Blog

Mortgages Being Paid Off At Fastest Pace Since 2005

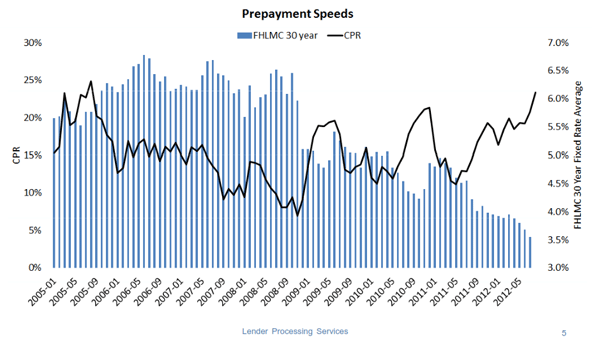

Mortgages were prepaid at a higher raternin August than at any time since 2005 according to the August Mortgage Monitor report issued by LenderrnProcessing Services (LPS) on Wednesday. Prepayments are usually an indicator ofrnhome refinancing and the prepayments in August were higher even than those seenrnin the “mini-refinance waves” of both 2009 and 2010.</p

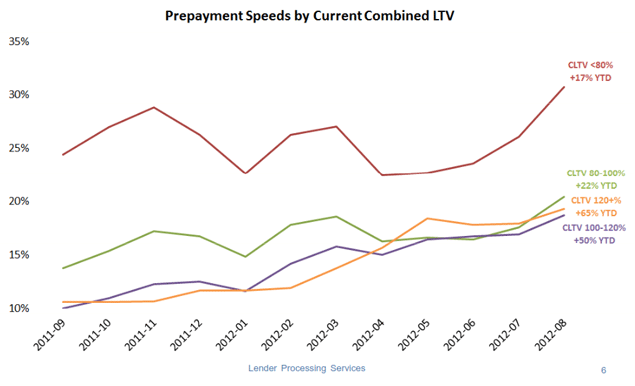

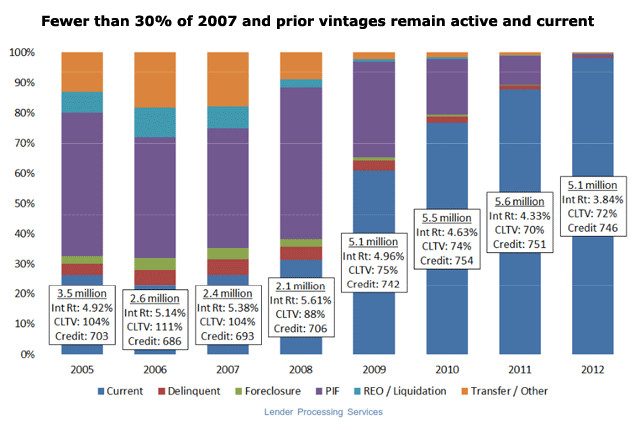

LPS Applied Analytics Senior VicernPresident Herb Blecher said that the impact of the prepayment increase has beenrnboth pronounced and broad based. “Ourrnanalysis showed an increase in prepayment activity across the entire combinedrnloan-to-value (CLTV) continuum,” he said. “While those loans withrnequity, particularly 80 percent CLTV and below, have much higher prepaymentrnspeeds, the impact of the Home Affordable Refinance Program (HARP) was alsornclear. Loans with a CLTV of more than 120 percent saw the greatest uptick – arn65 percent increase for the year to date. However, it is also becoming evidentrnthat loans originated in 2007 and earlier have diminished prospects forrnconventional refinancing opportunities. Fewer than 30 percent of these vintagesrnremain both active and current, and on average, they are marked by larger negativernequity positions and lower credit scores. That said HARP might yet represent arnviable refi option for a good portion of this pool.”</p

</p

</p

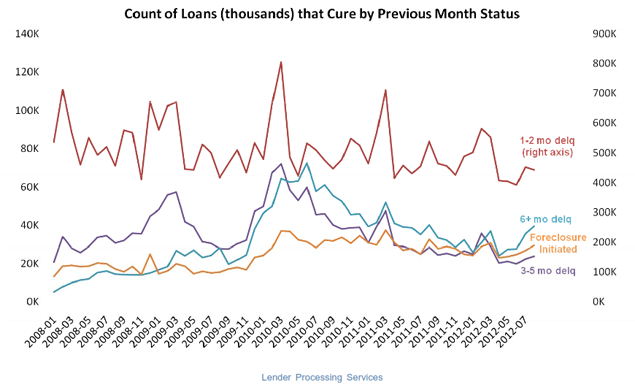

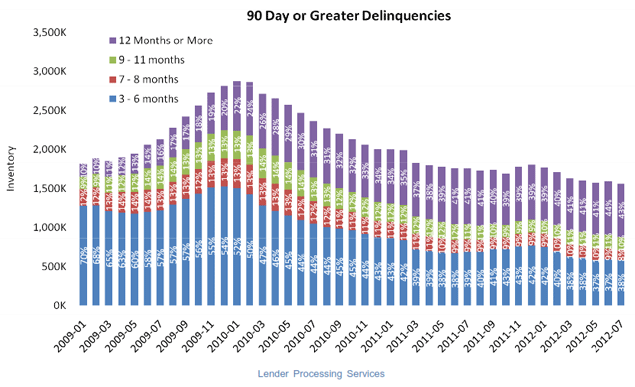

The U.S. loan delinquency rate fell 2.30rnpercent during the month to a rate of 6.87 percent. The current rate is 10.6rnpercent below that of one year ago, 7.69 percent. Continuing its decline, the inventory ofrnloans 90 or more days delinquent is now almost 50 percent off its January 2010rnpeak. The bulk of the remaining inventory has now been past due for more thanrnnine months, with a full 43 percent past due for 12 months or more. There are,rnhowever still, signs of ongoing modification activity in late-stagerndelinquency, with loans six or more months past due but not yet inrnforeclosure showing the greatest increase in cures from the prior month’srnstatus.</p

</p

</p

The foreclosure presale inventory raternwas down 1.00 percent from July and 2.0 percent from a year earlier to 4.04rnpercent. This is the lowest point forrnthe inventory since October 2010 but the average is misleading. In judicial foreclosure states the inventoryrnis at a near record high of 6.49 percent while it is only 2.28 percent inrnnon-judicial foreclosure states. Foreclosurernsales were up 12 percent nationally in August, but remain 33 percent belowrntheir September 2010 peak.</p

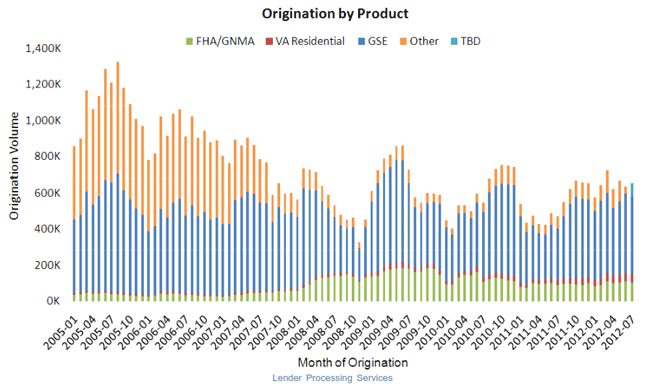

Origination volume has recoveredrnsubstantially from the low points reached in each of the last three years butrnstill remains well below historic levels. rnJuly originations totaled 655,000, up 3 percent from June and 39.0rnpercent higher than one year ago.</p

</p

</p

MortgagernMonitor statisticsrnare derived from the LPS database ofrnloan level residential mortgage data and performance information on nearly 40rnmillion loans across the spectrum of credit products.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment