Blog

Obama Announces New Bank Regulation Reforms

I am not going to lie to you…I tried to get official details on this plan, but there are none! All I could get my hands on was political poo slinging. Until I some tangible FACTS are presented, I am avoiding attempts to make sense of the rhetoric. Below is an excerpt from the press release.

From the White House Press Release:

The President’s proposal would strengthen the comprehensive financial reform package that is already moving through Congress.

“While the financial system is far stronger today than it was a year one year ago, it is still operating under the exact same rules that led to its near collapse,” said President Barack Obama. “My resolve to reform the system is only strengthened when I see a return to old practices at some of the very firms fighting reform; and when I see record profits at some of the very firms claiming that they cannot lend more to small business, cannot keep credit card rates low, and cannot refund taxpayers for the bailout. It is exactly this kind of irresponsibility that makes clear reform is necessary.”

The proposal would:

- Limit the Scope – The President and his economic team will work with Congress to ensure that no bank or financial institution that contains a bank will own, invest in or sponsor a hedge fund or a private equity fund, or proprietary trading operations unrelated to serving customers for its own profit.

- Limit the Size – The President also announced a new proposal to limit the consolidation of our financial sector. The President’s proposal will place broader limits on the excessive growth of the market share of liabilities at the largest financial firms, to supplement existing caps on the market share of deposits.

As part of the previously announced reform program, the proposals announced today will help put an end to the risky practices that contributed significantly to the financial crisis.

—————————————————————————————————-

I do think it is important to point out what Barney Frank said regarding the timing of proposed regulations after the press conference. This is what flashed across my newsfeed:

14:30 21Jan10 RTRS-REP. BARNEY FRANK SAYS THAT MANDATE TO REQUIRE IMMEDIATE RULE CHANGES FOR BANKS WOULD BE A MISTAKE –CNBC

14:32 21Jan10 RTRS-FRANK SAYS UP TO FIVE YEARS WOULD BE APPROPRIATE TO PHASE IN CHANGES -CNBC

14:33 21Jan10 RTRS-FRANK SAYS PROPRIETARY TRADING CHANGE COULD BE DONE MORE QUICKLY THAN OTHER CHANGES-CNBC

Don't expect financial reform to be swift, there will be a great deal of debate before anything is agreed upon.

From a mortgage banker's perspective (and broker's)…. we are trying to lend, there are not enough borrowers who qualify!!! Perhaps that is because there are 30 million jobless Americans who can't afford to make their debt payments. Should we be lending to these people????

I know I know regs are tooo tight, thats the problem. Regardless of overtightened lending guidelines, I still think we have a borrower credit problem inhibiting responsible lending, the banks are just looking to avoid making the same mistakes again. First they lend too much and they are irresponsible, now they dont lend enough and they are irresponsible.

HOW ABOUT WE FOCUS ON CREATING JOBS AND REBUILDING THE SUPPLY OF CREDITWORTHY BORROWERS!

Here are a few more comments that flashed across after the press conference…

13:23 21Jan10 RTRS-WHITE HOUSE SAYS OBAMA BANK PLANS NOT RETURNING TO GLASS-STEAGALL

13:24 21Jan10 RTRS-WHITE HOUSE SAYS WANTS TO IMPLEMENT BANK RULE CHANGES IN COORDINATION WITH ALLIES, CITING SIMILAR MOVES IN BRITAIN

13:24 21Jan10 RTRS-WHITE HOUSE SAYS FINANCIAL REGULATORY REFORM WILL BE AN IMPORTANT ASPECT OF OBAMA'S AGENDA THIS YEAR

13:25 21Jan10 RTRS-WHITE HOUSE SAYS HOPES FOR BIPARTISAN SUPPORT ON OBAMA'S BANKING PROPOSAL

13:29 21Jan10 RTRS-WHITE HOUSE SAYS WON'T COMMENT ON MOVEMENT IN US STOCK MARKET FOLLOWING OBAMA BANK PROPOSAL

13:34 21Jan10 RTRS-WHITE HOUSE-LACK OF GOOD FINANCIAL REGULATION UNDERMINES A COUNTRY'S LONG-TERM ECONOMIC STANDING, OBAMA PLAN WON'T HURT AMERICAN COMPETITIVE POSITION

13:32 21Jan10 RTRS-WHITE HOUSE SAYS BANK PROPOSAL HAS BEEN IN THE WORKS FOR MONTHS, DISMISSES SUGGESTION IT IN RESPONSE TO MASSACHUSETTS SENATE ELECTION OUTCOME

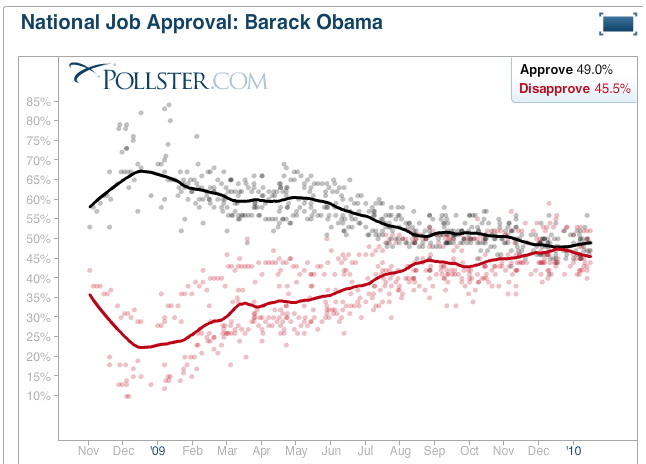

I found that last one to be interesting considering the Democrats are no longer fillibuster proof and President Obama's approval rating was heading down late last year. Is President Obama going on the offensive to regain America's confidence???

From Pollster.com

THIS is a good story to read if you are looking for more color. The WSJ also released a compilation of comments from economists and lawmakers. ENJOY THE POO SLINGING!!!

Sorry, politics really bother me sometimes. I am a registered independent by the way….

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment