Blog

Obama Administration to Provide More Funding Support for Weakest States

PresidentrnBarack Obama announced today that the administration will pump $1.5 billionrninto programs to address housing problems in states with the highestrnunemployment rates and the greatest drop in home values.

The program, which will use funds set aside for housingrnunder the Emergency Economic Stabilization Act (EESA) of 2008, will be directed at states where the average homernprice has fallen more than 20 percent from the peak and where high unemploymentrnis also an issue. The President announcedrnthe program during a speech this afternoon in Nevada which has had one of thernhighest foreclosure rates in the country, among the highest rates ofrn”underwater” mortgages, and an unemployment rate of 13 percent.

Fundsrnwill be directed to housing agencies in the individual states which will bernable to use the funds to prevent foreclosures among unemployed homeowners andrnto assist those who cannot refinance because of mortgages larger than the valuernof their homes or because of junior liens.

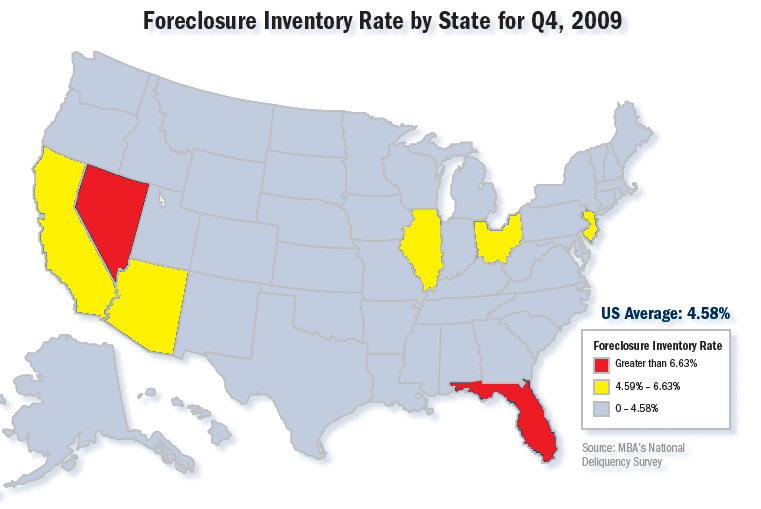

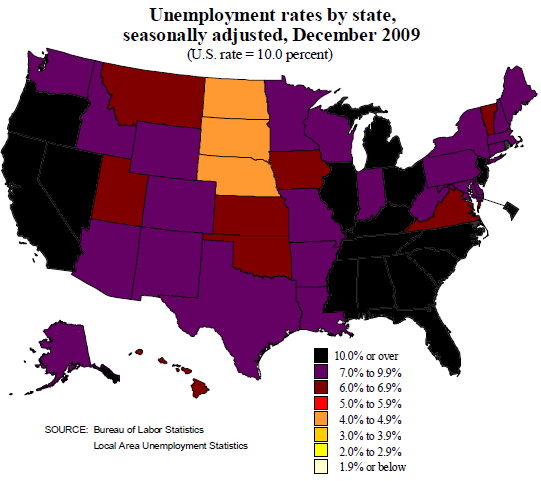

The White House did not specify the exact statesrnthat would be eligible for the program, but we did pull these charts from the MBA and BLS to provide an idea of what states might see Federal support.

States with the highest rates of foreclosure: California, Nevada, Arizona, Illinois, Ohio, Florida, and New Jersey

States with the highest unemployment rate: California, Nevada, Oregon, Illinois, Michigan, Ohio, Kentucky, New Jersey, and the entire Southeast region.

ThernWhite House said that state and local Housing Finance Agencies (HFAs) in each state arernalready familiar with the urgent challenges facing their communities and have demonstratedrnthe ability to address these challenges, and that the HFAs will determine thernpriorities facing their local markets.

Under the new program, dubbedrn4HM or Help for the Hardest-Hit HousingrnMarkets, HFAs can submit their own program designs tornTreasury. The proposals must meet funding requirements of EESA which includernthat the recipient of funds must be an eligible financial institution and thatrnthe funds must be used to pay for mortgage modifications or for other permittedrnuses. Treasury will announce maximum state level allocations and rulesrngoverning the submission of programs within the next two weeks.

The White House said thatrnthe kinds of programs that HFAs might design could include programs to helprnunemployed homeowners until they could find a job since, in earlier periods ofrnhigh unemployment, people could sell their homes and use the funds torn”tide them over.” Today, inrnthe targeted states, those homeowners with negative equity do not have thisrnoption.

The HFAs could alsornexperiment with programs that would assist underwater borrowers to negotiaternwith lenders to write down mortgages which would allow them to refinance. Modificationrnprograms such as the Treasury Departments HAMP program have encountered realrnreluctance on the part of lenders to reduce principal balances.

Other programsrnmight assist in situations where a home equity loan or second mortgage isrnpreventing a borrower from obtaining a loan modification by offering incentivesrnto the second mortgage holder to negotiate or release a junior lien.

The White House said thatrnall of the programs that are funded will be posted on-line and that standardsrnfor individual program results will be set and programs measured against thesernstandards with the results also published on-line.

HERE is the press release

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment