Blog

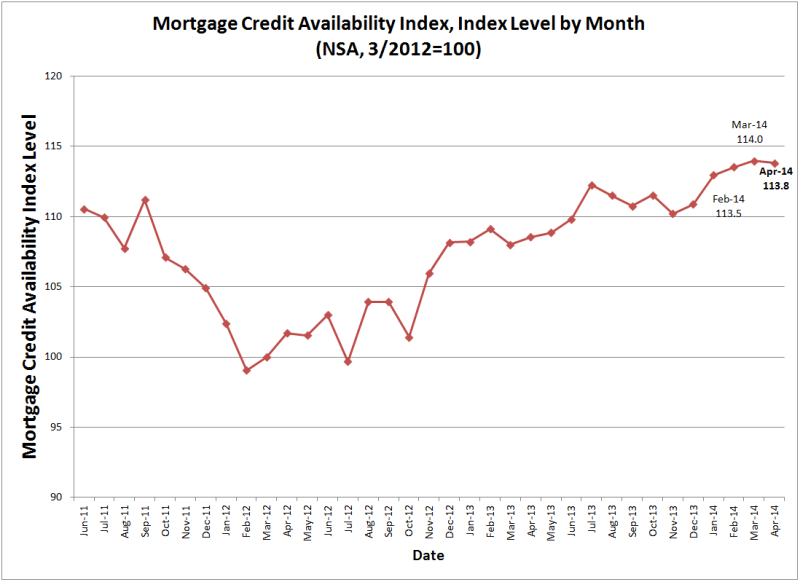

Mortgage Credit Tightens Slightly, but not for Jumbo Borrowers

Mike Fratantoni, Chief Economist of the Mortgage Bankers Associationrnexplained the slightly lower Mortgage Credit Availability Index (MCAI) forrnApril as the result of countervailing trends. “On one hand, creditrncontinues to be more available to jumbo borrowers, particularly those seekingrnadjustable rate mortgages,” he said “and we are beginning to see some looseningrnwithin conventional and FHA programs for conforming loans. On the otherrnhand, some investors shut down or tightened criteria for certain programs.” </p

The MCAI for the month was at 113.8 compared torn114.0 in March, a decrease of 0.18 percent. A decline in the MCAI indicatesrnthat lending standards are tightening, while increases in the index arernindicative of a loosening of credit. </p

</p

</p

The MCAI is calculated using several factors related to borrower eligibilityrn(credit score, loan type, loan-to-value ratio, etc.). Data is collected from over 85rnlenders/investors and combined with data from AllRegs® Market Clarity® productrnand a proprietary formula derived by MBA to create a summary measure indicatedrnmortgage credit availability at a point in time. The index was benchmarked to 100 in Marchrn2012. </p

This month MBA announced that MCAI now has anrnexpanded historical series covering 2004 through 2010. The new series was created to show how creditrnavailability has changed over the last 10 years, a period which includes thernhousing crisis and subsequent recession. rnFratantoni said, “This expanded time series goes back an additionalrnseven years and provides information on credit availability in pre-recessionaryrnperiods. It is particularly important with these data to distinguishrnbetween pre-recessionary periods and what might be considered ‘normal.’ rnGiven the new regulatory environment, there is no guarantee we will return tornthose levels.”<br /<br /Data prior to March 31, 2011, was generated using less frequent and lessrncomplete data measured at 6-month intervals and extrapolated in the monthsrnbetween for charting purposes.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment