Blog

Non-Mortgage Debt a Potential Concern for Lenders

Returning to economic normalcy apparently means thatrnAmericans are back into heavy-debt mode. rnBlack Knight Financial Services said today that levels of non-mortgagerndebt at the end of April were at the highest levels in 10 years. </p

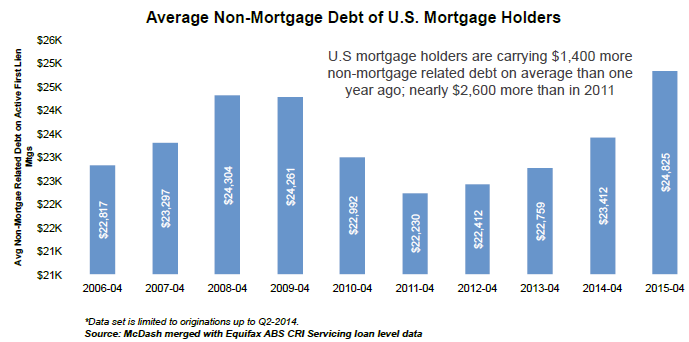

The company looked at average overall non-mortgage debt ofrnpersons who hold a mortgage and at the components of that debt in the currentrnissue of its Mortgage Monitor. The average debt level of thosernindividuals is just about $24,800, up from $23,400 in April of last year. Non-mortgage debt hit a recent low in 2011,rnaveraging $22,230, so the newer number is an increase of $2,600 in fourrnyears. </p

</p

</p

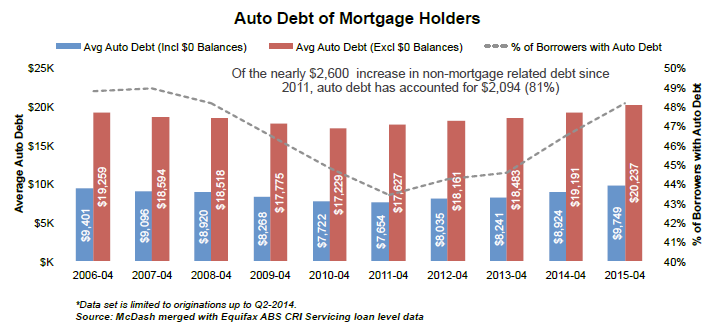

By far the greatest contributor to the increasernis auto debt. It accounts for 81 percentrnor $2,094 of the $2,600 increase and the share of mortgage holders who havernauto debt has risen from 43.4 percent to 48 percent, a 10 percent increase. </p

</p

</p

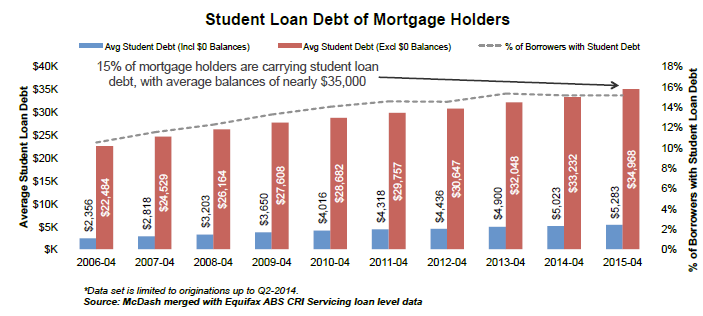

Another factor is student loan debtrnwhich is at an all-time high. In 2006rnonly 10 percent of persons with a mortgage were also carrying student loans; todayrn15 percent are so burdened. The averagernloan balance is $35,000, up about 56 percent from the average of $22,500 overrnthat same time frame. If the totalrnamount of all student loans is averaged across all persons with a mortgage -rneven those who are student loan free – the average has more than doubled inrnnine years.</p

</p

</p

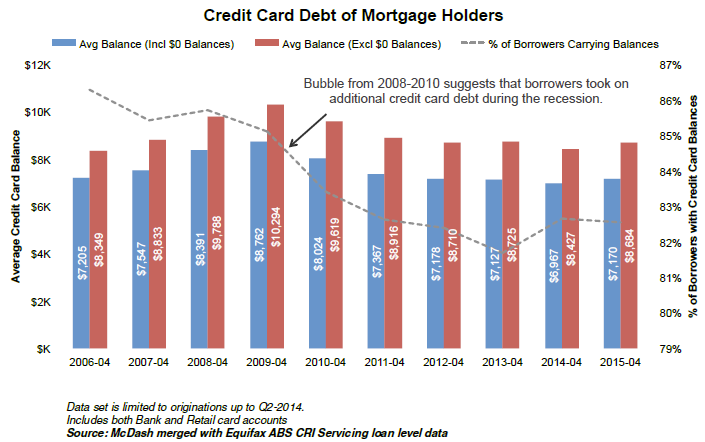

The third component, credit card debt,rnaverages just under 8,700 across the 83 percent of mortgaged homeowners whornhave such debt and $7,100 averaged over all people with mortgages. The credit card debt load has remained fairlyrnstable over the last four years after ratcheting down from a high of $10,300 inrn2009. Black Knight says it appears thatrnborrowers took on additional credit card debt in the recession – perhaps torncarry them through unemployment or other financial difficulties – but havernsince reduced their debt by about $1,600.</p

</p

</p

Black Knight Data & AnalyticsrnSenior Vice President Ben Graboske explained that non-mortgage debt among U.S.rnmortgage holders bears close watching due to its potential impact on both thernlending and housing industries. </p

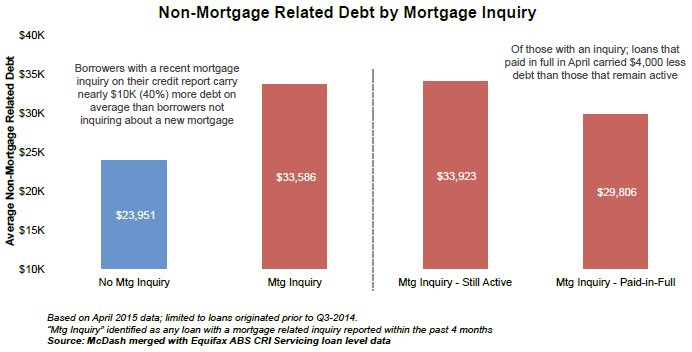

Non-mortgage debt is a key component ofrnhome affordability. The more total debt and the higher monthly non-mortgagernpayments borrowers have the less money is available to put towards a new homernpurchase, the less likely the possibility of refinancing, and the larger thernpotential for being unable to meet mortgage obligations. There is a clear correlation betweenrnnon-mortgage debt, mortgage inquiries, and prepayments, Black Knight said. </p

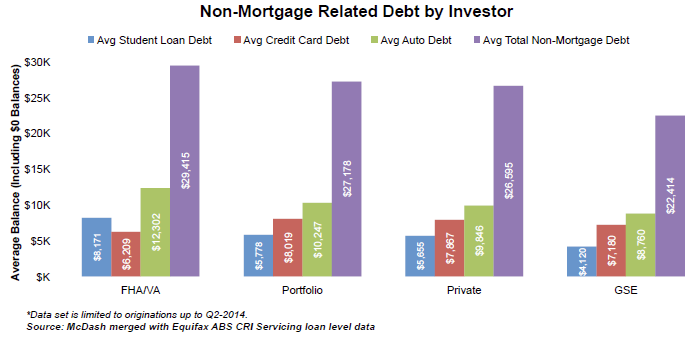

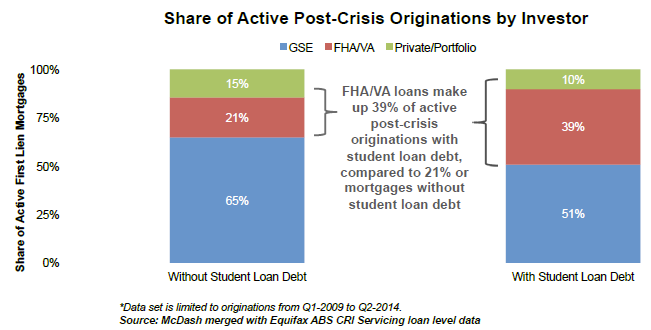

The Mortgage Monitor looked the levelrnof non-mortgage debt by borrowers for loans originated between 2009 and 2014 byrninvestor group. The highest level of overall debt was held by borrowers withrnFHA and VA mortgages and the lowest for those with loans originated for FanniernMae and Freddie Mac, the GSEs. Almostrnexactly $7,000 separated these loans. The biggest contributor to across FHA andrnGSE loans as well as originations for portfolio loans and private lenders werernauto loans. By far the largest amount ofrnstudent debt and lowest level of credit card debt was among FHA/VA borrowersrnand FHA was responsible for 39 percent of originations for borrowers withrncredit card debt but only 21 percent for those without it. </p

</p

</p

</p

</p

“Mortgage lenders know exactly how muchrndebt borrowers are carrying at the point of origination, but often lose sightrnfrom that point forward,” said Graboske. “Non-mortgage debt is another keyrnpiece of the home affordability puzzle — the more total debt borrowers arerncarrying and the higher monthly non-mortgage payments they have, the less moneyrnthey have to put toward a new home purchase, or potentially even their currentrnmortgage obligations. </p

We also noticed a clear correlation</bbetween non-mortgage debt and borrowers inquiring about a new mortgage, withrnthose who have recent mortgage inquiries on their credit reports carryingrnnearly 40 percent more debt than borrowers who do not," Graboske said.</p

That 40 percent translates to nearlyrn$10,000 more for those borrowers with a recent mortgage inquiry than thosernwithout one and those with a recent inquiry who paid their loan in full duringrnthe month of observation (probably an indication of refinancing) had $4,000rnless in debt that those who did not pay in full. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment