Blog

Nine States Set New Price Peaks in 2013

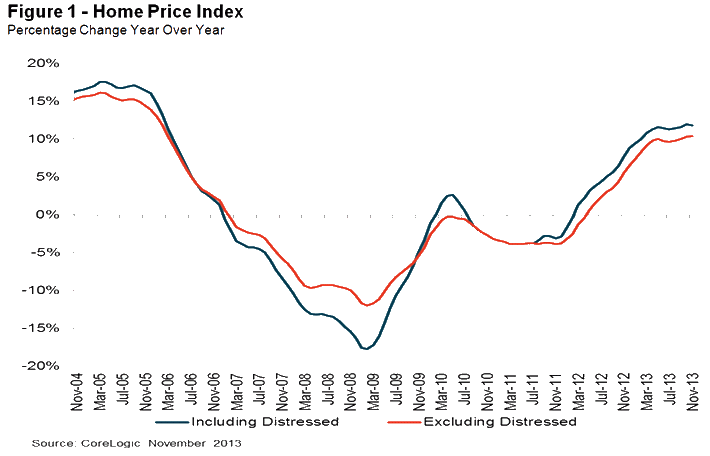

CoreLogic’s Home Price Index (HPI)rnposted its 21st consecutive annual gain in November. The company said U.S. home prices, includingrndistressed sales were up 11.8 percent in November 2013 compared to one yearrnearlier. When distressed sales arernexcluded the HPI was up 10.4 percent year-over-year. The index including distressed sales rose 0.1rnpercent from October to November and 0.3 percent excluding those sales. </p

The states with the strongestrnyear-over-year price performance are Nevada where the annual gain was 25.3 percent,rnCalifornia (21.3 percent), Michigan at 14.4 percent, and Arizona and Georgia atrn13.5 and 13.3 percent respectively.</p

</p

</p

Arkansas was the only state to experiencernan annual drop in values in November, declining 1.1 percent. Only small gains were posted in New Mexicorn(+0.3 percent), Mississippi (+0.7 percent), Kentucky (+0.8 percent) and Vermontrn(+1.4 percent.)</p

Despite the double digit annual gains,rnprices nationwide remain 17.6 percent below the peak levels set in Aprilrn2006. When distressed sales, includingrnboth short sales and sales of bank owned real estate (REO) are excluded, thernindex is down 13.3 percent from the peak.</p

Twenty-one 21 states and the District ofrnColumbia have climbed back to 10 percent or less of their peak value and ninernof these (Colorado, the District, Iowa, North Dakota, Oklahoma, South Dakota,rnTexas, Vermont, and Wyoming) have established new price peaks this year Other states still have a long way torngo. The five still furthest off of theirrnpeak values are Nevada which, despite a strong recovery is still down 40.5rnpercent, Florida, down 37.3 percent; Arizona (-31.4 percent), Rhode Island (-29.4rnpercent), and Illinois (-24.5 percent.)</p

CoreLogic projects an annual increase inrnits index including distressed sales of 11.5 percent in December and 10.6rnpercent for the index which excludes those sales. Month-over-month both of the HPIs arernexpected to dip 0.1 percent in December.</p

Mark Fleming, chief economist forrnCoreLogic said, “The housing market paused as expected in November for thernholiday season with very low month-over-month appreciation. Year-over-year home prices are up anrnimpressive 11.8 percent. Our pending HPIrnprojects that home prices will grow by 11.5 percent for the full yearrn2013. That will make 2013 the best yearrnfor home-price appreciation since 2005.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment