Blog

Mortgage Lender Satisfaction on the Rise Thanks to Transparency in Origination Process

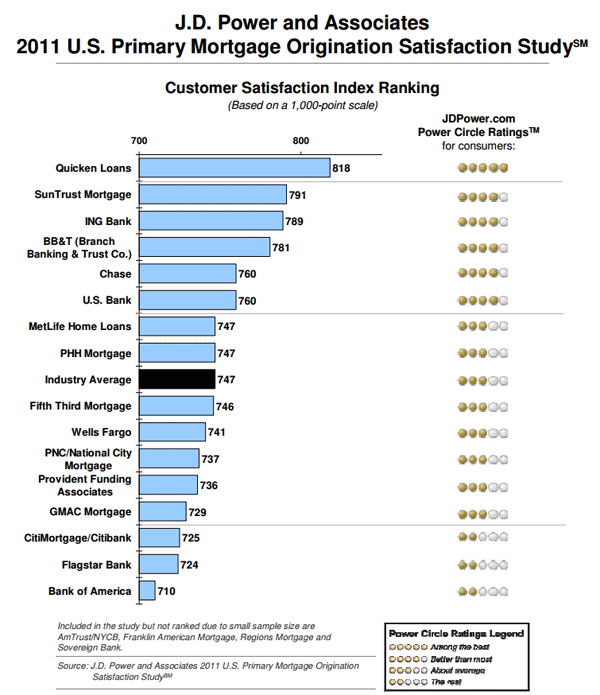

Overall customer satisfaction withrnmortgage lenders reached a six-year high in the J.D.rnPower and Associates 2012 U.S. Primary Mortgage Origination Satisfaction StudySM</supreleased today, rising from 747 on a 1,000 point scale last year to 761 thisrnyear. It was the second straight yearrnthat the average increased and of the 15 companies rated, five scored abovernthat average and nine below.</p

The 2012 U.S. Primary MortgagernOrigination Satisfaction Study is based on responses from more than 3,500rncustomers with a recent new mortgage. The study was fielded between July 31 andrnAugust 27, 2012.</p

Quicken Loans led the list with 817rnpoints while Bank of America was at the bottom in customer satisfaction withrn696 points. </p

The company said the increase inrncustomer satisfaction is driven by steady improvements related to transparencyrnand communication. The study finds that during the past three years, lendersrnhave improved in the areas of clearly explaining loan options and ensuringrncustomers understand them; following up with customers in a timely manner afterrnthey complete their application; and proactively updating customers on thernstatus of their application.</p

“Given the recent challenges acrossrnfinancial services, the highest-performing lenders in the 2012 study havernreduced customer uncertainty and apprehension with greater transparency andrncommunication regarding what to expect in the origination process,” said CraigrnMartin, director of the mortgage practice at J.D. Powers. “This increase in satisfaction is particularlyrnimpressive given the increasingly expanded origination timelines during thernpast year.”</p

The company said there is a strongrnrelationship between satisfaction with the origination process and the rates ofrncustomer consideration and usage of the same lender for refinancing. Among loanrncustomers who have refinanced in 2012, only 40 percent cite price as their mainrnreason for selecting their lender. Other reasons commonly cited for selectionrninclude an existing relationship; previously being a customer; andrnreferrals. </p

Overall satisfaction with a lenderrnwas based on customer satisfaction on a scale of one to five in four key areasrnof mortgage origination; the application and approval process, the loan representative,rnclosing, and contact. A score of threernindicated customers considered the lender “average.” Quicken scored five (“among the best”) on allrnfour measures while BB&T received a four ranking (“better than most”) onrneach. This is the third consecutive year</bthat Quicken Loans has ranked highest among primary mortgage lenders.</p

J.D. Power and Associates offers thernfollowing tips for consumers when selecting and working with a mortgage lender:</p<ul class="unIndentedList"<liResearch and understand therndifferent types of loans available, and be sure to consider more than just therninterest rate while shopping.</li<liExpect the mortgage originationrnprocess to take longer than it did a few years ago as a result of increasedrnregulations and scrutiny.</li<liAsk whether technology solutionsrnsuch as special website access or mobile apps are available to help you trackrnthe progress of our application. </li<liUnderstand the relationship you'llrnhave with the lender you select and whether it will ultimately service yourrnloan. </li<liInform your loan representative howrnyou prefer to be contacted-e.g., via email, phone or mobile. </li</ul

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment