Blog

Mortgage Fraud Could Reach $13B in 2012, "Unemployment Pressure" a Factor

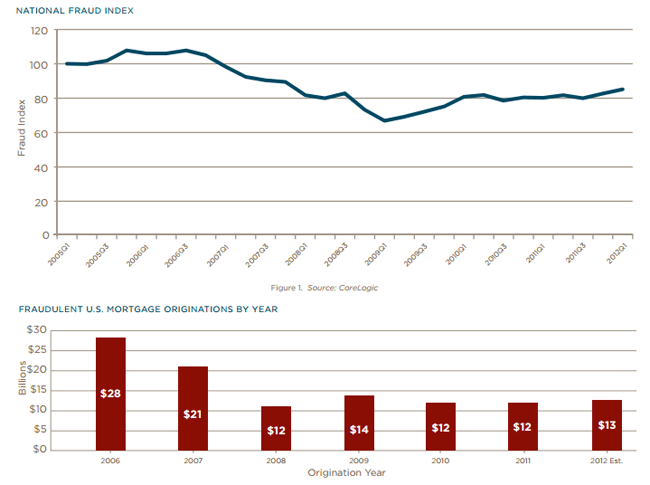

About $13 billion of residential mortgagesrnoriginated in 2012 could contain fraudulent information, a $1 billion increasernover estimates for both 2010 and 2011. CoreLogic’s Mortgage Fraud Trends Report projects this increase because of sharprngrowth in the incidence of both employment and identity fraud coupled withrnhigher mortgage origination volumes. </p

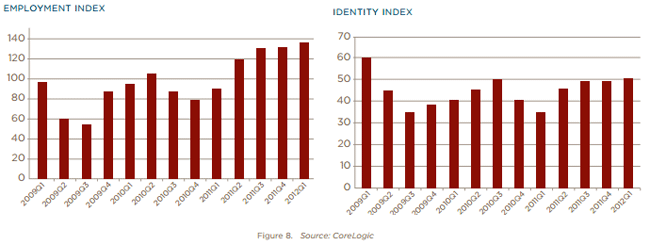

CoreLogic’s National Mortgage FraudrnIndex rose 6.23 percent in the first quarter of 2012 to 85 from 80 in the firstrnquarter of 2011 and is up by 27.5 percent from its low point of 67 in the firstrnquarter of 2009 to the highest level for the measure since 2007. The index provides a relative basis ofrncomparison over time for residential loan origination fraud risk and representsrnthe collective level of mortgage fraud that is likely to occur. It includes risk indices across multiplernfraud types including employment, identity, income, occupancy, property andrnundisclosed debt. </p

</p

</p

Employment related fraud isrndescribed by CoreLogic as “swelling under pressure – unemployment pressure.” Employment fraud risk rose by 50 percentrnbetween the first quarter of 2011 and the first quarter of 2012 driven byrncontinued challenges in the U.S. labor market. Florida, Nevada and Arizona, allrnwith above-average rates of unemployment, lead the nation in employment fraudrnrisk. Identify theft has followed arnsimilar pattern with a 44 percent increase over the same time frame.</p

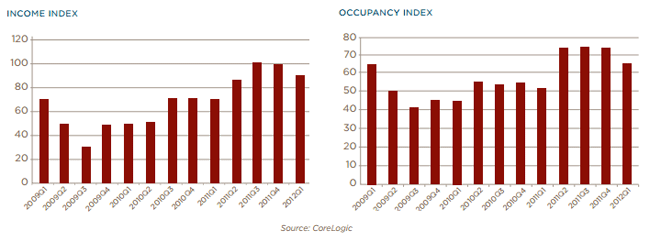

The Income Fraud Index is trendingrndownward, possibly as a result of the use of requests for tax transcripts on anrnincreasing number of originations. ThernOccupancy Fraud Index has been flat since the first quarter of 2011</p

</p

</p

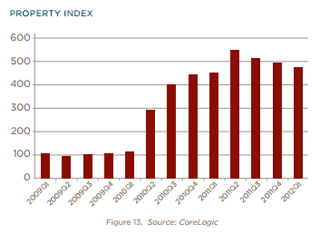

The Property Fraud Index hasrndecreased over the last four quarters but remains elevated because ofrnincreasing short sale volume, shadow inventory entering the market, and new GSErnshort sale guidelines, </p

</p

</p

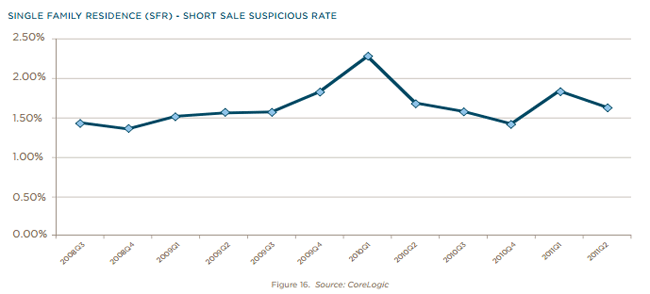

Short sale fraud losses will reachrnapproximately $325 million this year, representing a $25-million increase overrn2011. The increase in short sale fraud losses is due to a projected 10-percentrnincrease in short sale volume, which is expected to reach a five-year high inrn2012. California, Florida and Arizona have the highest rate of suspicious shortrnsales and account for more than half of all short sales in the U.S.</p

</p

</p

Nevada, Arizona, Georgia, Michiganrnand Florida experienced the highest levels of mortgage fraud risk at the staternlevel. Chicago is the riskiest city for the second consecutive year followed byrnAtlanta; Oakland, Calif.; Orlando, Fla.; and Kissimmee/St. Cloud, Fla.</p

“Mortgage fraud is a multi-billion dollarrncriminal activity that continues to be a critical concern for the mortgagernbanking industry. Increased risk and financial loss associated with mortgagernfraud has a direct negative impact on a lender’s bottom line,” said SusanrnAllen, vice president, Product Management for CoreLogic. “Heightened awarenessrnand analysis of emerging mortgage fraud threats are vital as criminalsrncontinuously look for opportunities to gain an unscrupulous profit at thernexpense of the lending community, taxpayers and homeowners.”</p

Going forward, CoreLogic outlines arnnumber of challenges for the remainder of 2012;</p<ul class="unIndentedList"<liEmployment and income fraud riskrnchallenges will continue, driven by low interest rates and unemployment. Best practices indicate utilization of IRS Formrn4506T requesting tax transcripts and both written and later verbal verificationrnof employment.</li<liHARP loans continue to represent significantrnrisk since borrowers typically have less skin in the game due to negativernequity. Fraud prevention measures shouldrninclude comparing current income and tax information to hardship affidavits andrnperforming occupancy verifications.</li<liDistressed sales will continue to bernproblematic as their volume increases.rnAn effective consortium-based Short Sale Monitoring Solution can helprnstem the tide of potential losses.</li</ul

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment