Blog

Loan Mod Conversion Rate Improves in February. True Success Depends on Job Creation

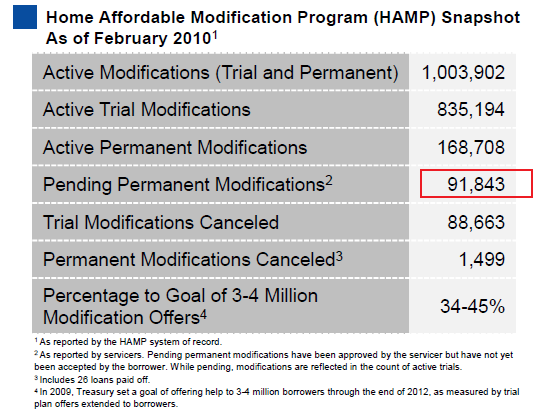

The Making Home Affordable Program (HAMP), a joint effort byrnthe Departments of the Treasury and Housing and Urban Development to preventrnforeclosures, is reporting that 168,708 homeowners have now graduated from thernHAMP trial modification program and have active permanent modifications by the end of February. This works out to a 12.4 percent conversion rate, a modest improvement from January when the permanent modification conversion rate was 9.2 percent.

The program, which began last spring, has now enrolledrn1,094,064 borrowers in modifications which lower mortgage payments to amaximumrnof 31 percent of monthly income. rn1,354,350 invitations to participate in the program have been extendedrnto distressed homeowners. This is 34 torn45 percent of the goal of 3 to 4 million set for the end of 2012. Atpresent 835,194 loans are in some phase ofrnthe trial period, a number which includes the pending permanentmodifications. To date 88,663 trial modifications and 1,499 permanentrnmodifications have been cancelled. The report does not give anyreasons for therncancellations. In addition, 91,843rnborrowers had successfully completed the three month trial period andpermanentrnmodifications were awaiting borrower acceptance.

Servicers handling administration of the program can modifyrnloans through a reduction of the interest rate, extension of the term of thernloan, and/or forbearance of principal. rn100 percent of permanent modifications had a reduction in rate, 41rnpercent an extension of term, and 27.8 percent received forbearance. The median decrease in monthly payment forrnthose in the program is $518.88, resulting in a median payment of $837.86. These homeowners' lower monthly payment represents a cumulative $2.7 billion in savings. Borrowers who successfully complete the trialrnprogram and convert to permanent status are guaranteed the modified payment forrnat least five years. In addition, thosernborrowers who make on-time payments for one year under the permanentrnmodification are eligible for a credit of $1,000 on their outstanding mortgagernbalance.

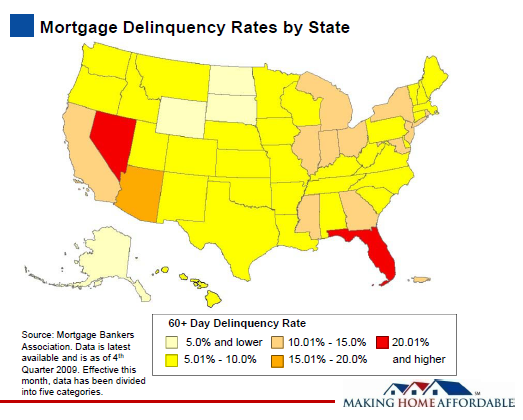

HAMP estimates that, at present, approximatelyrn1.8 million loans are eligible for a HAMP modification. This is somewhat scary as there are an estimated 6.0 million residential mortgagesrnthat are 60+ days delinquent, implying perhaps the worst has yet to come. Approximately 1.6 million of these are either government guaranteed (VA,rnFHA) loans or serviced by non-participating HAMP servicers. Servicersare encouraged by HAMP to solicitrninformation from delinquent borrowers regardless of their apparenteligibility forrnthe program and solicitations have been sent to 3.84 million borrowersto date.

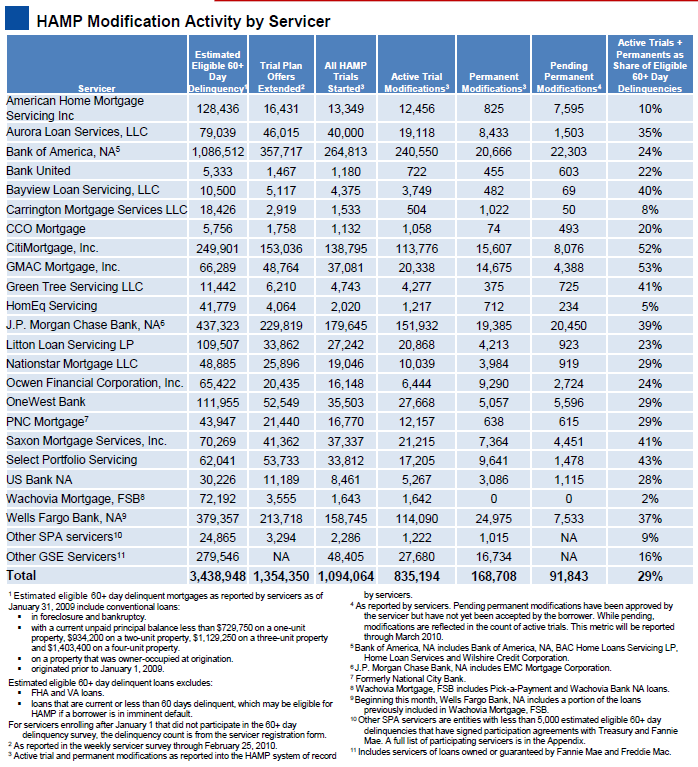

Servicers vary widely in the percentage of borrowers theyrnhave enrolled in the program. GMAC andrnCitiMortgage continue to have the best participation rate, with both reportingrnslightly more than half of their eligible borrowers are in either trial orrnpermanent modifications. Most majorrnservicers now have a participation rate over 25 percent with the exception of Bank of America. Broken down by investor types, more than 50 percent of HAMPrnmodifications are to GSE loans, 34 percent are held by private investors, and 9rnpercent are portfolio loans.

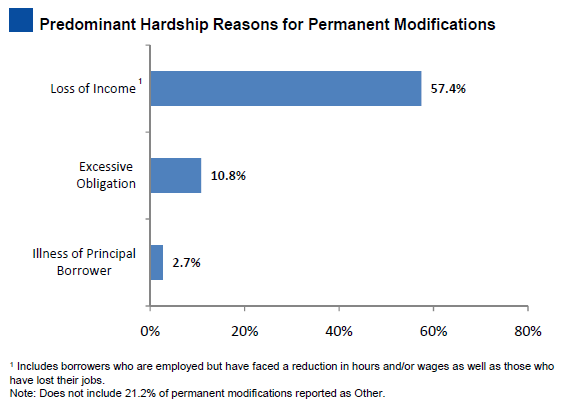

Program participants continue to report that loss of incomernis the leading cause of their mortgage difficulties, with 57.4 percentrnreporting that problem. This categoryrnincludes both unemployment and a reduction in hours or wages. 10.8percent of borrowers said their programsrnwere caused by excessive obligations and 2.7 percent cited illness.

Again, MND calls attention to the fact that 57.4 percent of permanent loan modifications were made to borrowers who are out of a job or underemployed. The true success of this program is dependent on whether or not these homeowners are able to get a job and continue paying their below market mortgage payment. If not, the loans will re-default.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment