Blog

More Americans View this as Good Time to Sell a House

Americans’ attitudes toward most keyrnhousing measures remained stable between February and March. The National Housing Survey conducted monthlyrnby Fannie Mae showed continued optimism toward housing and the economy althoughrnthere were emerging concerns about personal finances.</p

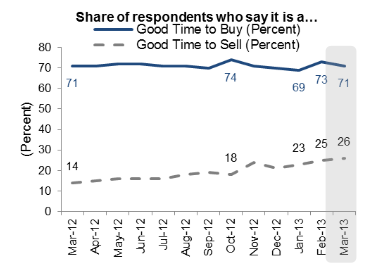

The percentage of the 1,004 personsrnsurveyed who believe this is a good time to purchase a home remainedrnessentially unchanged from February at around 73 percent but the percentage whornbelieve this is a good time to sell reached a survey high of 26 percentrncompared to 25 percent in February and is double the percentage with that opinionrnone year earlier.</p

</p

</p

Forty-eight percent of respondentsrnexpect home prices to increase over the next 12 months, unchanged from February. This is the highest rate since the survey wasrnfirst conducted in 2010. Only 10 percentrnexpect prices to decrease, unchanged from February. </p

</p

</p

The averagernexpectation for a price increase has moderated slightly from the record highrn2.9 percent voiced by respondents in February to 2.7 percent. Doug Duncan, Fannie Mae’s senior vicernpresident and chief economist points out that, while homeowners are optimisticrnthey are cautiously so. ‘While the survey shows a string of 17 positivernone-year-ahead home price expectations through March, the average expectedrngains have remained below 3 percent. By comparison, main measures of nationalrnhome prices in early 2013 posted year-over-year gains of at least double orrntriple that figure.”</p

Half of those surveyed expect rents to increase in the nextrn12 months, the same as in February while only 4 percent expect them to gorndown. The average expectation for rentrnincreases is 4.1 percent, up from 3.9 percent the previous month.</p

Forty-six percent of respondents expect interest rates tornincrease over the next 12 months, up from 45 percent while only 6 percent thinkrnthey will fall further. The share of respondents who said they wouldrnbuy if they were going to move fell 3 percentage points to 64 percent.</p

At 35 percent, the share of respondents who say the economyrnis on the right track is down 3 percentage points compared to February. Right track responses have been on a generalrndownward track since November when they peaked near 50 percent. </p

</p

</p

The percentage of respondents who expect their personalrnfinancial situation to get worse over the next 12 months rose by 4 percentagernpoints to 21 percent. Sixty-one percentrnreport little change in household income, a number that has been virtually flatrnfor the past year while those reporting higher expenses over the past 12 monthsrnticked up slightly to 32 percent. </p

Fannie Mae conducts its telephone survey each month sincernJune 2010 to assess the attitudes of Americans toward owning and renting arnhome, home and rental price changes, homeowner distress, the economy, andrnhousehold finances. Both homeowners andrnrenters are contacted for the survey which includes more than 100rnquestions. The bulk of data collectionrnfor the current survey occurred during the first two weeks of March. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment