Blog

MBA: Investors Increase Commercial, Multifamily Mortgage Holdings

Three of the groups that most heavilyrninvest in commercial and multifamily mortgages increased their outstandingrnbalance of such debt in the first quarter of 2012 according to data releasedrnthis morning by the Mortgage Bankers Association (MBA). The level of all commercial/multifamily debt increasedrnby $8.1 billion or 0.3 percent to $2.373 trillion compared to a total in thernfourth quarter of 2011 of $2.365 trillion. rnThe multifamily portion of that debt now totals $818 billion, up $6.9rnbillion or 0.8 percent from the previous quarter total of $811.4 billion. </a</p

</a</p

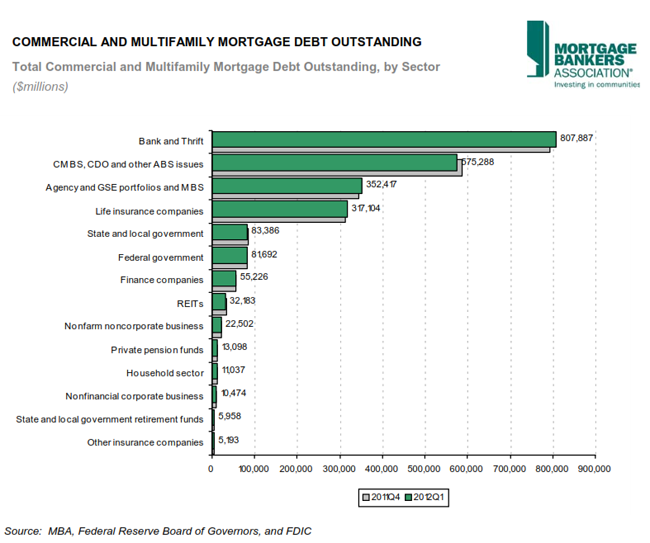

Banks and thrifts saw the largest dollarrnincrease in commercial/multifamily holdings during the first quarter, $13.5rnbillion or 1.7 percent. Agency and GSE portfoliosrnand MBS went up by $6.8 billion or 2 percent. The third sector, life insurance companies,rnincreased $3.8 billion or 1.2 percent. The largest drop was in the holdings of commercial mortgage-backed securities (CMBS), collateralizedrndebt obligations (CDO), and other asset-backed securities (ABS) which went downrn$11.7 billion or 2 percent. On arnpercentage basis the largest increase was 5.3 percent by other insurancerncompanies and the largest percentage drop was in the household sector, down 11rnpercent. </p

“Thernamount of commercial and multifamily mortgage debt outstanding increased duringrnthe first quarter, as lenders put out more in new loans than paid-off or paidrndown,” said Jamie Woodwell, Vice President of Commercial Real Estate Researchrnat the Mortgage Bankers Association. “Banks; Fannie Mae, Freddie Mac andrnFHA; and life insurance companies all increased their holdings of commercialrnand multifamily mortgages, more than offsetting declines among CMBS and otherrninvestor groups.”</p

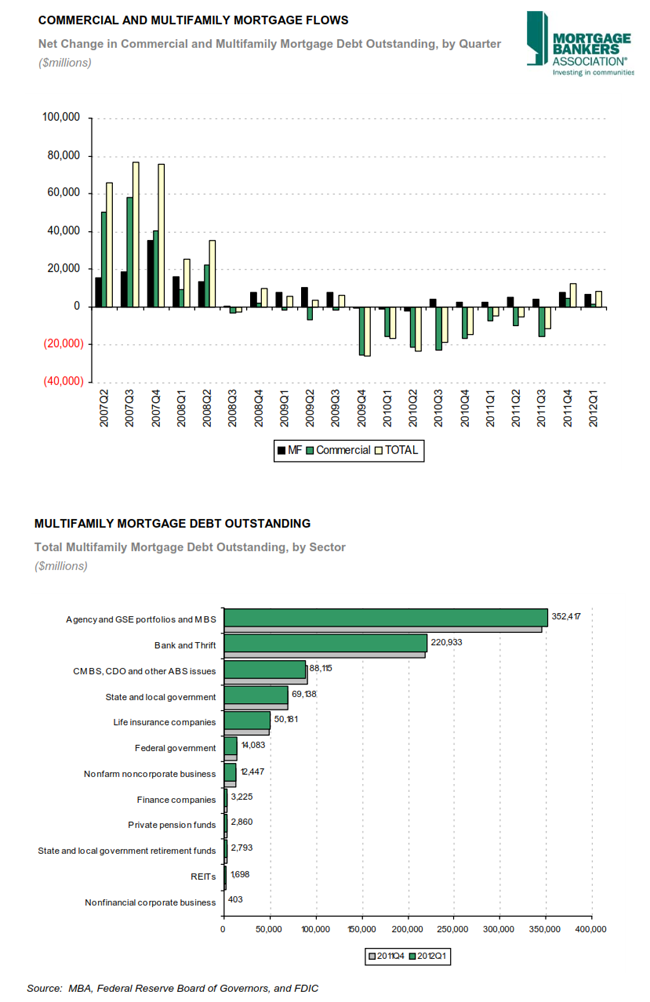

The $6.9 billion increase in multifamilyrndebt was accounted for by an increase in agency and GSE portfolios of 6.8rnbillion or 2 percent, commercial banks raised their holdings by $2.4 billion orrn1.1 percent and life insurance companies increased by $595 million or 1.2rnpercent. The largest decrease was $2.5rnbillion or 2.7 percent by CMBS, CDO, and other ABS issues. On a percentage basis agency, GSE portfoliornand MBS increased 2 percent while finance companies had the largest percentagerndecrease at 2.9 percent.</p

While commercial banks hold the biggest sharernof commercial/multifamily mortgages with $808 billion or 34 percent of therntotal, agency and GSE portfolios and MBS are first in the percentage of multifamilyrnmortgage debt outstanding, 43 percent or $352 billion. Banks and thrifts hold $221 billion or 27rnpercent, CMBS, CDO, and other ABS issues hold $88 billion or 11 percent, andrnlocal governments have 8 percent or $69 billion.</p

Thernanalysis summarizes the holdings of loans or, if the loans are securitized, thernform of the security. For example, many life insurance companies invest both inrnwhole loans for which they hold the mortgage note (and which appear in thisrndata under Life Insurance Companies) and in CMBS, CDOs, and ABS for which thernsecurity issuers and trustees hold the note (and which appear here under thernlatter designation).</p

MBArnrecently improved its reporting of commercial and multifamily mortgage debtrnoutstanding. The new reporting excludes two categories of loans that hadrnformerly been included – loans for acquisition, development and constructionrnand loans collateralized by owner-occupied commercial properties. Byrnexcluding these loan types, the analysis here more accurately reflects thernbalance of loans supported by office buildings, retail centers, apartmentrnbuildings and other income-producing properties that rely on rents and leasesrnto make their payments.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment