Blog

MBA Purchase Application Data Suggests Lower New Home Sales

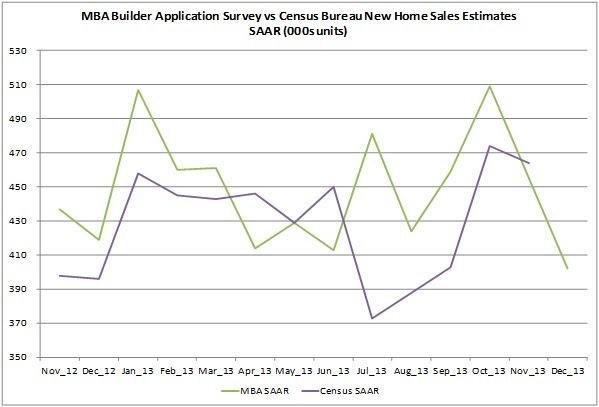

Applications for the purchase of newlyrnconstruction homes were down again in December, declining 11 percent fromrnNovember’s levels. November sales hadrnposted an 18 percent decline and October sales were down 11 percent. The Mortgage Bankers Association (MBA) saidrnthere was no adjustment made to its numbers to account for typical seasonalrnpatterns.</p

Applications for Veterans Administration</bloans rose from 12.9 percent of the total in November to 16.9 percent inrnDecember while applications for conventional loans fell by a similar amount -rnfrom 66.2 percent to 63.0. FHA loansrncomprised 19.2 percent and Rural Housing/USDA loans 0.9 percent of applicationsrncompared to 19.9 percent and 1.2 percent in November. The average size of a new home loan increasedrnfrom $295,523 to $300,444.</p

MBA’s data comes fromrnits Builder Application Survey conducted among mortgagernsubsidiaries of home builders across the country. This and data from other sources are used tornprovide an early estimate of new home sales and the financing methods used byrntheir buyers. Official new home salesrninformation is provided on a monthly basis by the Census Bureau based onrnpurchase contract signings with the next released scheduled for January 27. </p

</p

</p

MBS projects that salesrnof new homes were at a seasonally adjusted rate of 402,000 in December, downrnfrom 455,000 units in November. On anrnunadjusted basis MBA estimates there were 28,000 new home sales compared torn32,000 a month earlier. New home salesrnfor the full year 2013 averaged 445,000 homes according to the builder survey,rnaligning with MBA’s 2013 forecast of 449,000 new units.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment