Blog

Number of Underwater Borrowers Declines as Home Prices Rise

Negative and near-equity numbers in thernU.S. are diminishing steadily according to data released today by CoreLogic butrnstill affects more than a quarter of homeowners with a mortgage. The number of underwater homeowners – those who,rnbecause of a decline in home value, an increase in debt, or both, owe more on their mortgage than their homesrnare worth – dropped by about 100,000 in the third quarter of 2012. This brings the total decline in the firstrnnine months of 2012 to 1.4 million, leaving 10.7 million homeowners withrnnegative equity at the end of the period or 22 percent of all homeowners with arnmortgage. </p

An additional 2.3 million borrowers werernnear-negative in equity with less than 5 percent in their homes. Therncombination of these two categories means that 26.8 percent of homeowners withrna mortgage have little or no equity compared to 27 percent at the end of thernsecond quarter of 2012. The dollar valuernof underwater homes was estimated at $658 billion at the end of the thirdrnquarter compared to $689 billion at the end of the second. </p

</p

</p

The bulk of negative equity isrnconcentrated in the low end of the housing market. For example, for low- tornmid-value homes (less than $200,000), the negative equity share is 28.7rnpercent, almost twice the 14.6 percent for borrowers with home values greaterrnthan $200,000.</p

“Through the third quarter, thernnumber of underwater borrowers declined significantly,” said Mark Fleming,rnchief economist for CoreLogic. “The substantive gain in house prices madernin 2012, partly due to tight inventory caused by negative equity’s lock-outrneffect, has paradoxically alleviated some of the pain.”</p

“There has been steady progressrnrelative to reducing negative equity and its effects in 2012, but with nearlyrnone quarter of borrowers still underwater, we have a long way to go,” saidrnAnand Nallathambi, president and CEO of CoreLogic. “As we look ahead intorn2013, we expect to continue to see more borrowers escape the negative equityrntrap, which will be a strong positive for the housing market specifically andrnthe broader economy generally.” </p

As of Q3 2012, there were 1.8rnmillion borrowers who were only 5 percent underwater and if home pricesrncontinue increasing over the next year they could return to a positive equityrnposition.</p

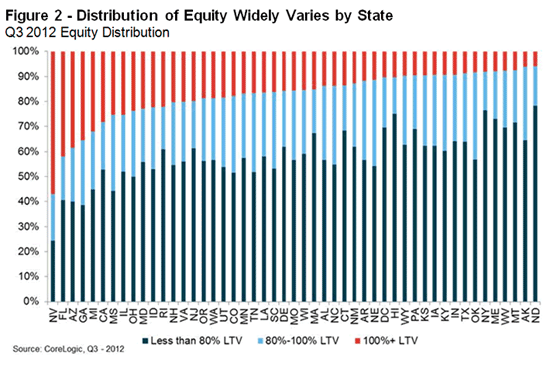

The highest percentage of mortgagedrnproperties with negative equity was in Nevada at 56.9 percent, followed byrnFlorida (42.1 percent), Arizona (38.6 percent), Georgia (35.6 percent) andrnMichigan (32 percent). These top five states combined account for 34 percent ofrnthe total amount of negative equity in the U.S.</p

Homeowners with only first liens accountedrnto $323 billion of the aggregate negative equity while first liens with homernequity loans accounted for $334 billion. rnUnderwater first liens without home equity loans are held by 6.6 millionrnborrowers with an average mortgage balance of $214,000. They are underwater by an average of $49,000.</p

There are 4.1 million negativernequity borrowers who have both first and second mortgages. The average mortgage balance for this grouprnis $214,000 and they are underwater by $82,000.</p

</p

</p

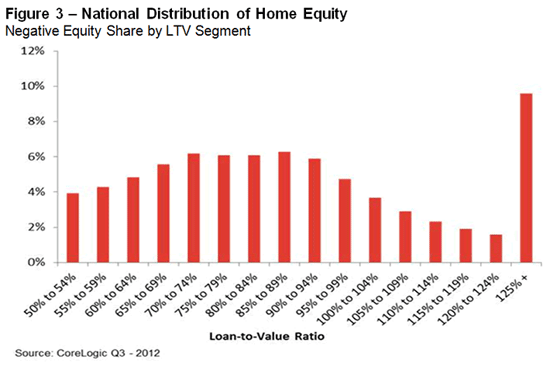

At the end of the third quarter therernwere 17.1 million borrowers who, based on their loan to value ratios, couldrnhave qualified for the Home Affordable Refinance Program (HARP) under thernoriginal requirements that capped LTVs at 125 percent. Under the new rules with no LTV cap another 4.6rnmillion borrowers could be eligible for the program.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment