Blog

National Foreclosure Rates Drop but 21 States Buck Trend

Foreclosure activity dippedrnsignificantly in May RealtyTrac reported on Tuesday with a decrease of 5rnpercent in foreclosure filings compared to those in April. RealtyTrac’s U.S. Foreclosure Market Reportrnalso noted a 26 percent decrease in filings compared to May 2013.</p

RealtyTrac reports on three categories</bof legal filings – notices of default or foreclosure starts, scheduledrnauctions, and bank repossessions or completed foreclosures. Aggregate filings in May numbered 109,824 orrnone filing for every 1,199 U.S housing units. </p

Foreclosures were started on 49,240rnproperties in May, a 10 percent decrease from April and 32 percent fewer startsrnthan one year earlier. It was the fewestrnstarts recorded by RealtyTrac since December 2005, a 101-month low. </p

Foreclosure auctions were scheduledrnon 47,085 properties, down 3 percent month over month and 22 percent on anrnannual basis. It was the fewest auctionsrnscheduled in a single month since December 2006.</p

There were 20,373 foreclosuresrncompleted during the month, a 6 percent and a 27 percent decrease from the twornearlier periods. It was an 82 month lowrnfor completed foreclosures, the fewest since July 2007.</p

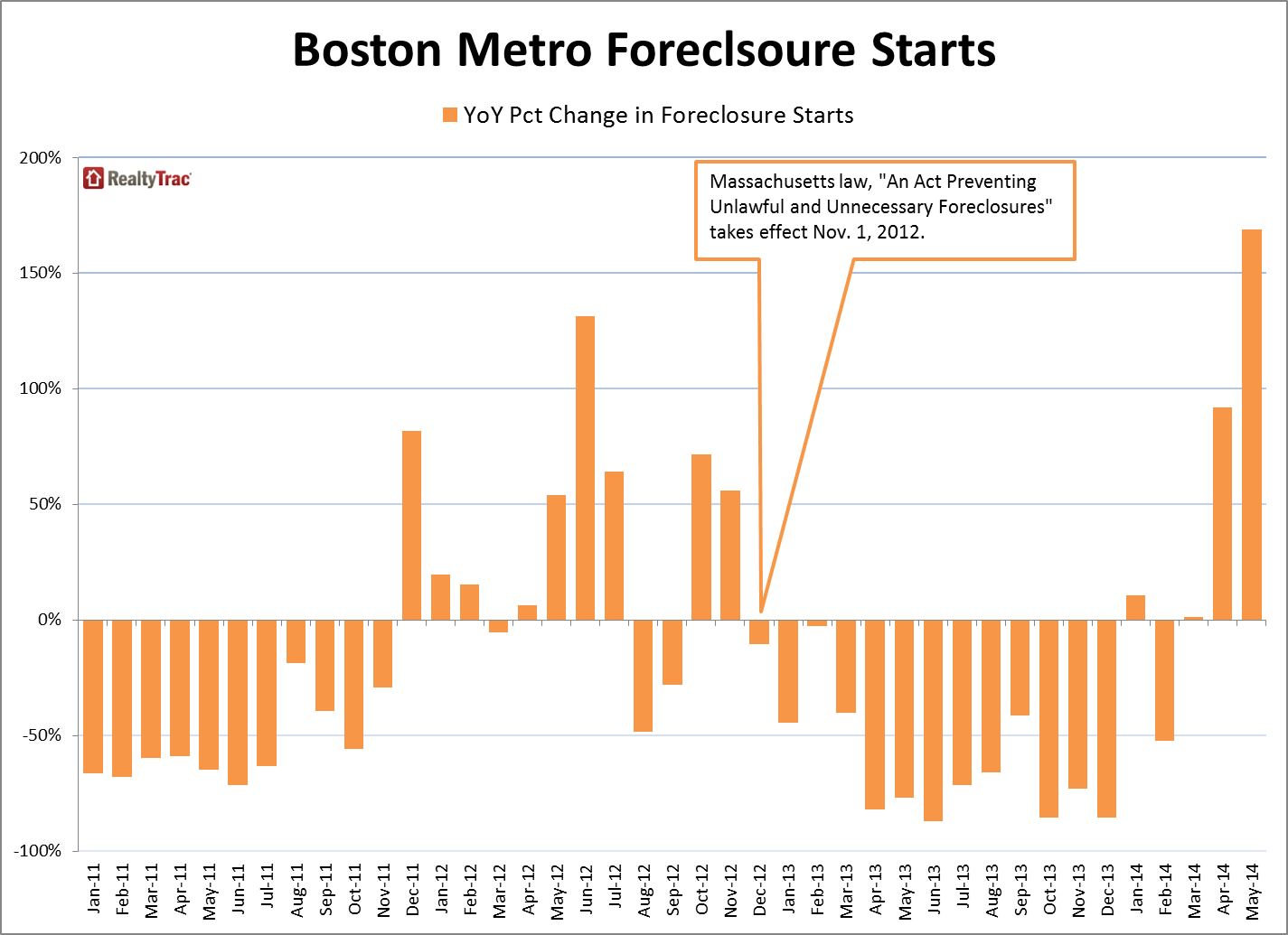

While foreclosure activity was downrnon a national basis it rose in 21 states compared to April and 11 states sawrnincreases on an annual basis. Thernlargest annual increases in filings were posted in Massachusetts, up 58 percentrnfrom May 2013 to an 18 month high and New Jersey where foreclosure activity hasrnincreased on an annual basis for 23 of the last 27 months and was up 27 percentrnin May. Other large annual increasesrnwere posted by New York (+18 percent), and Indiana (+12 percent). </p

</p

</p

Foreclosure starts increased in 17rnstates compared to April and in 12 states on an annual basis. There were large annual increases inrnMassachusetts (+178 percent), Indiana (+67 percent), and Delaware (+26rnpercent). Scheduled auctions were uprnmonth-over-month in 27 states and increased annually in 16 with Utah, Oregon,rnand New Jersey jumping 199 percent, 157 percent, and 70 percent respectively. Twenty-fivernstates had more bank repossessions in May than in April and 14 states postedrnannual increases, most notably New York which has grown annually for 16 out ofrnthe last 20 months, this time by 117 percent. rnNew Jersey increased for the 11th month out of 12, up 96rnpercent and Connecticut had a 15th consecutive increase, up 85rnpercent. </p

“It’s not surprising that some ofrnthe states with the longest foreclosure timelines are those with markets stillrndealing with increasing foreclosure activity even as the country as a wholerncontinues to hit new lows,” said Daren Blomquist, vice president at RealtyTrac.rn”On the other hand, the increase in bank repossessions in some states withrnshorter foreclosure timelines like California and Oregon demonstrates there isrnstill some pent-up foreclosure activity in those states as well.”</p

The nation’s highest overallrnforeclosure rate continues to be in Florida. rnEven with 10 consecutive months of annual decreases the state still hadrna foreclosure filing on one in every 436 housing units in May, nearly threerntimes the national average.</p

Florida was followed by Marylandrnwith a filing on one in every 621 housing units. The state however did finally see a positivernchange with overall foreclosure activity down percent on an annual basis afterrn22 consecutive increases. </p

Nevada is still in the top threerndespite eight consecutive months with annual decreases and a 57 percentrnyear-over-year drop in May. One in everyrn717 housing unit in the state had a foreclosure filing in May.</p

Other states in the top five arernIllinois, one in 790 housing units; Ohio, one in 805; while New Jersey,rnDelaware, Indiana, Connecticut, and South Carolina round out the top ten.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment