Blog

Mortgage Metrics Report Shows Increase in "Seasonal" Delinquencies

The performance of mortgagesrnserviced by banks regulated by the Office of Comptroller of the Currency (OCC)rndeclined in the second quarter but was improved over the same period one yearrnearlier according to the OCC MortgagernMetrics Report for the Second Quarter of 2012 released Thursdayrnmorning. OCC called the quarterly change in delinquencyrnrates “seasonal.” The report covers 30.5rnmillion first-lien mortgages with $5.2 trillion in outstanding balances, aboutrn60 percent of all first-lien mortgages in the United States. </p

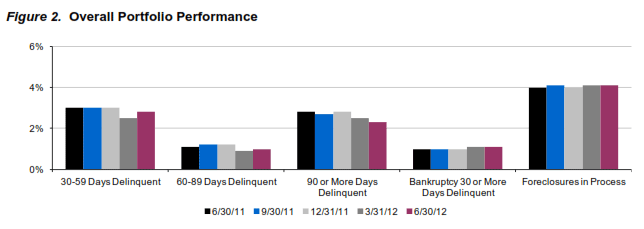

OCCrnreported that 88.7 percent of mortgages serviced by large national and federalrnsavings banks were current and performing at the end of the second quarter, arndecline of 2 basis points from Q1, but up from 88.1 percent in the secondrnquarter of 2011. Loans that were 30 torn59 days past due increased by 12.1 percent to 2.8 percent, but this rate wasrn7.5 percent lower than a year earlier. rnThose mortgages that were seriously delinquent, i.e. 60+ days past duernor where the borrower was in bankruptcy, fell to 4.4 percent, down 0.8 percentrnfrom the prior quarter and 9.2 percent from a year earlier and the lowest levelrnin three years.</p

</p

</p

OCC said several factors contributed tornthe year-over-year improvement including a strengthening economy, servicingrntransfers, and both the effects of home retention programs and home forfeiturernactions.</p

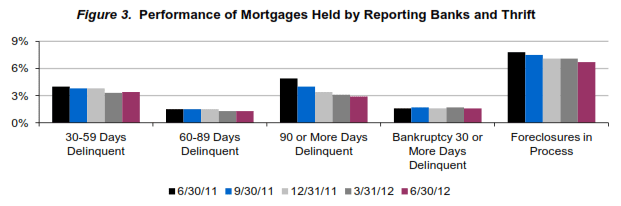

The nine reporting institutions held 7.8rnpercent of the 30.5 million mortgages included in the report. The performance of mortgages held by the institutionsrnimproved both from the previous quarter and from a year earlier with 84.0rnpercent current and performing compared to 83.5 percent in the first quarterrnand 80.3 percent a year earlier</p

</p

</p

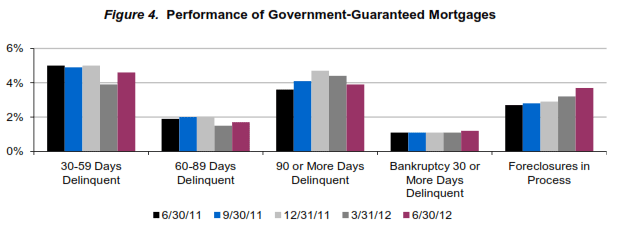

Government guaranteed mortgages made uprn22.9 percent of the mortgages in the report, up from 20.7 percent a yearrnearlier. Current and performing mortgagesrnwere down both quarter-over-quarter and year-over-year at 84.9 percent comparedrnto 85.9 and 85.7 percent in the respective earlier periods. </p

GSE mortgages comprised 58.4 percent ofrnthe loan universe compared to 60.2 percent a year earlier. The performance of these loans was betterrnthan others because the portfolio contains more prime loans and was unchangedrnfrom the previous quarter at 93.7 percent current and performing. A year earlier this figure was 93.1 percent. </p

</p

</p

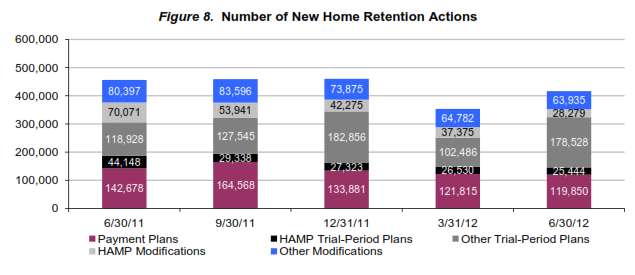

Servicers continued to emphasizernalternatives to foreclosure, implementing 416,036 new home retention actionsrnwhile starting 302,636 new foreclosures. rnHome retention actions were up 17.9 percent from Q1 but down 8.8 percentrnfrom a year earlier.</p

</p

</p

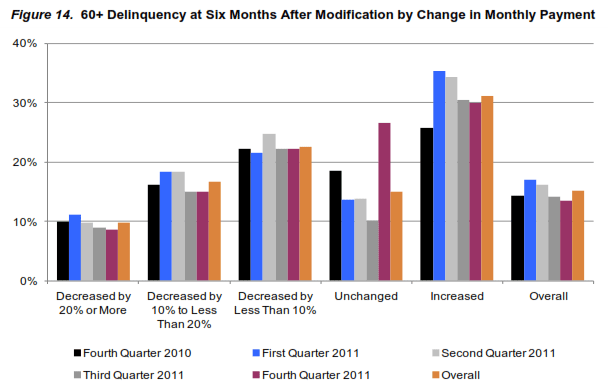

Home retention actions during thernquarter reduced borrowers’ monthly principal and interest payments by 24.6rnpercent or $381. HAMP modifications hadrnan average payment reduction of 35.3 percent or $576. At the end of the quarter 55.3 percent ofrnmodifications that reduced payments by 10 percent or more were current andrnperforming compared to 34.3 percent which did not.</p

</p

</p

Servicers havernmodified 2,645,290 mortgages from 2008 through the end of the first quarter ofrn2012. At the end of the second quarterrnof 2012, 48.6 percent of those modifications remained current or had been paidrnoff. Another 7.6 percent were 30 to 59rndays delinquent, and 14.9 percent were seriously delinquent. There were 10.5 percent in the process of foreclosure and 6.5 percent had completed the foreclosure process.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment