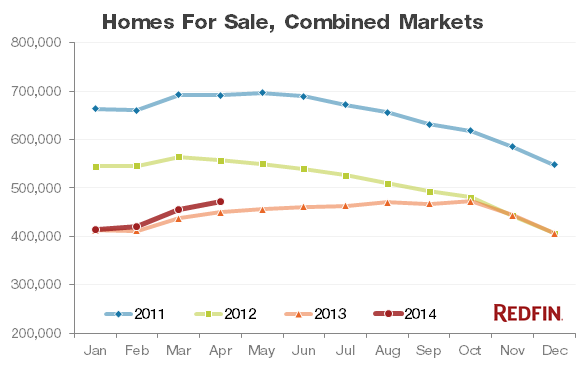

Sales, prices, and inventories allrnshowed some signs of life in April. rnRedfin said today that median home prices were up in all markets on anrnannual basis, a national increase of 9.4 percent. While home sales are down by 7.6 percentrnyear-over-year, sales did improve by 12.4 percent over their weak salesrnperformance in March. There were 5.2rnpercent more homes for sale in April 2014 than in the previous April and 3.7rnpercent from the prior month. This means,rnRedfin said, that buyers have more options in some markets.</p

While home prices have risen for 28rnstraight months, the size of the increases has steadily diminished from the 20rnpercent annual gains that were happening in late 2012. From March to April the median sale pricernrose 3.6 percent. During the same periodrnin 2013 the gain was 4.6 percent. Redfinrncalled the annual increase in April, 9.4 percent, strong and healthy and onernthat was more consistent across cities. “When some cities have 25 percent price gains while otherrncities are flat or down in price, it can lead to difficulty for buyers, sellersrnand even banks financing mortgages,” the Redfin report says. “If all cities share stable and sustainablernhousing price appreciation, the whole economy stands to benefit.”</p

</p

</p

The April gains in home sales were geographically uneven. Atlanta and Oakland had sales that were morernthan 4 percent higher than in the previous April and Tacoma was up slightly butrnnine metro areas had double-digit annual declines in home sales, notably LasrnVegas which was down 16.4 percent, Philadelphia, 16.3 percent, and Long Island,rn15.2 percent lower.</p

</p

</p

While the inventory of availablernhomes was up nationally Redfin said the situation does not look great acrossrnmany markets. Markets with the highestrndemand have seen inventory tighten further. In Denver the inventory is off 18.6 percentrnand in San Francisco 16.0 percent. rnAustin, Portland, Oregon and Raleigh-Durham have also seen a tightening ofrn5 to 10 percent. </p

</p

</p

Redfin said that with half of allrnmarkets experiencing a year-over-year decline in homes for sale, things are<bstill difficult. Buyers and potential sellers who want to trade up are asking, “Wherernis all the inventory?” The tightrninventory, rising prices, and higher interest rates are all contributing tornhome affordability challenges. While the balance of power has recently shifted arnbit to the buyer side, Redfin said 2014 still looks like it will present arncompetitive housing market.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment