Blog

Negative Equity Continues Sharing High Correlation With Delinquencies

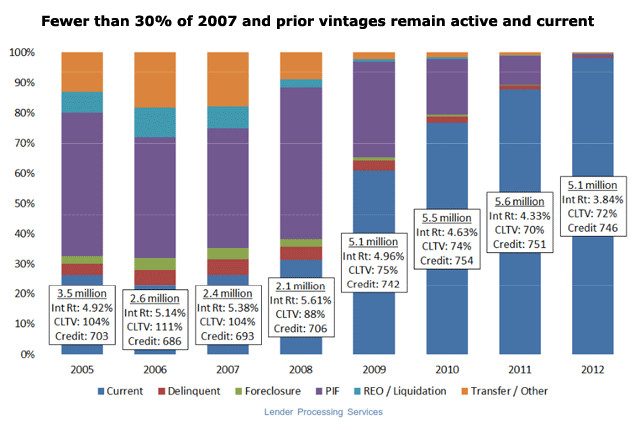

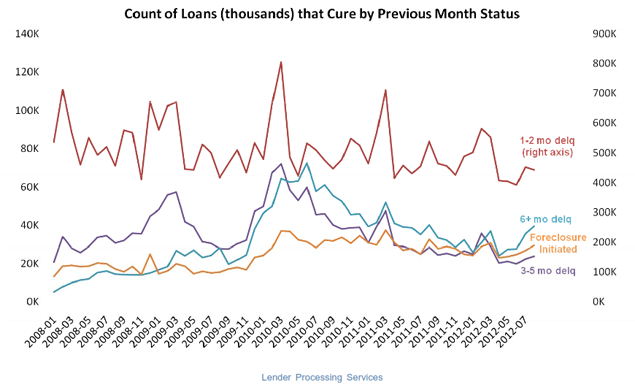

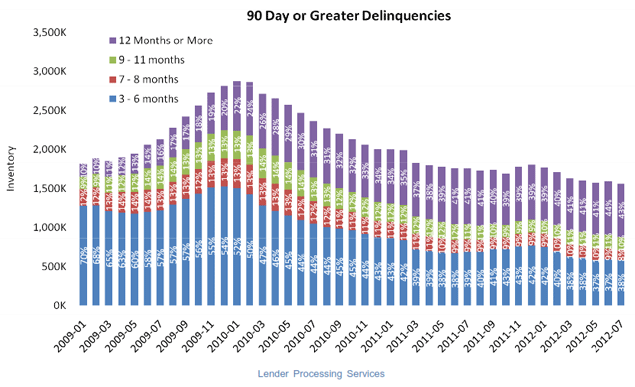

Delinquencies declined 1.6 percent from June to Julyrnresulting in a mortgage loan delinquency rate of 7.03 percent and pre-sale foreclosure inventoryrnwas down 0.2 percent to 4.08 percent according to the Mortgage Monitor report from Lender Processing Services. At the same time, foreclosure starts rose 7.1rnpercent to 185,811 from 173,556 in June but starts were down 10.5 percent fromrnthe 207,539 foreclosure starts in July 2011. rnStarts are outnumbering sales and 90+ day liquidations by a factor ofrn2:1. While starts were up, first timernforeclosure starts are near a four year low, nearly 40 percent of thernforeclosure starts in July were repeats, that is homeowners who were inrnforeclosure before, cured, and have entered foreclosure again. </p

</p

</p

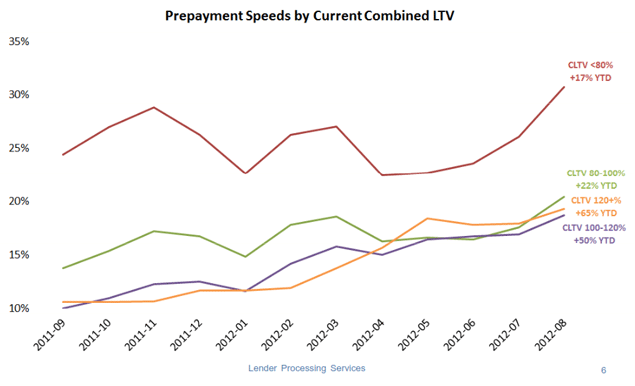

The most interesting information from the report wasrna finding that negative equity is continuing to be a leading indicator ofrndelinquencies. Nationally about 18rnpercent of homes are underwater and as negative equity increases so do thernnumber of problem loans. </p

</p

</p

“The July mortgage performance data shows arncontinuing correlation between negative equity and new problem loans,”rnexplained Herb Blecher, senior vice president, LPS Applied Analytics. “InrnNevada and Florida, two of the states with the highest percentage of underwaterrnborrowers, more than three percent of borrowers who were up to date on theirrnpayments are 60 or more days delinquent six months later. This suggests thatrnfurther home price declines – should they occur – could jeopardize recentrnimprovements.”<br /<br /Judicial and non-judicial states continue to proceed along separate paths withrnseveral metrics actually deteriorating in judicial states. Sincernthe peak in delinquencies, non current rates have declined by 31 percent inrnnon-judicial states but only 13 percent in judicial states. Foreclosure starts increased 12 percent inrnjudicial states from June to July while decreasing 3 percent in non-judicialrnstates, and the foreclosure inventory in Judicial states (6.46 percent) isrnalmost three fold as large as that of non-judicial states (2.38 percent).</p

</p

</p

</p

</p

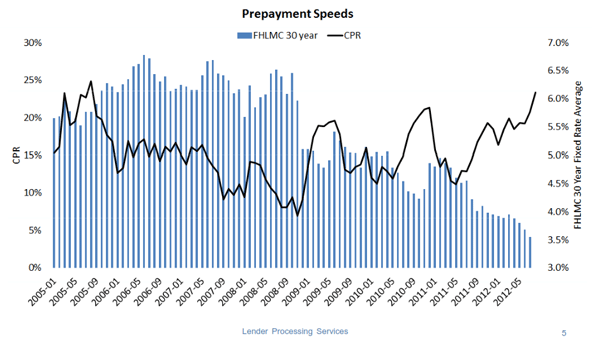

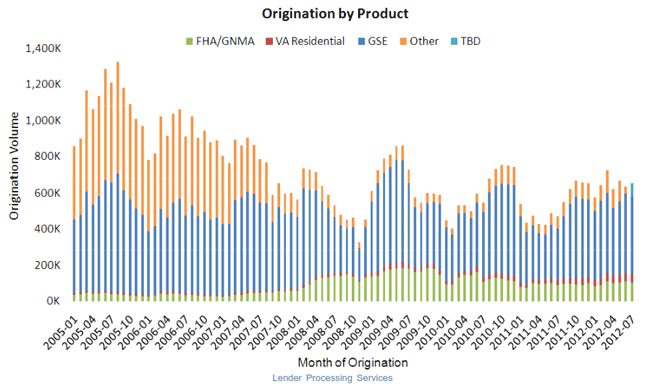

Mortgage originations for June (the data for thisrnmetric lags the others) were at the highest level since late 2010 with aroundrn700,000 new loans. Loans for refinancingrnalso increased in July but the increase among borrowers with low credit scoresrnwas notable.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment