Blog

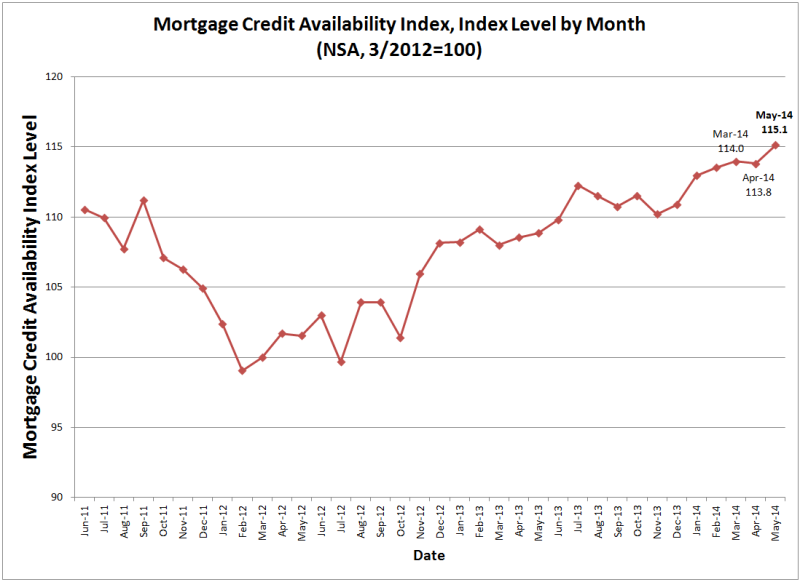

Mortgage Credit Availability up slightly in May

Mortgage credit was marginally morernavailable in May than it was in April the Mortgage Bankers Association (MBA) saidrntoday. Its Mortgage Credit AvailabilityrnIndex (MCAI) inched up 1.14 percent to 115.1 compared to 113.8 in April. </p

The increase in the index, benchmarkedrnto 100 in March 2012, was partially due to a slight uptick in the availabilityrnof jumbo loans. There was also a move byrnsome investors toward lowering credit scores for FHA loans. </p

</p

</p

The MCAI is calculated using data fromrnthe AllRegs® Market Clarity® product and a proprietary formula derived by MBA. It takes into account several factors ofrnborrower eligibility such as credit scores, loan type, and loan-to-value ratiorntaken from its regular survey of over 85 lenders and investors. </p

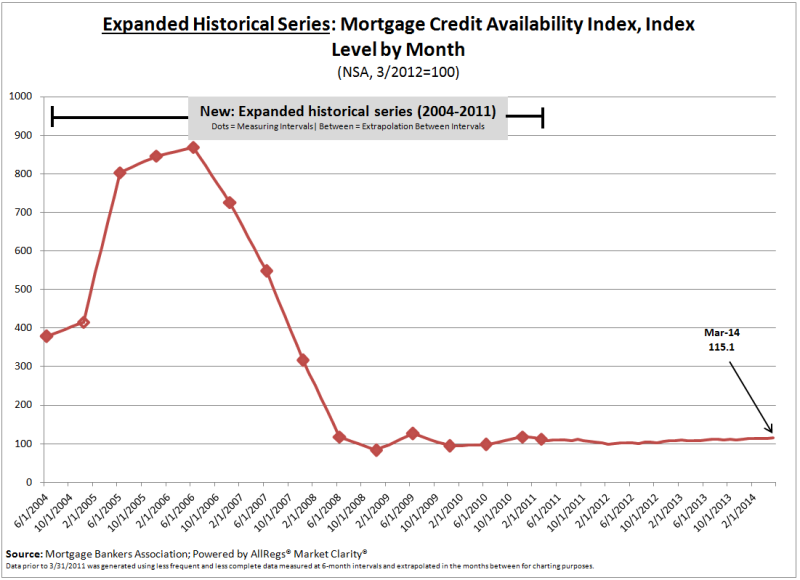

MBA has also produced a new expandedrnhistorical series which tracks credit availability over the previous tenrnyears. This series permits historicalrnperspective on credit availability since 2004, a period which includes both thernhousing boom and the ensuing recession.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment