Blog

Multifamily Mortgage Debt Continues Surge in Q4

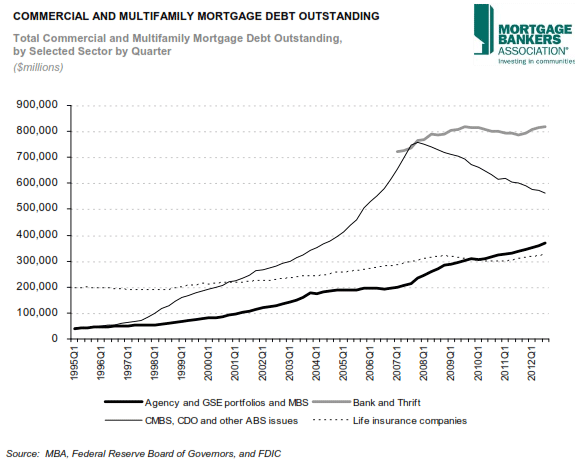

Commercial and multi-family mortgagerndebt increased by $6.6 billion to $2.38 trillion in the third quarter, anrnincrease of 0.3 percent according to the Mortgage Bankers Association (MBA). The multi-family share of that debt increasedrnto $824.9 billion from $812.8 billion in the second quarter, an increase ofrn$12.1 billion or 1.5 percent.</p

MBA tracks commercial and multi-familyrnmortgages held by various sectors, principally life insurance companies, banksrnand thrifts, state and local government, federal government, Agency/Governmentrnsponsored enterprise (GSE) portfolios and mortgage-backed securities (MBS);,rnand commercial mortgage-backed securities (CMBS) collateralized debtrnobligations (CDO) and other asset backed securities (ABS).</p

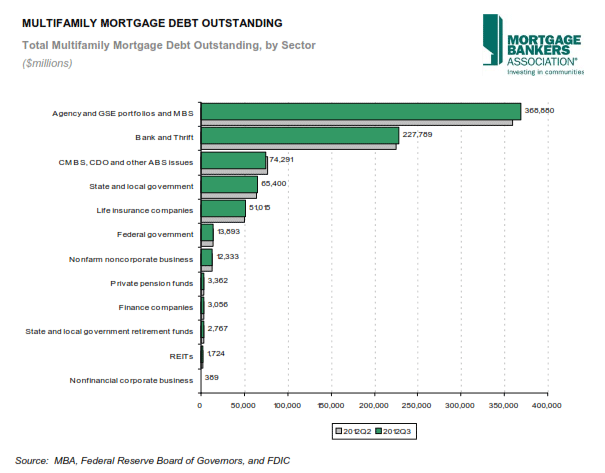

The largest amount of multi-familyrnmortgage debt (44.7 percent) was held in Agency and GSE portfolios. The total in this sector was $368.9 billionrncompared to $359.5 billion in the second quarter, an increase of $9.4 billionrnor 2.6 percent. This sector accountedrnfor 77.2 percent of the increase in multi-family debt. Banks andrnthrifts held the second largest share of multi-family mortgages, $227.8rnbillion, up 1.4 percent form Q2 and a 27.6 percent share. CMBS, CDO, and ABS holdings comprised 9.0rnpercent of the total at $74.3 billion. rnThis was a decrease in holdings from the second quarter of $2.5 billionrnof 3.2 percent. State and local governmentsrnincreased their holdings by 2.5 percent to $65.4 billion and held a 7.9 percentrnshare of the total. While they stillrnhold only a negligible 0.4 percent of multi-family debt, private pension fundsrnincreased their holdings by 8.2 percent in the third quarter to $3.4 billion. </p

</p

</p

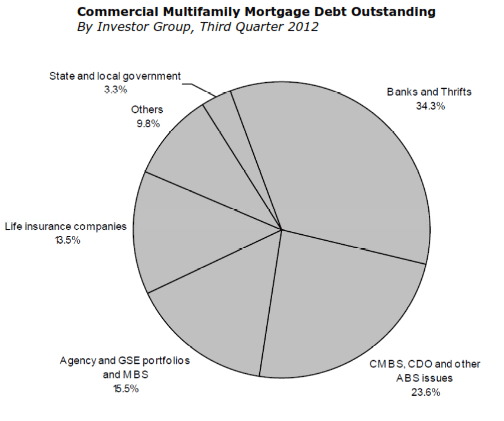

While multi-family mortgage debtrnincreased, commercial debt actually decreased during the quarter, due to a $9.4rnbillion or 1.7 percent drop in CMBS, CDO and other ABS issues. This was partially offset by increases by thernother three major investor groups. Commercial banksrncontinue to hold the largest share of commercial/multifamily mortgages, $819rnbillion, or 34 percent of the total. rnCommercial banks increased their holdings by 0.5 percent quarter-over-quarter.rn</p

Despiternthe quarterly decrease CMBS, CDO and other ABS issues remain the second largestrnholders of commercial/multifamily mortgages, holding $562 billion, or 24rnpercent of the total. Agency/GSErnportfolios and MBS hold $369 billion, or 16 percent of the total, an increasernof 2.6 percent; and life insurance companies hold $323 billion, or 14 percentrnof the total. Many life insurance companies, banks and the GSEs purchase andrnhold CMBS, CDO and other ABS issues and these loans appear in the “CMBS, CDOrnand other ABS” category.</p

</p

</p

“Thernoverall amount of commercial and multifamily mortgage debt continues to grow,”rnsaid Jamie Woodwell, MBA’s Vice President of Commercial Real Estate Research. rn”Fannie Mae, Freddie Mac, FHA, life insurance companies and banks are allrnincreasing their holdings and/or guarantees of commercial and multifamilyrnmortgages. And for the fourth quarter in a row, the net increase by thesernand other investor groups has outpaced a decline in the balance of commercialrnand multifamily mortgages held in commercial mortgage backed securitiesrn(CMBS).”</p

MBA’srnanalysis is based on data from the Federal Reserve Board’s Flow of FundsrnAccount of the United States and the Federal Deposit Insurance Corporation’srnQuarterly Banking Profile.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment