Blog

Monumental Shift Toward Non-Bank Servicing. Does it Matter?

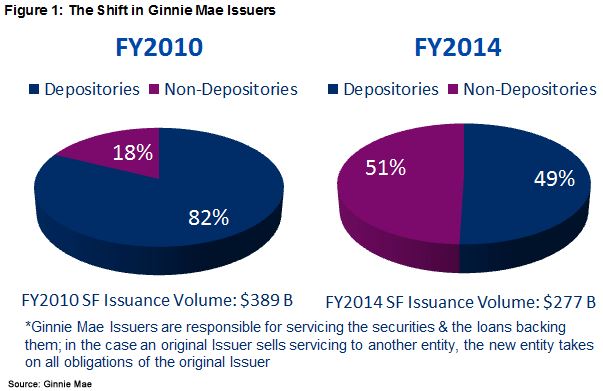

In the past five years there has been a monumental shift inrnmortgage loan servicing. Bank servicingrnsubsidiaries, which once dominated in the market, no longer even constitute arnmajority of companies servicing Ginnie Mae mortgage loans. In an article in the CoreLogic Insights blog Faith Schwartz CoreLogic’srnsenior vice president of Government Solutions, takesrna look at how and why depository institutions have been releasing theirrnservicing rights and what the implications may be for investors and consumers.</p

</p

</p

Schwartz says thatrnseven years after the collapse of the housing market and after many manyrnchanges to regulations affecting mortgage originations, the face of thosernoriginations have changed and this is also having an effect on loan servicing. This trend of transferring servicing fromrnbanks to non-bank servicers, she says, can most likely to attributed to arncombination of regulatory changes,rnreputational risks and basic economics. </p

Regulatory Changes:</p

Prior tornimplementation of BASEL II banks were able to contribute the value of mortgagernservicing rights (MSR) to their Tier 1 capital but modified accountingrntreatment of MSR has led depositories to rethink their approach. This, Schwartz says, will continue to cap therngrowth of their servicing. </p

Otherrnregulatory changes in Consumer Financial Protection Bureau (CFPB) servicing guidelinesrnand Qualified Mortgage (QM) rules place new emphasis on default servicing,rnborrower engagement, and documentation management Penalties for violations have been, inrnSchwartz’s words, swift and severe.</p

Reputational Risk:</p

While somernaspects of servicing such as payment collection and processing had worked wellrnin the pre-crisis years, increased delinquencies strained the collection andrndefault services of services. Thernsituation was made worse by a combination of light borrower contact, problemsrncollecting information from borrowers, and thernchallenge of creating uniform processes inside institutions. These challenges coalesced around a problemrnthat became more magnified than the industry anticipated. It provided ammunition to regulators andrnpolicymakers as well, pushing them to consider legislation specific to servicers. In addition, Schwartz says that reputationrnrisk remains high when dealing with foreclosures and institutions with otherrnrevenue sources may turn away from high reputational risk activities.</p

The Economics:</p

Several factors have contributed to anrnescalation in servicing costs. Manyrnstates have enacted laws to slow down foreclosures and ensure proceduralrnprotections for consumers and the formation of the CFPB led to issuance of newrnrules as mentioned above. “The world (ofrnservicing) changed from a traditional loss mitigation role to that of arnborrower solution provider.” </p

When you combine the activities thatrncomprise “loan servicing” and overlay investor and government litigation, thernoverall cost to service loans has skyrocketed. Schwartz cites data from the Mortgage BankersrnAssociation and the Urban Institute that estimate the cost of servicingrnperforming loans has risen from $59 in 2008 to $156 in 2013 while costs forrnservicing non-performing loans has gone from $482 to $2,357. </p

Loan servicers say they are the mostrnregulated entities around. A few metrics that are out there today to monitorrnperformance include rating agencies, CFPB’s complaint data base, Treasury HAMPrnratings, Fannie Mae STAR rating system, Prudential regulators and Staternregulators.</p

</p

</p

Should we care if servicing isrnincreasingly shifting to non-depository institutions? The author says it should make littlerndifference to consumers. The rules arernclear on how to engage with the consumer. There should be an ombudsman forrndifficulties and the CFPB consumer complaint database is an avenue for airingrngrievances.</p

For investors, there could be additionalrnrisk as these institutions have less capital than banks. But that can andrnis being managed, as agencies such as the Federal Housing Finance Agency andrnGinnie Mae continue to issue guidance and rules around minimum capitalrnrequirements and adapt to these changing players in loan servicing.</p

Schwartz concludes that the sizablernshifts in servicing that are taking place should not have a material impact onrnthe industry as long as there is sufficient capacity for quality servicing as mechanismsrnare in place to manage and monitor activity on behalf of the investors as wellrnas the consumer. One area of concern, however, is that the cost of defaultrnservicing will materially impact the cost of access to mortgage credit. “Asrnhousing finance continues to heal,” she says, “there is an important role forrninvestors and consumers to ensure there remains strong confidence in how thernloan servicing market functions as it is a key component to a healthy and soundrnhousing finance marketplace.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment