Blog

MBA Reports Increases in Commercial Loan Originations

ThernMortgage Bankers Association (MBA) reported on Tuesday that commercial mortgagernoriginations were at a higher level during the last quarter of 2009 than inrneither the previous quarter or in the 4th quarter of 2008, butrnmultifamily originations continued to lag. The data was part of the MBA'srnQuarterly Survey of Commercial/Multifamily Bankers Originations.

Commercial and Multifamily originationsrnin the October-December 2009 period were 12 percent higher than those recordedrnJune through September. Among investor types, loans from commercial banksrnincreased 39 percent and life insurance companies increased originations by 35rnpercent. Conduits for Commercial Mortgage Backed Securities (CMBS) decreased byrn50 percent and those from GSEs dropped 15 percent.

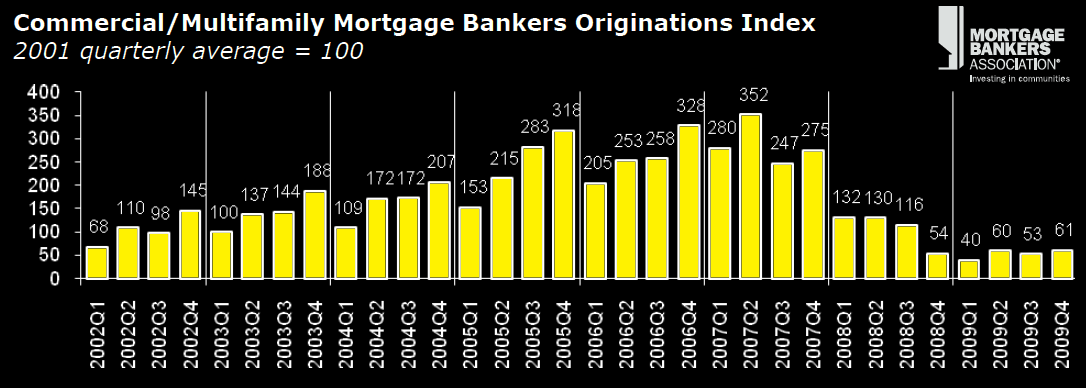

Below is a chart of the commercial/multifamily originations index. As you can see, relative to recent history, the index is still well below averages.

Loansrnfor health care properties were up 58 percent and retail properties 34rnpercent. Loans for hotel properties werernup 30 percent, industrial properties 19 percent. However multifamily propertiesrnsaw an increase of only 4 percent and office properties decreased 12 percent.

Averagernloan sizes also increased from the third to fourth quarter. The average loanrnsize overall increased from $9.9 million to $11.0 million. The average commercialrnbank loan was $8.2 million compared to $6.4 million and life insurancerncompanies lent $15.6 million compared to $12.4 million. Loan sizes decreasedrnfrom $18.2 million to $12.4 million for CMBS conduits and from $14.8 to $13.8rnmillion for Fannie Mae and Freddie Mac.

Acrossrnproperty types, hotels were the big winners. The average loan was $35.3 millionrnin the third quarter and $48.7 million in the fourth. Loans for health carernproperties nearly doubled from $5.9 million to 10.7 million on average. Thernaverage loan size decreased only for multifamily properties, going from $12.9rnmillion to $12.4 million.

Originations during the recent quarter of 2009rnwere 15 percent higher than experienced during the same period in 2008. Thernincrease was driven primarily by life insurance companies which saw an increasernof 112 percent compared to one year ago. Commercial banks increased by 17 percentrnbut CMBS conduits and the GSEs decreased by 82 percent and 26 percentrnrespectively.

Lendingrnto hotel properties increased by 105 percent over the year and retail lendingrnwas up by 101 percent. Loans for industrial properties, office properties, andrnhealth care properties increased by 59 percent, four percent, and 1 percentrnrespectively. Loans for multifamilyrnproperties were down 8 percent.

“Commercial and multifamilyrnmortgage originations picked up in the fourth quarter, but remain at a lowrnlevel in absolute terms,” said Jamie Woodwell, Vice President of CommercialrnReal Estate Research at the MBA. “The trend shows stability coming backrnto the market, but the pick-up in volumes really indicates just how lowrnorigination levels had fallen.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment