Blog

New Dividend Structure May Speed GSEs' Treasury Debt Payoff

The FederalrnHousing Finance Agency’s Office of Inspector General (FHFA OIG) released arnreport today examining the recent changes to the Preferred Senior StockrnPurchase Agreements (PSPAs) between the Department of the Treasury and the tworngovernment sponsored enterprises (GSEs) Fannie Mae and Freddie Mac. </p

The objective of this report was to:</p<ol

OIGrnconcluded that the changes had the potential to allow for larger payments tornthe Treasury than the old dividend structure, hastening the payoff of theirrndebt to taxpayers. They would also endrnthe circularity of the GSEs borrowing money from Treasury in order to payrndividends to Treasury. </p

When the GSEsrnwere placed into conservatorship under FHFA, the U.S. Treasury committed tornfinancially support them when needed to ensure that their liabilities did notrnexceed their assets. </p

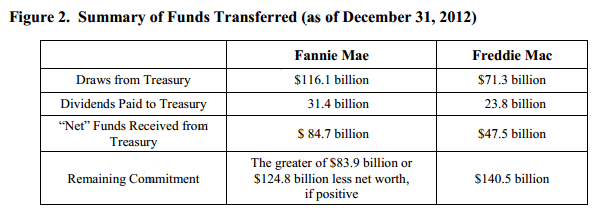

Under thernPreferred Senior Stock Purchase Agreements the two companies signed with thernTreasury in September 2008 Treasury agreed to make quarterly payment to the GSEsrnif needed in order for them to maintain a zero net worth at the end of eachrnquarter up to a cap of $100 billion for each GSE. In February 2009 that cap was expanded torn$200 billion for each and later that year was increased further to coverrn”quarterly net worth deficits from 2010 to 2012 and then for future years subjectrnto an intricate formulaic cap. As of January 1, 2013, Freddie Mac had $140.5 billionrnin commitment availablernunder that cap and Fannie Mae’s was the greater of $83.9 billion or $124.8rnbillion less any positive net worth on December 31, 2012.</p

In return the GSEs agreed to provide Treasury with seniorrnpreferred stock, quarterly dividends, warrants tornpurchase 79.9% of each Enterprise’srncommon stock, andrncommitment fees. The GSEsrnalso agreed to certain covenants including that they reduce their respectivernmortgage portfolios by 10 percent each year until they each reached $250rnbillion. </p

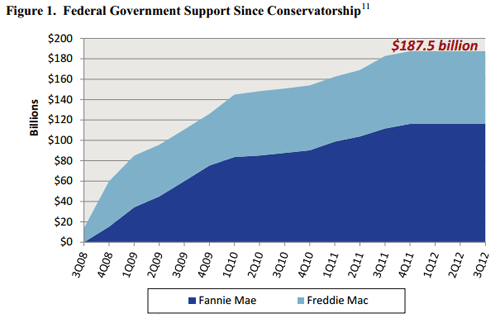

The seniorrnpreferred stock had an initial value or liquidation preference of $2 billionrnwhich increased dollar for dollar with each draw made from Treasury by arnGSE. Asrnof December 2012, Treasury held senior preferred stock withrna liquidation preference of $189.5 billion for the twornGSEs – the original $2rnbillion plus $187.5rnbillion in draws since then.rn</p

</p

</p

Under thernoriginal agreement the stockrncertificates required a dividend at an annual rate of 10% ofrnthe liquidation preference, to be paid quarterly. As a result, even before Treasury provided any funds to thernGSEs, they each owed Treasury payments of $100rnmillion per year, </p

As Treasury provided funds to the Enterprises under the PSPAsrnthe liquidation preference of the stock increased as did the amount of the dividends, eventually to nearly $19 billion perrnyear from both GSEs.</p

</p

</p

InrnAugust 2012 both GSEs announced they had generated positive quarterly earningsrn- $5 billion for Fannie Mae and $3 billion for Freddie Mac. Two weeks later Treasury and FHFA announcedrnmodifications to the PSPAs in five areas. The amendments: (1) changed the structure ofrndividend paymentsrnowed to Treasury; (2)rnincreased the GSEs’ rate of mortgage asset reduction from 10 percent each year to 15rnpercent; (3) suspended the periodicrncommitment fee; (4) requiredrnthat the GSEs producernannual risk management plans;rnand (5) exempt dispositions at fair market value under $250rnmillion from the requirement of Treasury consent. </p

Forrnpurposes of the OIG report the most important change was that of the dividendrnstructure so that the GSEs are no longer required to draw funds from Treasury just to pay Treasury dividends.rnAs of January 1, 2013, the dividend payment is no longer based on a fixed percentage of the liquidation preference. Instead, the dividend is based on a “positive net worth” model,rnin which Treasury wouldrnsimply take, as dividends, the entire positive net worth of each GSE above a buffer amount. Thernbuffer was set at $3 billionrnfor each GSErninitially, tornbe incrementally reduced to zero over five years. If an Enterprise has positive net worth that is less than the buffer, then the dividend payment to Treasury under thern2012 Amendments would be zero.</p

OIGrnassessed the financial impact of the changes in dividend structure as follows.</p<ul<liAsrnthe GSEs were able to pay to Treasury their dividends for the second and thirdrnquarters of 2012 and Freddie Mac was able to pay in the fourth quarter withoutrnany draws under the PSPAs, the new system could result in larger net paymentsrnto Treasury.</li

OIG said thatrnthe 2012 Amendments had threernintents: </p<ul class="unIndentedList"<liBenefit to taxpayers;</li<liContinued flow of mortgage credit; and</li<liWind down of the Enterprises.</li</ul

To some extent, the 2012 Amendments provide the mechanisms to achieve these goals,rnwith the dividend structure allowing faster payoff of the Treasury debt andrnending the circularity of financing the dividend. This could in turn shore up investorrnconfidence and promote the continued flow of mortgage credit. The Amendments, while accelerating the wind downrnof the GSEs’ portfolios, do not wind down their securitization business and,rnOIG said that side of the enterprises may continue to prosper, as least in thernnear term. “Fundamentally, the 2012 Amendmentsrnposition the GSEs to function in a holding pattern,rnawaiting major policy decisions in the future.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment