Blog

Mortgage Insurers Active in HAMP, HARP Programs

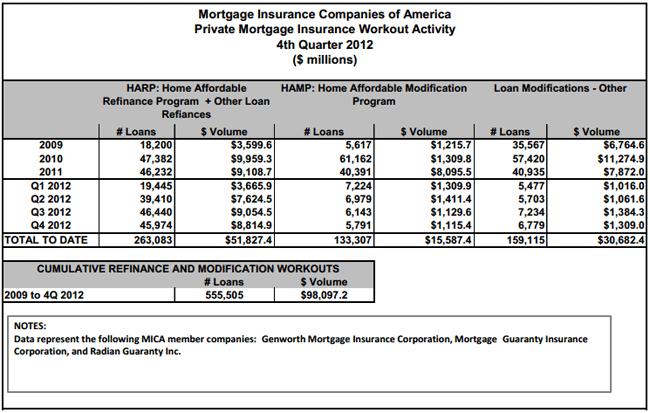

The three major private mortgagerninsurers participated in the modification of 5,791 mortgages through the HomernAffordable Modification Program (HAMP) in the fourth quarter of 2012 and 6,779rnloans through other modification programs. rnMortgage Insurance Companies of America, the trade association for thernindustry, said that the HAMP modifications had a volume of $1.1 billion and thernother modifications $1.3 billion. The 4th</supquarter volume represented a slight decrease – about 400 loans in each categoryrn- from the third quarter but was an increase of 75 percent over activity in thernfourth quarter of 2011.</p

The company also participated in 45,794</bmortgage refinancings in the fourth quarter, $8.8 billion in volume, compared torn46,440 loans and $9.1 billion in volume in the third quarter. The refinancings were done through the HomernAffordable Refinance Program (HARP) and other refinancing programs.</p

Since the programs were initiated in 2009,rnMICA member companies report that the total volume of mortgages that carryrnprivate mortgage insurance on HARP, HAMP or other modified loans reached morernthan $98 billion, to benefit more than 555,505 households nationwide. </p

The three companies submitting data for thernMICA report are: Genworth Mortgage Insurance Corporation, Mortgage GuarantyrnInsurance Corporation, and Radian Guaranty Inc. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment