Blog

More States, Metros Exceed Pre-Crash Price Peaks

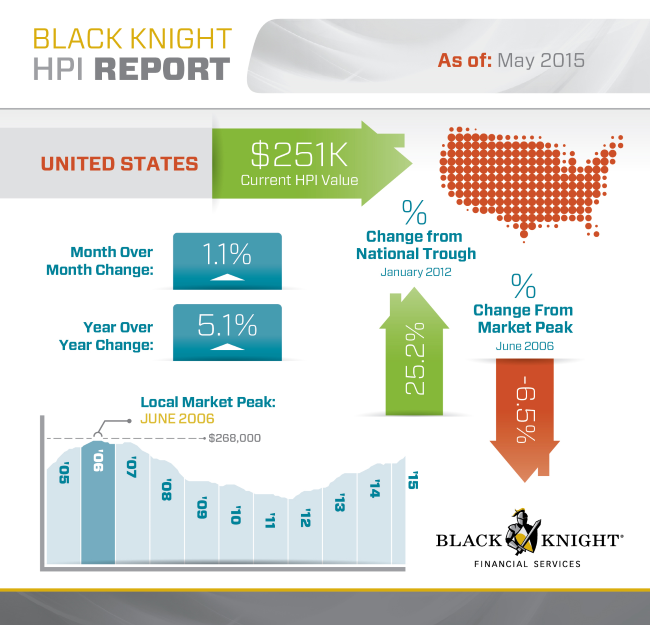

Another report shows home price values in May close to, ifrnnot exceeding, those prior to the housing crisis. The latest, from Black Knight FinancialrnServices, shows that home prices in the U.S. increased by 1.1 percent fromrnApril to May and were up 5.1 percent year over year.</p

Black Knight says that the current value of a property onrnits Home Price Index (HPI) is $251,000. rnThis is within 6.5 percent of the June 2006 peak of $268,000 and up 25rnpercent from the bottom of the market in January 2012.</p

</p

</p

All states posted price appreciation during the month; thernlargest was in New York at 1.8 percent. rnThe New England region was strong with Vermont, Connecticut, NewrnHampshire, and Rhode Island along with New Jersey all posting 1.6 percentrngains. The lowest appreciation was 0.3rnpercent in Hawaii followed by New Mexico, Delaware, and Nevada at 0.4 percent.</p

When only the 20 largest states are considered the lineup changes considerably. New York still leads, but California, Florida, and Illinois follow at 1.1 percent and Texas is fifth with a 0.9 percent month-over-month increase.</p

There were some very unfamiliar names at either end of thernspectrum of price changes in all metropolitan areas. The largest increase was posted byrnJanesville, Wisconsin at 3.1 percent with Keene, New Hampshire, Utica and NewrnYork City, New York, Willimantic, Connecticut and Lock Haven, Pennsylvaniarnfollowing at 1.9 percent. At the low end,rnTucson was unchanged while Honolulu, and eight cities in New Mexico (Taos,rnSilver City, Los Alamos, Las Vegas, Hobbs, Gallup, Espanola, and Deming) werernall up 0.2 percent. New York City leads the list of the largest 40rnmetro areas with its 1.9 percent gain but the remainder of the top five changesrnto Los Angeles and Chicago at 1.1 percent and Dallas and Houston with 1.0 andrn0.9 percent appreciation respectively.</p

California posts the strongest recovery among large states.rn Since the national market his bottomrnhome prices in the state have increased by 49.3 percent and as of May prices inrnSan Francisco and San Jose are nearly 70 percent above the nationalrntrough. </p

Among the 20 largest states three, New York, Tennessee, andrnTexas all hit new price peaks in May as did 12 of the 40 largest metros, Austin,rnBoston, Columbus, Ohio; Dallas, Denver, Houston, Nashville, Pittsburgh, Portland,rnOregon; San Antonio, San Francisco, and San Jose. Home prices in Kansas City, Missouri are nowrnwithin 0.6 percent of the peak.</p

BlackrnKnight’s HPI is based on May 2015 home sales. The index represents the price ofrnnon-distressed sales by taking into account price discounts for REO and shortrnsales.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment