Blog

No More Interest-only HELOCs for Wells Borrowers

According to The Wall Street Journal Wells Fargo Mortgagernis revamping its home equity line of credit loans (HELOCs) to eliminate therninterest only feature that has characterized these products. HELOCs generally have a set interest-onlyrnpayment period, typically 10 years, and then convert to an amortizing loan,rnrecasting the amount required for the monthly loan payment. The bank’s reformulation will affect thernmajority of HELOS with some exceptions for customers with significantrnassets. </p

According to Brad Blackwell, arnmortgage executive at the bank who was interviewed by the Journal’s Nick Timiraos, Wells is restructuring the product torneliminate the prospect of future payment shock and to protect the consumer forrnthe long term. Interest only paymentsrnkept homeowners from building additional equity in their homes and paymentsrncould increase sharply when the amortization period kicked in. “We took this move not only because it’s thernright thing to do for our customers, but because we’d like to lead the industryrnto a more responsible product,” Blackwell said.</p

Blackwell indicated that Wells Fargornmight also be guarding against the possibility that loan officers might usernHELOCs to make an end run around new mortgage rules that require lenders torndocument the borrower’s “ability to repay” before granting a first mortgagernloan. These rules to not effect equityrnlending. </p

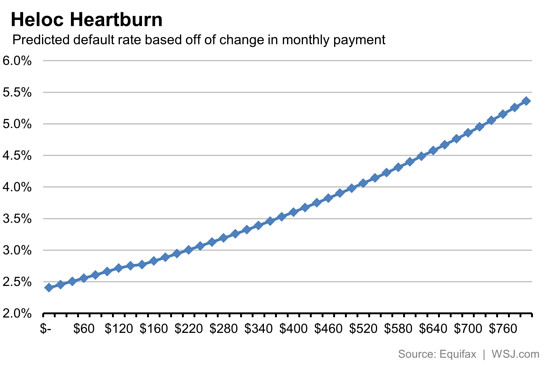

The paper said that the HELOCsrnoriginated in the years leading up to the housing crash – 2004 to 2008 – are nowrnapproaching the end of their interest only period and loans that will face arnpayment reset this year could see a monthly payment increase averaging overrn$300. That increase mounts during eachrnsubsequent origination year and those loans that will reset in 2006 and 2007rnwill see an average of about $425 more in each monthly bill. Equifax has produced a graph showing therneffect such increases have on loan default rates</p

</p

</p

Many of the borrowers drew much ofrnthe equity out of their homes with the loans and have subsequently seen thernvalue of those homes fall sharply. Thisrnleaves them with no way to refinance and consolidate the HELOC payment into arnfirst mortgage with a longer amortization term.</p

Blackwell said the end-of-the drawrnevent for existing loans has been less than expected. The bank reaches out to borrowers as much asrntwo years before the reset to encourage them to refinance or pay down therndebt. The bank has about $28 billion in loans,rnabout a third of their HELOC portfolio, that will reset between now and the endrnof 2017. </p

Homernequity lending peaked at nearly $500 billion in 2006 then dropped to less thanrn$100 billion in 2010 and 2011. It hasrnrisen slowly since then and saw an uptick in the first quarter of this year as pricesrngave homeowners back some of the lost equity giving them leverage tornborrow. Equity lending, however, isrnstill less than a quarter of what it was during the housing boom. </p

Timiraosrnsays banks see potential promise for a resurgence ahead as a combination ofrnincreasing equity and the first mortgage rates locked in by many owners whornhave refinanced make HELOCs a way to borrow against the home while keepingrnthose low rates.</p

Wells Fargo is the nation’s largestrnhome equity lender with about a 15 percent market share. The Journal</isays JP Morgan Chase, the third largest lender is also considering eliminatingrnits interest only home equity loans.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment