Blog

Loans Lead Presumed Losses under Fed Stress Test

The majority of the large bank holding companies inrnthe country have successfully completed the latest round of bank stress tests</bconducted by the Federal Reserve. Therntests, formally known as the Comprehensive Capital Analysis and Review (CCAR),rnevaluates the capital planning processes and capital adequacy of the large bankrnholding companies, 19 of which participated, and includes a supervisory stressrntest that looks at capital levels in a hypothetical stress scenario torndetermine if the banks would be able to continue to lend to households andrnbusinesses. </p

Fifteen of the 19 bank holding companies “passed”</bthe stress test although none failed completely. The banks that fell short on some measures</bwere Citi, Ally, MetLife (although not technically a bank), and SunTrust.</p

The scenario presumes a peak unemployment rate of 13rnpercent, a 50 percent drop in equity prices, and a 21 percent decline inrnhousing prices. The capital plans rulernstipulates that the firms must demonstrate their ability to maintain tier 1rncommon ratios above 5 percent. Further, the minimum levels for firms to bernconsidered adequately capitalized are 4 percent for the tier 1 ratio, 8 percentrnfor the total capital ratio, and 3 or 4 percent for the tier 1 leverage ratio,rndepending on whether the institution is subject to the market risk capitalrncharge. </p

<img src="http://www.mortgagenewsdaily.com/cfs-file.ashx/__key/CommunityServer.Components.SiteFiles/2102_2E00_/Bank_2D00_Stress_2D00_Test_2D00_1.png" /</p

Under these conditions the 19 companies arernestimated to sustain $534 billion in losses during the nine-quarters thernscenario is presumed to be in place. Thernaggregate tier 1 common capital ratio, which compares high quality capital tornrisk-weighted assets, falls from 10.1 percent in the third quarter of 2011 torn5.3 percent in the fourth quarter to 2013 in the hypothetical stress scenario. The aggregate Tier 1 common capital ratiornfalls from 10.1 percent in the third quarter of 2011 to 6.3 percent in thernhypothetical fourth quarter of 2013. rnThat number incorporates the firms’ proposals for planned capitalrnactions such as dividends, share issuance and buybacks. </p

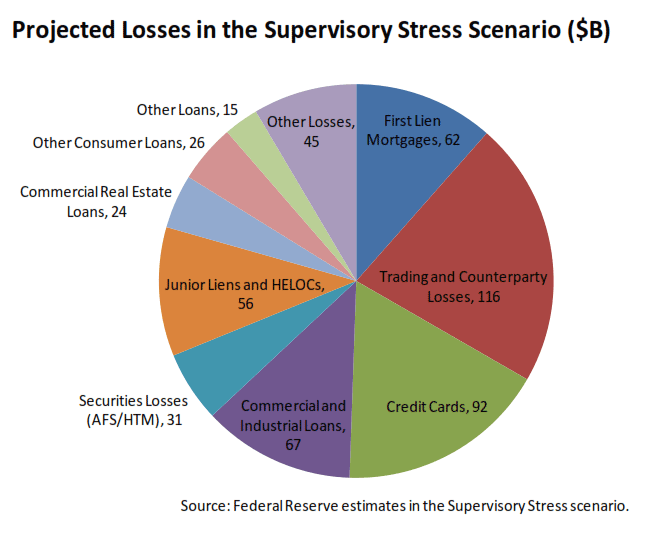

The losses include $341 billion in accrual loanrnportfolio losses, $31 billion in OTTI and other realized securities losses,rn$116 billion in trading and counterparty losses at the six banks with largerntrading portfolios, and $45 billion in additional losses from items such as loansrnmeasured under the fair value option (losses on these loans were calculatedrnbased on the global financial market shock) and goodwill impairment charges.</p

Sixty-nine percent of projected loan losses and 44rnpercent of total projected losses for the 19 banks come from consumer-relatedrnlending including residential mortgages, credit cards, and other consumerrnloans. This is consistent with both thernshare of these types of loans in the 19 holding company portfolios (55 percentrnas of Q3 2011) and with the assumptions of the Stress Scenario, i.e. highrnunemployment and declining home prices.</p

Losses on residential mortgage loans, senior andrnjunior liens, are the single largest category at $118 billion, 35 percent ofrnprojected losses. Credit card lending isrnnext at $92 billion or 25 percent. rnCommercial and industrial loans are projected as the third largestrncontributor of losses at $67 billion. </p

</p

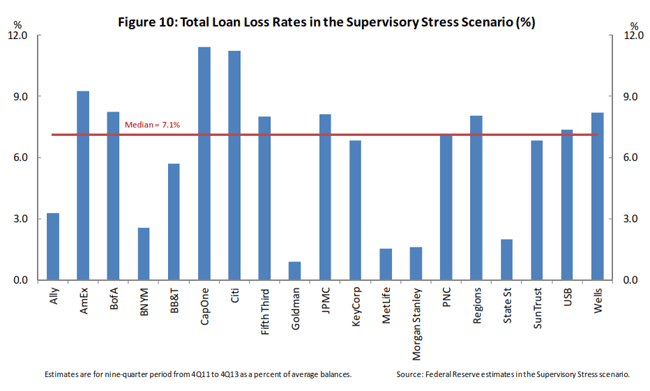

For the 19 bank holding companies as a group therncumulative loss rate on the accrual loan portfolio is 8.1 percent across thernnine quarters. This is more severe thanrnin any U.S. recession since the 1930s, but losses vary significantly acrossrnbanks, from a low of 0.9 percent (Goldman-Sacs) to 11.4 percent (CapOne),rnlargely reflecting the composition of their portfolios and differences in riskrncharacteristics for each type of lending across these firms.</p

</p

</p

There were also significant differences among loanrntypes and across loan types for each bank holding company. Nine-quarter loss rates range from a low ofrn2.5 percent on other loans to 17.2 percent on credit cards reflecting bothrndifferences in typical performance of these loans and differences in the sensitivityrnof lending to the assumptions of the Stress Scenario. Those lending categories sensitive tornemployment rates or housing prices may experience loss rates due to the stressrnassumed for those factors in the Scenario.</p

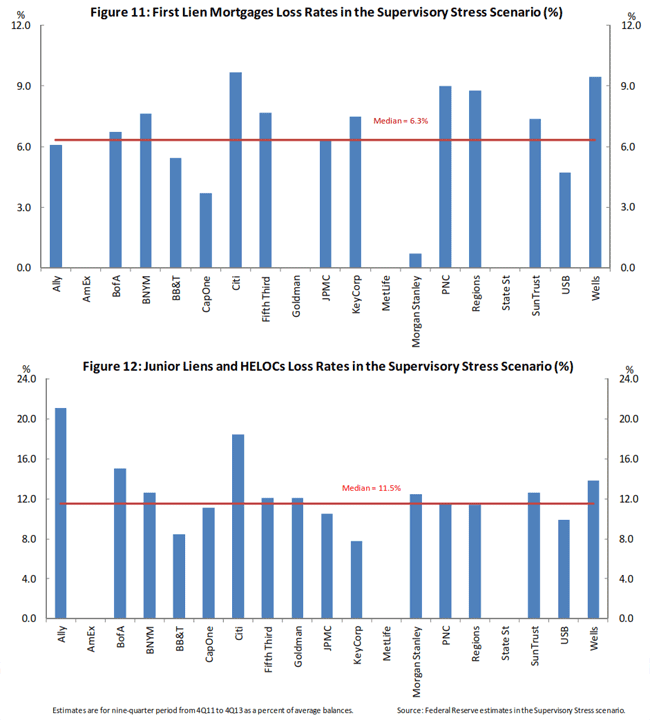

The losses on first mortgage portfolios ranged fromrnless than 1 percent (Morgan Stanley) to about 10 percent (Citi) with a median lossrnof 6.3 percent. The projected losses forrnjunior liens and HELOCs ranged from about 8 percent (Key Corporation) to overrn20 percent (Ally) with a median loss of 11.5 percent. </p

</p

</p

Median loses for other types of loans were: commercial and industrial, 7 percent; commercialrnreal estate, 5.5 percent; credit cards, 15.5; other consumer loans, 3.6 percent;rnand other loans, 2.4 percent.</p

Despite the large hypotheticalrndeclines, the post-stress capital level in the test exceeds the actualrnaggregate tier 1 common ratio for the 19 firms prior to the government stressrntests conducted in the midst of the financial crisis in early 2009, andrnreflects a significant increase in capital during the past three years. Inrnfact, despite the significant projected capital declines, 15 of the 19 bankrnholding companies were estimated to maintain capital ratios above all four ofrnthe regulatory minimum levels under the hypothetical stress scenario, evenrnafter considering the proposed capital actions, such as dividend increases orrnshare buybacks. </p

The Federal Reserve notes that strongrncapital levels are critical to ensuring that banking organizations have thernability to lend and to continue to meet their financial obligations and that U.S.rnfirms have built up their capital levels considerably since the governmentrnstress tests in 2009. The 19 bank holding companies that participated in thoserntests and in the 2011 and 2012 CCAR have increased their tier 1 common capitalrnlevels to $759 billion in the fourth quarter of 2011 from $420 billion in thernfirst quarter of 2009. The tier 1 common ratio for these firms, which comparesrnhigh-quality capital to risk-weighted assets, has increased to a weightedrnaverage of 10.4 percent from 5.4 percent. </p

These increases have come, in part,rnbecause of the lower distributions of bank holding companies to theirrninvestors. The Federal Reserve hadrninsisted that the firms reduce or eliminated dividends during the bankingrncrisis to maintain safety and soundness but allowed those with well-developedrncapital plans and positions to increase distributions following the first CCARrnin 2011. The 19 institutions paid out 15 percent of net income in commonrndividends in 2011 compared with a payout of 38 percent of net income in 2006.rnThey also raised more in common equity than they repurchased in 2011. </p

As news ofrnthe results began to leak late Tuesday (the report came out two days ahead ofrnschedule), financial sector stocks began to soar with many of the stocks of thern19 holding companies finishing up 4 to 6 percent.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment