Blog

Mortgage Delinquency Falls To 4-Year Low, But Remains Historically Elevated

TransUnion said today that the serious mortgagerndelinquency rate is heading downhill at a quickening pace, however long termrndelinquencies and the slow process of resolving them are impeding a return tornmore normal rates. According to year-end data from the credit reportingrncompany, the rate of serious delinquencies – 60 days or more – fell 14 percentrnin 2012 compared to 7% in 2010 and 6% in 2011. By contrast, when rates were rising, fromrn2007 to 2009, they increased by at least 50 percent each year.</p

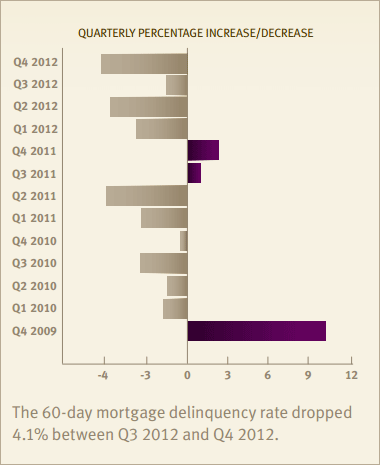

Thernfinal quarter of 2013 was the fourth consecutive one in which the 60+ day raterndeclined, dropping from 6.01 percent in Q4 2011 to 5.19 percent in Q4rn2012. The rate was 5.41 percent at thernend of Q3 2012. TransUnion expects the mortgage delinquency rate to continuernits downward trend in the first quarter of 2013, though it will likely remainrnabove 5%. </p

“The national mortgagerndelinquency rate experienced its largest yearly decline since the conclusion ofrnthe recession, though we still remain far above normal levels,” said TimrnMartin, group vice president of U.S. Housing in TransUnion’s financial servicesrnbusiness unit. “For the most part, newer vintage mortgage loans are notrnthe reason for the stubbornly high delinquency rate. They are performingrnrelatively well. The elevated delinquency levels that we still are experiencingrnare a result of older vintage loans — borrowers who haven’t been making theirrnpayments for a rather long time — that are still in the system, inflating thernoverall rate.</p

“The declines in the mortgagerndelinquency rate will likely be muted for the foreseeable future as thernforeclosure process in some states can take more than 1,000 days,” saidrnMartin. “It’s not clear yet, but recently announced regulatory rulesrnrelated to mortgage servicing may tend to slow down this process further. Whatrnis clear from the data TransUnion collects is that, until the old vintages workrnthrough the system, we expect the delinquency rate to remain elevated.”</p

On a quarter-over-quarter basis thirty-sevenrnstates and the District of Columbia experienced improvement in their mortgagerndelinquency rates along with 81.4 percent of metropolitan statistical areasrn(MSAs). The greatest declines were experienced inrnArizona (-30.93 percent), California (-29.55 percent), and Utah (-20.89rnpercent.)</p

On a year-over-year basis all butrnthree states, Maine (+4.26 percent), Arkansas (+3.02 percent), and North Dakotarn(+2.00 percent), had delinquency rate decreases. North Dakota, however still has the lowestrnrate in the nation, 1.53 percent, followed by South Dakota (1.97 percent) andrnNebraska and Alaska tied at 2.20 percent. The highest rates of delinquency arernin Florida at 12.47 percent, Nevada (10.45 percent), and New Jersey (7.72 percent.)</p

The average mortgaged homeowner inrnthe U.S. was carrying mortgage debt of $186,785 in Q4 compared to $188,194 arnyear earlier, a -0.75 percent change. rnThe states with the highest average mortgage debt were the District ofrnColumbia ($375,353), California ($324,867), and Hawaii ($315,721.)</p

TransUnion’s forecast is based on variousrneconomic assumptions, such as gross state product, consumer sentiment,rnunemployment rates, real personal income, and real estate values. The forecastrnwould change if there are unanticipated shocks to the economy affectingrnrecovery in the housing market or if home prices fall more than expected

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment