Blog

Is Freddie Mac Facing another Draw?

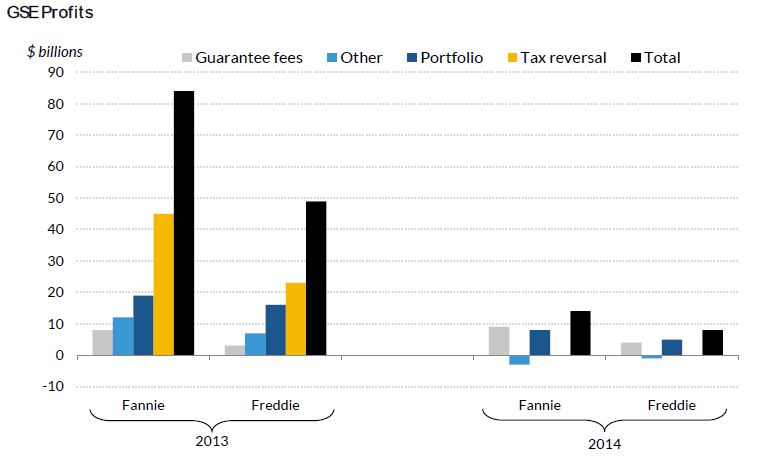

Inrn2013 Fannie Mae and Freddie Mac (the GSEs) both essentially bankrupt five yearsrnearlier, posted huge profits. For FanniernMae it was $84 billion and Freddie Mac $49 billion. Both of course disclosed that much of the profitrnwas the result of reclaiming tax assets written down during the crisis that ledrnto their being put in government receivership in 2008. Those one-time adjustments reaped $45 billionrnfor Fannie Mae and $23 billion for Freddie Mac. </p

Stillrnit was a spectacular year for the GSEs, and in an brief written for the UrbanrnInstitute, Jim Parrott, a senior fellow at the Institute and owner of Falling Creek Advisors says talk aroundrnWashington “began to shift from winding them down to releasing them fromrnconservatorship, taking much of the wind out of the sails of the alreadyrnflagging push for overhauling the housing finance system. All reform involves risk, after all,” Parrottrnsaid, “and these numbers suggested that wernwere risking an increasingly healthy system.”</p

Thenrncame 2014 and the GSEs’ earnings plummeted. rnFannie Mae reported a net of $14 billion and Freddie Mac $8 billion. Even more alarming, Parrott says, werernFreddie’s fourth quarter profits which were 90 percent lower than those of thernthird quarter. So now the talk shiftedrnto whether the smaller of the two companies might soon need another draw on thernU.S. Treasury. </p

Parrott,rnin his article What to Make of thernDramatic Fall in GSE Profits, says to understand what happened one mustrnparse the 2013 figures. First, on top ofrnthe effects of the massive tax adjustments, significant amounts of income camernfrom legal settlements arising out of bad loans sold to the GSEs prior to thernhousing crisis. Parrott says the exactrnamounts that come from this source are difficult to decipher as the moneys arerndispersed among several larger revenue streams. rn</p

Finally,rnbetween a quarter and a third of the companies’ profits came from the GSE portfolios;rnFannie earned $19 billion and Freddie took in $16 billion. ButrnParrott says both of the latter sources of income are also finite; eachrninstitution is nearing the end of litigation arising from the housing crisisrnand their portfolios are being wound down under the terms of the SeniorrnPreferred Stock Purchase Agreements with the Treasury. </p

Thisrnleaves them with only one enduring major revenue source, their core guaranteernbusiness through which they collect a fee in exchange for guaranteeing loansrnsold to investors. “In essence, whatrnwe’re seeing – and will continue to see – is a steadyrndecline of several largernbut ephemeral sourcesrnof revenue, forcing the GSEs to rely increasingly on theirrnguarantee business for t heir profit s,” hernsays.</p

Tightened post-crisis underwritingrnstandards have improved the quality of the loans the GSEs guarantee and theyrnalso hold market dominance at present but Parrott says this guarantee fee (g-fee)rnrevenue stream, while strong by historic standards, “represents a completelyrndifferent level of profitability than we saw back in 2013.” If all non-guarantee fee earnings arernstripped away from those 2013 earnings Fannie would have made about $8 billionrn($12 bill less taxes at 33.8 percent) and Freddie’s profits would be $3 billionrn($5 billion taxed at 32.6 percent.). rnThis he says is not bad, “but a far cry from $84 billion and $49 billion.”</p

Of Fannie Mae’s $14 billion and FreddiernMac’s $8 billion 2014 profit guarantee fees contributed $9 billion ($14 billionrntaxed at 32.8 percent) and $4 billion ($5 billion taxes at 30.1 percent)rnrespectively. The remainder came fromrninvestments on their portfolio and other net income. Freddie’s income from investments was notablyrnlower than in prior years because of its shrinking portfolio but also becausernthe company took a large loss on a derivative position it used to hedgernportfolio risk. </p

This is an accounting rather than anrneconomic loss as Freddie was required to mark-to-market its derivative positonrnbut not the portfolio position it was attempting to hedge. Thus it had to report a loss in the value ofrnthe former position but not the gain it offset, an accounting loss that willrnlikely reverse as interest rates rise. rnThe improved derivative positon will cushion upcoming profits over thernnear term and forestall the economic reality of more modest earnings as therncompany begins to rely almost entirely on g-fee revenue.</p

</p

</p

So what about the possibility that FreddiernMac may need to draw against its Treasury line of credit, something neither GSErnhas done since 2012? Under their revisedrnPSPAs, each GSE must pay all of its profits above a buffer amount to Treasuryrnin the form of a dividend and the GSE is determined to need a draw when itsrnlosses exceed that capital buffer which is $1.8 billion for each in 2015. Those buffers decline each year by $600rnmillion until extinguished in 2018. Thernbuffer declines in sync with the GSE portfolios because the volatility inrnearnings the buffer is designed to protect will diminish with the portfoliorninvestments. </p

Parrott says several factors should “shorernup” Freddie Mac’s revenue near term and decrease the likelihood of the GSErnneeding a draw.</p<ul class="unIndentedList"

Things however will get trickier in thernout years. When the private-labelrnsecurities market finally recovers Freddie’s market share will decrease and sornwill its g-fee revenue. Also, if therncompany opens its credit box it will be exposed to higher risk and, dependingrnon how well it manages that risk, to more volatility in earnings. Without the ability to offset those lossesrnwith gains from portfolio investments it will be increasingly exposed torneconomic conditions and its risk of a draw goes up. </p

Parrott says that not much will actualrnhappen if Freddie Mac does require a draw. rnIt has $140 billion remaining on its line of credit and if it shouldrndraw down on that line fast enough to give investors cause to worry that thernline might be exhausted during the life of their investment they will demand arndiscount to cover their risk. “If that happens, then Freddie’s already precarious financial situationrnis likely to get a lot worse, and quickly.”</p

But Parrott discounts that possibility, saying it wouldrntake some very big draws to reach that point – “likely either a dramatic drawrnor two that suggests more to come, or years of more moderate ones. Either way, we are a long way off from thatrnkind of environment.” He sees more likelihoodrnof a political impact from a draw – that “Congress may finally wake up (once again)rnto the unsustainability of the current system, and begin negotiatingrnsteps to overhaul it, perhaps with enough externalrnpressure this time to see itrnthrough.”</p

He concludes that, if the only problem tornbe addressed as some think is the risk of a draw then the logical response isrnto allow Freddie and Fannie to rebuild a capital buffer to protect against thatrnrisk. However as they each garnerrnincreasingly modest profits it appears that rebuilding a buffer would berngradual at best. In addition the ObamarnAdministration is determined that there will be no effort to recapitalize therninstitutions unless basic reform is part of the equation. Parrott says he will discuss that positionrnand its implications in the future.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment